🏆 Bitcoin Soars Again, Raydium Crushes Uniswap

Welcome to the Daily Tribune for Thursday, December 12, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, December 12, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

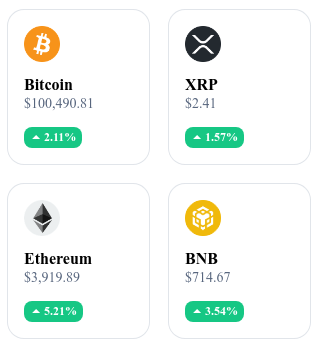

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🌏 India Embraces the Future with CBDC

India is taking a decisive step towards abandoning cash with the digital rupee project, defended by Shaktikanta Das, outgoing governor of the Reserve Bank of India (RBI). Under his guidance, India launched a pilot CBDC project, positioning the country as a leader in experimenting with digital currencies. Das's vision relies on a gradual adoption, guided by user data collected during tests, to anticipate potential impacts on the economy and citizens.

The future of this initiative will depend on the monetary policy and the ability of incoming governor, Sanjay Malhotra, to balance innovation and economic stability. By aiming for more efficient payments and simplified cross-border transactions, the CBDC could transform India's position on the global financial stage.

🚀 Bitcoin and Altcoins on Fire

The cryptocurrency market is experiencing an unprecedented explosion, with Bitcoin surpassing the symbolic threshold of $100,000 for the first time. This record can be explained by several factors: favorable economic data in the United States, especially controlled inflation (+0.3% for Core CPI), which fuels speculation about a potential upcoming interest rate cut by the Federal Reserve, and a massive influx of institutional investments, such as the $3.85 billion injected into Bitcoin ETFs in one week.

This momentum has also pulled up altcoins like XRP (+17%, at $2.44), supported by the announcement of Ripple's stablecoin RLUSD, as well as Dogecoin and Solana, which are showing significant gains.

🔗 Nevada Revolutionizes Elections with Blockchain

After a major electoral scandal related to "fake voters" accusations in 2020, Nevada is betting on blockchain to restore trust in its electoral system. Secretary of State Francisco Aguilar announced the integration of this technology into the electoral certification process. This innovation will allow the registration of electoral certificates on an immutable ledger, making any tampering practically impossible.

The goal is to ensure transparency and security in elections, positioning Nevada as a pioneer of democratic innovation. Inspired by past scandals, this measure also aims to strengthen voter confidence while establishing a model that other states could follow. With similar projects in Alaska and Georgia, blockchain is shaping up to be a key solution for modern digital democracy.

📊 Raydium Outperforms Uniswap: Confirmed Dominance over DEX

For the second consecutive month, Raydium, a DEX based on Solana, has surpassed Uniswap in terms of monthly volumes, recording about 30% more volumes in November 2024, representing a difference of nearly $30 billion. Raydium owes this success to the Solana ecosystem, which offers fast and low-cost transactions, and the growing popularity of memecoins, which account for 65% of its monthly volume.

With platforms like Pump.fun generating over $100 million in fee revenue, Raydium is solidifying its dominant position in the DeFi universe. This growth is also fueling the rise of Solana (SOL), whose price reached $217.60, boosted by increased activity on its network. Raydium seems well-positioned to continue dominating the DEX market while propelling Solana as a leader in the crypto ecosystem.

Today's Crypto: Aave (AAVE)

Aave is a decentralized finance (DeFi) protocol that allows users to lend and borrow cryptocurrencies. Built on the Ethereum blockchain, Aave innovates with its "flash loans," instant loans without collateral.

Its native crypto, AAVE, is a governance token that enables its holders to participate in the protocol's strategic decisions. Originally distributed through a 1:100 migration of the old LEND token, AAVE offers benefits such as fee discounts, staking rewards, and an insurance function in case of liquidity shortfalls. Users can stake AAVE, vote on proposals, and use it to secure the network.

Recent Performance

Current Price: €363.19

24h Change: +30.27%

Market Cap: €5.448 billion

Rank on CoinMarketCap: 34

🔐 Cryptos and Quantum Technology: Should We Really Fear Shor's Algorithm?

Quantum computers, which use qubits capable of maintaining multiple states simultaneously, represent a revolutionary potential for computing power. And this advancement raises concerns in the cryptocurrency world, especially regarding Bitcoin, whose security relies on asymmetric cryptography (public/private keys). Shor's quantum algorithm could theoretically break these mechanisms by solving underlying mathematical problems, including the discrete logarithm. However, estimates indicate that it would still require millions of qubits to effectively execute this algorithm on a large scale.

Despite the impressive development of processors like Google’s "Willow," capable of performing calculations in minutes that would take billions of years on classical computers, we are still far from an immediate threat.

Bitcoin Vulnerabilities and Current Measures

Indeed, Bitcoin relies on two layers of protection: hash functions (SHA-256 and RIPEMD-160) and elliptic curve cryptography (secp256k1). The former remain invulnerable to current quantum computers, but the latter is exposed if public keys are visible. Fortunately, modern transactions conceal these public keys behind addresses generated by hash functions, limiting risks. However, about 1.7 million BTC remain associated with old scripting methods (P2PK), directly exposing their public keys. Additionally, there are 4 million BTC vulnerable due to address reuse. These practices, if they persist, increase the risk of compromise as the power of quantum computers improves.

Preparing for the Future: Solutions and Challenges

The future of cryptocurrencies in the face of the quantum threat relies on two main axes: the adoption of new resistant cryptographic methods and the education of users.

Although post-quantum solutions are under development, their robustness remains to be proven in the long term. Meanwhile, there should be a massive push to migrate existing BTC to safer addresses, a process that could take years. Estimates show that total migration would require over 20,000 blocks, or about 142 days, and likely more due to practical inertia and millions of BTC forgotten in inaccessible wallets.

In summary, while the quantum threat is not imminent, it highlights the need to remain proactive in technological evolution to securely protect digital assets.