Hello Cointribe! 🚀

Today is Thursday, May 22, 2025 and as every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you shouldn't have missed!

But first…

✍️ Cartoon of the day:

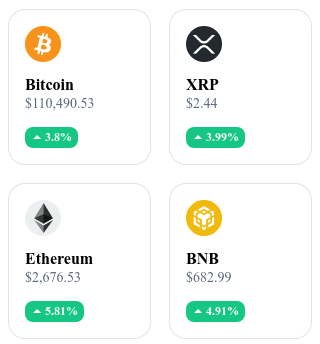

A quick look at the market…

🌡️ Temperature:

Sunny ☀️ (Very sunny indeed)

24h crypto recap! ⏱

📈 Bitcoin: open interest at $72 billion, close to an all-time high

Open interest on Bitcoin futures contracts has reached $72 billion, approaching the all-time record. This increase coincides with a trend of investors shifting gold reserves towards Bitcoin.

⚖️ Robinhood submits regulatory framework for tokenized assets to the SEC

Robinhood has submitted a proposal to the SEC aimed at establishing a national framework for regulating tokenized real-world assets, giving them legal equivalence with their traditional versions. The company plans to launch the Real World Asset Exchange (RRE), a platform using Solana and Base, capable of processing up to 30,000 transactions per second.

🏛️ The Democratic Party under pressure after a controversial vote on stablecoins

The Democratic Party faces internal tensions after a controversial vote regarding the regulation of stablecoins. Some members express concerns about the political and ethical implications of the proposed legislation.

💼 States increase their Bitcoin exposure via Strategy

Several states are increasing their indirect exposure to Bitcoin by investing in Strategy. According to Standard Chartered, this adoption could support Bitcoin's rise to $500,000 by 2029. Bitcoin thus positions itself as a macroeconomic hedge asset in global sovereign portfolios.

Crypto of the day: Ethena (ENA)

Ethena positions itself as an innovative solution in the DeFi universe by offering USDe, a synthetic dollar backed by crypto assets, notably liquid staking tokens like stETH. Thanks to a delta hedging strategy combining long positions on staked assets and short positions on perpetual contracts, Ethena maintains the stability of USDe, providing a reliable alternative to traditional stablecoins.

The token ENA plays a central role in Ethena’s ecosystem. It allows holders to actively participate in the protocol’s governance, influencing key decisions such as risk management and strategic partnerships. Additionally, staking ENA offers attractive yields, strengthening user engagement and network security.

📊 Market data as of May 21, 2025

Current price: $0.4166 USD

24-hour change: +9.70%

Market capitalization: approximately $2.42 billion

Rank on CoinMarketCap: #46

Circulating supply: 5.82 billion tokens

24-hour trading volume: approximately $426.4 million

Bitcoin crosses $111,000: how far can the market absorb?

Bitcoin has crossed a new symbolic threshold exceeding $110,000 last night, then $111,000 this morning, driven by a continuous wave of inflows via spot Bitcoin ETFs. This bullish acceleration comes amid regulatory clarification and increasing institutional adoption. But behind the apparent enthusiasm, the central question remains: is this momentum sustainable in the medium term, or are we witnessing a fragile extension of an already advanced cycle?

ETFs as catalyst: a flow with psychological leverage

The main driver of this surge is clearly identified: net inflows into spot Bitcoin ETFs, which continue to capture the attention of professional investors and legitimize the asset among traditional managers. These sustained flows occur in an environment of improved regulatory clarity in the United States, notably after official approvals for ETF listings on major exchanges.

This institutional movement, coupled with slightly recovering overall liquidity, has triggered a rapid revaluation of BTC, strengthened by self-reinforcing narrative effects in the markets. However, several analysts urge caution: the core of the rise today relies on a class of buyers sensitive to flows — and not on organic momentum driven by on-chain activity or network innovation.

Risk of overheating: Technical signals to watch closely

The crossing of $111,000 happened with high volumes, but some technical signals invite vigilance. The RSI approaches overbought levels on multiple timeframes, and minor bearish divergences appear between price and momentum. Moreover, the concentration of long positions on derivative markets is increasing, exposing BTC to rapid liquidation phases in case of exogenous shocks (macro, regulation, technical incident).

Added to this are significant external factors: persistent uncertainty about the trajectory of U.S. interest rates, latent geopolitical tensions, and a dollar struggling to stabilize. All elements that could weaken a crypto market too dependent on a single bullish lever.

The crossing of $111,000 marks a significant moment for Bitcoin, both symbolically and institutionally. But the strength of this trend will depend on the market's ability to consolidate this level without speculative excess, and to diversify its growth drivers beyond the ETF factor alone.