Hello Cointribe! 🚀

Today is Tuesday, October 14, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the top news from the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

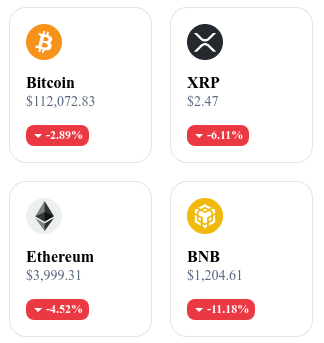

A quick look at the market…

🌡 Weather:

🌧️ Stormy

24h crypto recap! ⏱

🟠 BitMine buys 2.5% of the total Ether supply after the crash

BitMine has acquired 202,037 ETH, worth about $827 million, taking advantage of the recent crypto market crash to strengthen its reserves. The purchase brings its total holdings to over 3 million ETH, representing about 2.5% of the total supply, with an average purchase price of $4,154 per token and a total value of $13.4 billion, which also includes 192 BTC, $104 million in cash, and an investment of $135 million in Eightco Holdings.

👉 Read the full article

🟢 Strategy buys 220 Bitcoin for $27.2 million

Strategy has acquired 220 BTC for a total of $27.2 million, at an average price of $123,561 per BTC. This purchase continues its accumulation strategy, bringing its total reserves to 640,250 BTC, worth $47.38 billion in total.

👉 Read the full article

🇧🇹 Bhutan integrates Ethereum into its national ID system

Bhutan has integrated Ethereum into its national digital identity infrastructure, allowing citizens to use the blockchain to access public services and verify their information. The initiative combines security, traceability, and interoperability with administrative and financial applications.

👉 Read the full article

🔄 Binance distributes $45 million in airdrops to memecoin traders

Binance has carried out a total airdrop worth $45 million to reward active users trading memecoins and volatile assets. The initiative aims to encourage market activity during periods of high volatility and strengthen trader engagement on the BNB Chain.

👉 Read the full article

Crypto of the Day: Render (RENDER)

Innovation and Added Value 🧠

Render is a decentralized GPU rendering platform that allows creators, artists, and researchers to access unused global GPU computing power through blockchain technology. In 2023, Render migrated from Ethereum to Solana to take advantage of faster transactions and lower fees, addressing the growing demand for computational resources in 3D rendering and artificial intelligence applications.

The network supports major rendering engines such as OctaneRender, Redshift, and Blender Cycles, and integrates cutting-edge generative AI tools, offering a unified platform for next-generation digital creation workflows.

The Token 💰

RENDER is the native token of the Render network. It is used to compensate node operators who provide GPU computing power and to pay for rendering services. RENDER holders can also participate in Render DAO governance, influencing development proposals and key ecosystem decisions.

The project’s economy is based on the Burn and Mint Equilibrium (BME) model, where new token issuance adjusts dynamically to supply and demand, ensuring long-term balance and sustainable growth.

Real-Time Performance 📊

💵 Current Price: 2.76 USD

📉 24 h Variation: − 4.27 %

💰 Market Cap: 1 431 085 341 USD

🏅 CoinMarketCap Rank: #58

🪙 Circulating Supply: 518 584 616 RENDER

📊 24 h Trading Volume: 135 257 980 USD

Bitcoin under pressure: Tariff shock reignites market volatility

As trade tensions between Washington and Beijing intensify once again, the cryptocurrency market is taking another hit. Bitcoin has fallen below $112,000, while Ethereum and Dogecoin have dropped by 6%, dragged down by a wave of risk aversion triggered by China’s retaliatory measures against U.S. tariff threats.

A geopolitical reaction shaking the crypto markets

The latest correction in the crypto market does not stem from any internal weakness within the sector, but rather from a major geopolitical event. Beijing responded firmly to Washington’s tariff threats, fueling fears of a long-lasting trade war. The announcement sent shockwaves through risk assets — and cryptocurrencies were no exception.

Bitcoin plunged below $112,000, losing more than 5% of its value. Ethereum and Dogecoin also fell by 6%, in a move largely correlated with broader market panic. Derivatives markets amplified the decline: $630 million in positions were liquidated, 66% of which were longs, highlighting a wave of excessive optimism abruptly punished.

Bitcoin no longer behaves as a safe-haven asset but rather as a risk-on asset, directly exposed to macroeconomic tensions. This challenges the dominant narrative among certain institutional investors who had viewed BTC as a form of “digital gold.”

Volatility persists as investors seek direction

In this uncertain climate, crypto markets lack both structural and psychological support capable of reversing the trend in the short term. Donald Trump’s recent tariff threat — with potential hikes of up to 100% on Chinese imports — fuels fears of a prolonged trade war that could weigh heavily on global liquidity.

Traditional markets are showing similar anxiety: Japan’s Nikkei index fell more than 3%, while U.S. and European futures are trending lower. This alignment between crypto performance and traditional equities confirms the growing integration of digital assets into the global risk cycle.

Without a clear bullish catalyst in sight, the likelihood of a prolonged consolidation phase remains high. Technical analysts are watching key support levels, but signals remain mixed — particularly in trading volumes.