Hello Cointribe! 🚀

Today is Thursday, July 3, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

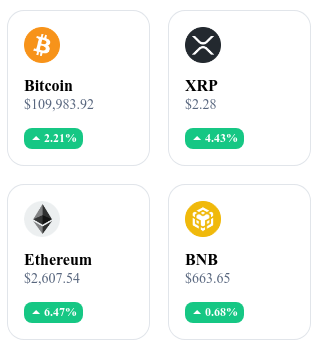

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📊 PancakeSwap posts a historic quarter

The DEX PancakeSwap recorded 530 billion dollars in volume in the second quarter of 2025, including 325 billion in the month of June alone. This performance is mainly based on BNB Chain, which accounts for more than 96% of the trades.

🛡️ Naoris builds a post-quantum Layer 1

Naoris Protocol is developing a Layer 1 blockchain resistant to quantum attacks to secure the Web3 applications of tomorrow.

The protocol relies on a new distributed consensus algorithm and a permanent defense system against future threats.

🛑 Arizona vetoes Bitcoin for the third time

Governor Katie Hobbs has rejected for the third time the creation of a public Bitcoin reserve funded by criminal seizures. She believes this project harms cooperation with local law enforcement.

📉 Bitcoin becomes scarce on platforms

The share of BTC available on exchanges has fallen below 15% of the total supply, according to the latest market data. This drop in accessibility raises concerns about a potential liquidity crisis.

🎮 Ultra unveils EMPIRES, its Web3 strategy game

The Ultra platform has launched the closed alpha of EMPIRES, a Web3 game interconnected with CITADELS where resources influence the global ecosystem. The beta opening is planned for September, with an official launch expected in October.

Crypto of the day: Virtuals Protocol (VIRTUAL)

🧠Technology & innovation

Virtuals Protocol is a blockchain in the Solana/Base ecosystem that allows the creation and monetization of autonomous AI agents — virtual entities programmed to interact, learn and act continuously. Thanks to its GAME (Generative Autonomous Multimodal Entities) framework, each agent has:

an autonomous software architecture,

an on-chain wallet allowing to buy, sell, generate income,

constant interactions with other agents or users.

Each agent thus becomes a digital asset generating value, with the possibility of co-ownership via Agent Tokens linked to VIRTUAL.

💰Main utility & token benefits

The VIRTUAL token is the driving element of this ecosystem:

It is necessary to deploy and power AI agents (via bonding curves).

Used to buy, stake and start Agent Tokens.

Powers the governance and development incentives, also remunerating the DAO treasury.

With 1 billion units (60% circulating, and emissions capped at 10% per year for 3 years), the protocol ensures stable and responsible tokenomics.

📊 Market data (as of July 3, 2025)

Current price: $1.69 USD

24h change: +13.2%

Market cap: ≈ $1.10 billion USD

CMC rank: #66

Circulating supply: 654,917,543 VIRTUAL

24h volume: ≈ $310 million USD

Bitcoin on the way to a new ATH

Bitcoin has just regained the $110,000 mark, supported by favorable macroeconomic signals. This return above this key level marks a positive turning point for the market, driven by encouraging economic data and renewed technical interest. But despite this momentum, caution remains among professional investors.

A technical peak under professional watch

This rebound was supported by two major macro elements. First, the increase in M2 money supply in the eurozone, seen as a factor supporting overall liquidity. Second, a drop in private hires in the United States, indicating a slowdown in the labor market, which could delay future rate hikes. These two signals have reactivated demand for alternative assets, including Bitcoin.

Technically, the threshold of $110,000 plays a pivotal role. Crossing it and holding stably could represent much more than a simple cyclical rebound: it would be a trend recovery signal for technical observers. But at this stage, conviction is not yet widespread.

On the derivatives markets side, caution persists. The Bitcoin futures premium has risen to around 4%, a level considered neutral. This lack of enthusiasm in derivatives products highlights hesitation among institutional players to increase exposure. The open interest has not soared, and volumes, though increasing, have not yet reached levels typical of market euphoria phases.

Why professionals remain cautious despite the recovery

The gap between spot price and derivatives widens. Institutional positioning does not follow the initiated bullish momentum. Funding rates remain moderate and the long/short ratio shows no clear directional bias. In short, the price surge has not (yet) convinced major holders.

This discrepancy can be explained by the absence of a clear structural catalyst. If macro factors triggered a spike, no fundamental event — like the arrival of a new ETF, major regulatory announcement, or technical breakthrough — has validated this movement. The market now seems to await a more durable trigger.

This context places Bitcoin in an unstable situation: between fragile recovery and test zone. Technical signals encourage optimism, but without validation from institutional side, the solidity of this rise remains questionable.

To turn this momentum into a sustainable movement, the market will need to capture more engaged institutional flows. Meanwhile, the current structure remains fragile, exposed to reversals if a new catalyst does not come to support the dynamic.