🔥 Bitcoin: Reserves reach a historically low level!

Welcome to the Daily Tribune of Thursday, February 13, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Thursday, February 13, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

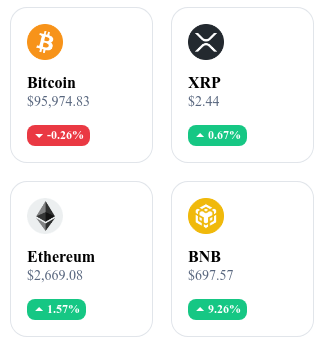

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🔗 Uniswap challenges the competition with Unichain!

Uniswap announces the launch of Unichain, its own Layer 2 blockchain on Ethereum, with the goal of reducing fees and improving transaction speed. With a block time of one second and optimized interoperability via EIP-7683, Uniswap aims to compete with Layer 2 giants like Arbitrum and Base. This initiative is expected to generate nearly $500 million in revenue for Uniswap Labs, redistributing part of the fees usually charged by Ethereum validators. Meanwhile, Uniswap deploys its V4 on 12 blockchains, confirming its ambition to dominate DeFi. 🔗 Read the full article

📉 Ethereum: the biggest ETH outflow in 23 months, a bullish signal?

Between February 8 and 9, 224,410 ETH, or $605 million, were withdrawn from exchanges, marking the largest ETH outflow in nearly two years. This phenomenon is often interpreted as a signal of investor confidence, as a reduced supply on exchanges limits major sales. With a current price around $2,714, Ethereum must now break through the key resistance of $2,850 to aim for a return towards $3,050. However, the derivatives market remains cautious, with a preference among traders for selling rather than accumulating. 🔗 Read the full article

⚖️ Binance and the SEC take a 60-day judicial pause!

In an unexpected turn, the SEC and Binance have decided on a 60-day judicial truce to allow the new Crypto Task Force of the SEC to evaluate the case. This suspension, granted under the leadership of Mark Uyeda, the new interim chairman of the SEC, could redefine the relationships between regulators and the crypto industry. Some observers believe that other platforms like Ripple, Coinbase, or Kraken might seek to obtain similar pauses. This decision could open the way for a more structured dialogue between market players and U.S. regulation. 🔗 Read the full article

🏆 Bitcoin becomes scarce: reserves on exchanges at an all-time low!

Bitcoin reaches an unprecedented level of scarcity, with only 2.5 million BTC available on exchanges. This decrease suggests a supply shock, which could lead to a massive price increase if demand continues to rise, particularly through Bitcoin spot ETFs. Despite recent outflows of $186 million from U.S. ETFs, institutional interest remains strong, keeping BTC above $95,000. Some analysts predict BTC at $160,000 – $180,000 if this trend continues. 🔗 Read the full article

Today's crypto: PancakeSwap (CAKE).

PancakeSwap is a decentralized exchange (DEX) originally built on the BNB Chain (formerly Binance Smart Chain). It allows users to trade tokens without resorting to a centralized exchange, using an automated market maker (AMM) model where users trade against liquidity pools. PancakeSwap offers a range of DeFi products, including token swaps, yield farming, Syrup pools for staking its native CAKE token, liquid staking of Ethereum, a prediction market, token launches via Initial Farm Offerings (IFO), cross-chain bridges to Ethereum and Aptos, a lottery, and an NFT market.

In April 2023, PancakeSwap adopted a deflationary token model called "Ultrasound CAKE", combining real yields and reduced token emissions, with over 102% of issued CAKE burned each week.

The native token of PancakeSwap, CAKE, is used for various functions within the ecosystem. CAKE holders can participate in yield farming by providing liquidity to the platform's pools, allowing them to earn rewards. They can also stake their CAKE in Syrup pools to earn additional tokens or participate in the governance of the platform by voting on proposals that influence the development of PancakeSwap. Additionally, CAKE is used to participate in IFOs, lotteries, and to purchase NFTs on the dedicated marketplace.

Recent performances:

Current price: $2.86 (approximately €2.60)

24-hour variation: +38.2%

Market capitalization: $838.2 million

Rank on CoinMarketCap: #107

Bitcoin on the verge of a new peak? A new ATH expected within 2 to 3 weeks according to experts

Bitcoin could be a few weeks away from a new all-time high (ATH), according to several analysts. As gold reaches new heights, surpassing $2,942 per ounce, some experts believe Bitcoin will soon follow the same trajectory. The hypothesis is based on a delayed correlation between gold and Bitcoin, already observed in the past. Michaël van de Poppe, a renowned analyst, states that BTC could reach a peak in the next 2 to 3 weeks, identifying a key buying zone around $90,000. Charles Edwards, founder of Capriole Investments, shares this view, reminding that rising phases of gold often precede those of Bitcoin, which reacts with more intensity.

However, the crypto market remains under pressure. On February 11, Bitcoin lost $1,500 in one hour, after a rumor spread that Binance had liquidated some of its reserves in BTC, ETH, and SOL. Although denied, this information was enough to trigger temporary panic in the market, illustrating Bitcoin's sensitivity to movements of large platforms. At the same time, current monetary policies, marked by an explosion of the U.S. deficit ($838 billion borrowed in 4 months), reinforce the appeal of safe-haven assets like gold… and potentially Bitcoin.

The real test for Bitcoin lies in its ability to break through the $70,000 mark in weekly closing. If this threshold is surpassed, an acceleration towards a new ATH could quickly start. The current macroeconomic dynamics, combined with growing institutional adoption, could accelerate the process, shortening the time generally observed between the rise of gold and that of Bitcoin. It remains to be seen whether this prophecy will come true or if other turbulence will slow this anticipated rise.