🥇 Bitcoin or gold? J.P. Morgan decides and sets a record target at $170,000

Welcome to the Daily for Friday, November 7, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, November 7, 2025, and as every day from Tuesday to Saturday, we bring you the top news from the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

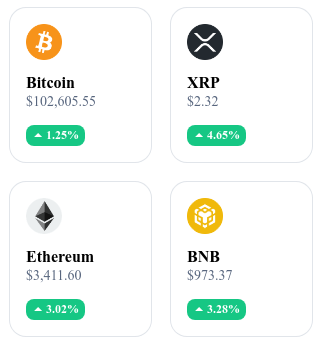

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🔫 Circle authorizes the legal purchase of firearms with USDC

The USDC stablecoin issuer has updated its policy to allow payments for legally purchased firearms in the United States. This decision reignites the debate on cryptocurrency neutrality and marks a turning point in Circle’s regulatory strategy.

👉 Read the full article

⛔ United States: Political deadlock threatens the crypto bill

The ongoing 36-day U.S. government paralysis is stalling progress on the digital asset regulation bill. Political gridlock and budget tensions could delay the reform for several months.

👉 Read the full article

💱 Cathie Wood: Stablecoins are gradually eclipsing Bitcoin

ARK Invest CEO Cathie Wood still predicts Bitcoin could hit $1.2 million by 2030 but acknowledges that stablecoins are gaining traction in payments and emerging economies — a trend she sees as a lasting rebalancing of the market.

👉 Read the full article

📊 Bitcoin accumulation hits record levels, on-chain data shows

Accumulation wallets have added 214,069 BTC in 30 days, bringing the total to 387,305 BTC at the start of November. This peak reflects renewed interest from institutional investors and long-term holders.

👉 Read the full article

Crypto of the Day: Hedera (HBAR)

🧠 Innovation and Added Value

Hedera is an open-source public network based on the hashgraph consensus algorithm — an alternative to traditional blockchains. Its unique “gossip-about-gossip” structure allows nodes to communicate efficiently while ensuring high levels of security and speed.

This model enables near-instant finality, minimal transaction fees, and extremely low energy consumption compared to conventional networks.

Compatible with EVM smart contracts, Hedera supports real-world asset (RWA) tokenization, decentralized applications (DeFi, gaming, digital identity), and enterprise-scale integrations.

Today, Hedera stands out as a powerful, sustainable, and enterprise-ready Web3 infrastructure.

💰 The Token

HBAR is the native token of the Hedera network. It serves three main purposes: paying transaction fees, securing the network through staking, and rewarding validators for their participation in the consensus.

Holders can delegate their HBAR to a node to participate indirectly in validation and earn rewards without compromising the security of their funds.

HBAR also functions as the network’s economic fuel — every interaction with Hedera services (smart contracts, tokenization, data storage) consumes a small amount of tokens, creating continuous demand.

Its deflationary structure and versatile utility make HBAR a cornerstone of the hashgraph ecosystem.

📊 Real-Time Performance

💵 Current Price: ≈ 0.1736 USD

📉 24h Change: -0.83%

💰 Market Cap: ≈ 7.50 B USD

🏅 Rank on CoinMarketCap: #21

🪙 Circulating Supply: ≈ 42.48 B HBAR

📊 24h Volume: ≈ 319.7 M USD

Bitcoin undervalued according to J.P. Morgan: why it could reach $170,000

When a bank as influential as J.P. Morgan releases a six-figure projection for Bitcoin, the financial world takes notice. Behind this impressive $170,000 estimate lies a rigorous methodology based not on speculation, but on comparative economic data. How was this figure calculated? And why does J.P. Morgan consider Bitcoin undervalued compared to gold?

A valuation based on comparison with gold

J.P. Morgan recently published a report stating that Bitcoin is currently undervalued relative to gold. To justify this position, the bank relies on a key indicator — the Bitcoin/gold volatility ratio. Estimated at 1.8, this ratio means Bitcoin is 1.8 times more volatile than gold. Adjusting Bitcoin’s valuation to this level of risk, analysts estimate that the asset’s market capitalization should rise by about 67 % to reach parity with gold. That would correspond to a price of around $170,000 per BTC.

This model is based on a mechanical approach that excludes emotional and speculative factors, aiming to align Bitcoin’s expected return with that of gold while factoring in its risk profile.

Other market outlooks: between caution and confidence

Not everyone shares J.P. Morgan’s bullish outlook. Galaxy Digital, for instance, forecasts a more conservative $120,000 by year-end. Their model focuses on current market trends, institutional demand, and broader macroeconomic conditions.

If J.P. Morgan’s projection proves correct, it would mark a major step toward Bitcoin’s recognition as a legitimate financial asset. The report suggests BTC is entering a new stage — one of maturity, where it is no longer just a speculative instrument but a core component of institutional portfolios, much like gold.