🚀 Bitcoin smashes $112,000, driven by record institutional flows

Welcome to the Daily Tribune of Thursday, July 10, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, July 10, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

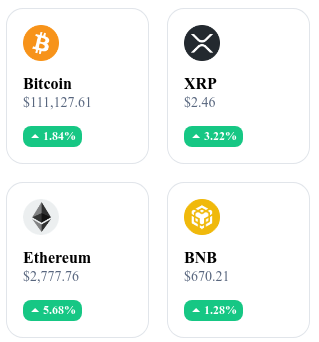

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🚀 Bitcoin surpasses $112,000 for the first time

Bitcoin briefly exceeded $112,000, an increase of nearly 18% since the beginning of the year, driven by a renewed appetite for risk and high institutional flows. This historic breakthrough occurs in an environment where Bitcoin ETFs reach new highs and Ethereum also benefits from this momentum.

🏛️ Ethereum crosses the $6 billion mark in tokenized assets

The Ethereum blockchain surpasses $6 billion in real tokenized assets for the first time, according to Token Terminal. Issuers include BlackRock, Franklin Templeton, and WisdomTree, highlighting the growing appetite of institutions for on-chain financial products.

💰 Binance accumulates $31 billion in stablecoins: altseason ahead?

USDT and USDC reserves on Binance have climbed to a record level of $31 billion, signaling capital ready to invest in altcoins. Analyst Timo Oinonen mentions an "explosion of liquidity" that could precede a major rotation towards alternative tokens.

📈 Record inflows to Bitcoin and Ethereum ETFs

Bitcoin and Ethereum ETFs recorded unprecedented combined inflows exceeding one billion dollars in a single day, pushing their assets under management to historic levels. Bitcoin, notably via BlackRock's IBIT, attracted $530.6 million in one day, illustrating a tremendous institutional influx.

Crypto of the day: Stellar (XLM)

🧠 Technology and innovation

Stellar is a Layer 1 blockchain designed to facilitate fast, cheap, and interconnected international payments. Launched in 2014 by Jed McCaleb (co-founder of Ripple), it is based on a proprietary protocol called the Stellar Consensus Protocol (SCP).

This system uses federated voting mechanisms to validate transactions without mining, allowing confirmations in 2 to 5 seconds with minimal fees.

Its architecture makes Stellar particularly efficient for the issuance and exchange of digital tokens, especially for stablecoins, carbon credits, or tokenized local currencies. Large institutions like IBM or Franklin Templeton have used Stellar in projects related to asset tokenization or cross-border payments.

💰 Main utility and advantages

The native token XLM plays a key role in the Stellar ecosystem:

It is used to pay transaction fees, which are very low (about 0.00001 XLM).

It serves as a bridge currency to facilitate exchanges between digital assets and fiat currencies.

It guarantees basic network security, via minimum balance requirements.

It provides access to an interoperable network promoting financial inclusion, especially in regions underserved by banking systems.

📊 Market data (July 10, 2025)

Current price: $0.2971 USD

24h change: +7.62%

Market capitalization: ≈ $9.047 billion USD

CoinMarketCap rank: #15

Circulating supply: 31,013,426,765 XLM

24h trading volume: ≈ $945.8 million USD

XRP soars after Ripple and BNY Mellon alliance around RLUSD

The announcement of a partnership between Ripple and the 240-year-old bank BNY Mellon sparks major renewed interest in XRP. This strategic alliance around the RLUSD stablecoin reveals Ripple's ambitions to strengthen its institutional foothold while energizing its XRP Ledger network.

A historic alliance for a token seeking credibility

Ripple has formalized its partnership with BNY Mellon, one of the oldest American banking institutions, to custody the RLUSD. This decision marks a key milestone in structuring the Ripple ecosystem around a stablecoin that aims to be both reliable and widely adopted.

The RLUSD, currently used 87% on the Ethereum network, could benefit from a partial activity transfer to the XRP Ledger (XRPL), known for its speed and minimal fees. This shift aims to encourage tangible use of Ripple's native blockchain, positioning RLUSD as a lever for adoption.

The market reaction was positive: XRP rose from $2.15 to $2.40, showing an increase of nearly 12% over the last 24 hours. This surge reflects renewed investor confidence who see in this association a maturity signal for the Ripple project. In a context where seeking institutional partners becomes a key factor for sustainability, this rapprochement with BNY Mellon considerably strengthens RLUSD's credibility.

Towards confirmed bullish momentum?

Chart analysis highlights an inverted head-and-shoulders pattern, coupled with a descending triangle, two figures suggesting continuation of the bullish trend. Projections place the next target around $2.87, with an extension potential to $3.72 by August.

These perspectives, if confirmed, could reposition XRP as a central player in crypto exchanges, especially in the booming stablecoin sector. In an environment still marked by regulatory uncertainties and legal battles, Ripple seems to opt for pragmatic refocusing: demonstrating its value through the concrete utility of its products, supported by solid alliances.