🌐 Bitcoin slips below $103,000 after Israeli strikes in Iran

Welcome to the Daily Tribune for Friday, June 13, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, June 13, 2025 and like every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you couldn’t miss!

But first…

✍️ Cartoon of the day:

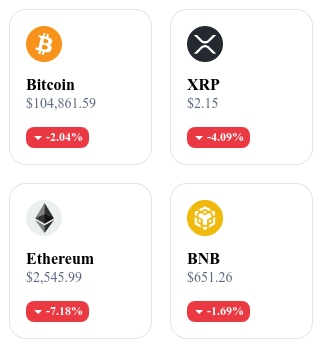

A quick look at the market…

🌡️ Temperature:

⛈️ Stormy

24h crypto recap! ⏱

👮 France: new arrests after crypto-related kidnappings

The French police have taken several additional suspects into custody in connection with a series of kidnappings targeting entrepreneurs in the crypto sector. Among the accused, twenty-five people aged 16 to 23 are under investigation related to the attempted kidnapping of the daughter of the CEO of Paymium.

📉 Bitcoin drops to $103,000 after Israeli strikes on Iran

Bitcoin lost 2.8% in 90 minutes, falling from $106,042 to $103,053 following Israeli strikes on Iran.

More than 427 million dollars of long positions were liquidated within 24 hours.

🏛️ The GENIUS Act bill approved by 68 votes to 30

The U.S. Senate passed the GENIUS Act bill on Tuesday by 68 votes to 30, allowing it to move towards a plenary session discussion.

John Thune presented this law as an initiative aimed at legally regulating dollar-backed stablecoins.

🌐 PayPal deploys its PYUSD on Stellar

PayPal announces the extension of its stablecoin PYUSD to the Stellar blockchain, following Ethereum and Solana, pending regulatory approval in New York.

The declared goal is to strengthen cross-border payments via a fast and low-cost network.

Crypto of the day: Theta Network (THETA)

🧠 Technology & Innovation

Theta Network combines two complementary systems: on one side, Theta EdgeCloud, a decentralized network of more than 10,000 nodes providing GPU power of about 80 PetaFLOPS for heavy tasks like video, AI, or 3D rendering; on the other, an EVM-compatible blockchain that ensures the secure execution of smart contracts and reward distribution. This hybrid model not only decentralizes video streaming but also offers a large-scale decentralized cloud infrastructure, supported by partners such as Google, Samsung, Sony, and Binance.

💰Theta's Dual-Token Model

Theta adopts a well-thought-out two-token economic model. THETA is the governance and validation token: it powers validator and guardian nodes, enabling block creation and security. TFUEL, on the other hand, serves as a utility token: it is the "fuel" for micro-operations (streaming, smart contract execution, EdgeCloud services), and it rewards users sharing their bandwidth or GPU power. With the recent launch of Theta Mainnet 3.0, a portion of every TFUEL spent is burned, stabilizing its supply based on actual usage.

📊 Market Data (as of June 13, 2025)

Current price: 0.9446 CAD (~ 0.69 USD)

24h change: –6.45%

Market capitalization: ~ 692 million USD

CoinMarketCap Rank: #90

Circulating supply: 1,000,000,000 THETA

24h trading volume: ~ 49 million USD

Bitcoin as corporate treasury: towards massive strategic adoption?

A silent but potentially decisive shift is underway in corporate financial management practices: Bitcoin is progressively establishing itself as a reserve asset in the balance sheets of an increasing number of corporate actors. Far from the speculative surges of early crypto cycles, this movement reflects a new strategic approach amid monetary uncertainties, bond yield erosion, and persistent geopolitical tensions.

According to recent data from Bitwise Europe, more than 746,000 BTC are already in the hands of companies, a volume that reflects not only intensified purchases but also a willingness for durable integration into internal financial structures.

Changing balance sheets: Bitcoin as a response to macroeconomic misalignment

Most large companies operating globally face a double challenge: increasing exposure to weakened currencies (USD, JPY, EUR) and lack of real yield on their liquid assets. In this context, Bitcoin appears no longer as a speculative bet but as a strategic hedge asset against monetary depreciation.

Among the first actors to have initiated this shift are MicroStrategy, Tesla, and Square. But according to Bitwise, a growing number of mid-sized companies—especially in the tech, energy, and logistics sectors—have already integrated BTC into their reserve strategies.

Towards a market dynamic reconfiguration: scarcity, liquidity, and influence

This massive corporate adoption of Bitcoin leads to three major consequences for the ecosystem:

Increased scarcity: each BTC locked in a corporate balance sheet is, by nature, off market. The actual liquidity available for trading decreases, intensifying structural upward pressure.

Change in the nature of holders: as companies settle durably in the ecosystem, we see an institutionalization of holdings, making market movements more sensitive to internal decisions than external speculation.

Reflective leverage effect: a rise in BTC price improves the balance sheets of holding companies, which can then more easily refinance debt or reinvest. This virtuous circle has a self-reinforcing effect that could amplify bullish moves during recovery phases.

The multiplication of companies integrating Bitcoin into their balance sheets represents much more than a cyclical phenomenon: it is a paradigm shift in corporate financial management in the post-fiat era. This shift towards a "crypto-compatible" treasury redefines standards of financial sovereignty and accelerates the institutionalization of the world’s rarest digital asset.

In this context, ignoring Bitcoin becomes for some companies no longer a prudent choice but a strategic risk.