⏳Bitcoin: The "final boss" of 2025 is being fought this week

Welcome to the Daily of Tuesday, December 30, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, December 30, 2025, and just like every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ must-know crypto news!

But first…

✍️ Cartoon of the day:

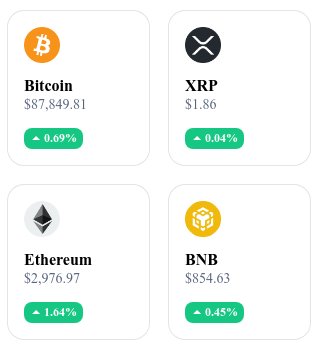

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

📈 Tokenized stocks surge in crypto market with record capitalization

The market cap of tokenized stocks on blockchains has surpassed $1.2 billion, marking a 167% growth in 18 months from roughly $450 million. Tokenized shares replicate traditional stocks like Apple, Tesla, or Amazon and enable 24/7 trading. Ethereum and Stellar are key infrastructures in this trend, attracting players such as Kraken and Coinbase.

👉 Read the full article

🔥 Uniswap burns 100 million UNI, but the market doesn’t ignite

On December 27, 2025, Uniswap activated its fee switch and burned 100 million UNI tokens—about 0.5% of the circulating supply. Despite the burn, the UNI price dropped by around 6% in the following hours. While the move aligns with Uniswap’s “UNIfication” governance shift, it failed to spark immediate bullish momentum.

👉 Read the full article

📉 US dollar drops 10% in a year

Over the past 12 months, major currency indexes show the US dollar down about 10% against a basket of global currencies. This decline reflects broader global monetary dynamics and diverging economic policies. The weakening dollar impacts various dollar-denominated assets and affects hedging and diversification strategies.

👉 Read the full article

⚡ Bitcoin: Strategy buys 1,229 BTC despite market doubt

Strategy has announced a purchase of 1,229 BTC, added to its reserves amid ongoing market volatility. The accumulation reflects the firm’s continued conviction in Bitcoin, even as broader sentiment remains hesitant across the crypto sector.

👉 Read the full article

Crypto of the Day: Immutable (IMX)

🧠 Innovation & Added Value

Immutable is a Web3 infrastructure built for gaming and NFTs, operating as a layer-2 on Ethereum. It enables fast transaction execution with very low fees while maintaining Ethereum’s security standards.

The network offers developer-friendly tools and streamlined NFT integration, tailored for game studios aiming to build accessible, scalable blockchain games.

Its ecosystem aims to become the go-to platform for mainstream blockchain gaming, combining performance, scalability, and Web3 compliance.

💰 The Token

The IMX token is the cornerstone of Immutable’s ecosystem. It’s used to pay fees, incentivize users, and support governance. Both users and developers rely on IMX to interact with network services and contribute to its sustainability.

IMX also helps redistribute value across the platform, particularly through activity-based rewards tied to NFT usage and gaming engagement. The token’s utility grows in line with adoption of games and marketplaces built on Immutable.

📊 Live Performance (CMC)

💵 Current price: €0.1940

📉 24h change: –4%

💰 Market cap: €385.87M

🏅 CoinMarketCap rank: #90

🪙 Circulating supply: 1.98B IMX

📊 24h trading volume: €16.62M

🛑 Year-End Close: Bitcoin Faces a Historic Shockwave

It’s December 30, 2025. In less than 48 hours, Bitcoin’s annual candle will close. While for most people it’s just the end of a calendar year, in the crypto world, it’s a moment of unprecedented technical and psychological truth.

The stakes are clear: Bitcoin is fighting to uphold a golden rule that’s held since its creation. Here’s our full analysis.

The $93,500 Pivot: The Line Between Success and Failure

The “annual close” is a key reference for institutional investors. For 2025 to be officially considered a bullish year, the price must end above its January 1 opening: $93,500.

Current risk: With BTC hovering between $87,000 and $89,000, we are in the red zone.

Psychological impact: A close below that level would signal weakness to trading algorithms and fund managers who rebalance portfolios based on yearly performance. A failure to reclaim $93,500 would technically mark 2025 as a year of “distribution” rather than expansion.

The Specter of the End of the 4-Year Cycle

This is perhaps the most alarming point raised by Cointribune analysts. Historically, Bitcoin has followed a reliable halving-based cycle:

Halving year (2024): Accumulation and moderate growth.

Post-halving year (2025): Parabolic surge and new highs.

Correction year (2026): Bear market.

If 2025 closes in the red, it would be the first time ever that a post-halving year ends without gains. This could signal that the structure of Bitcoin’s cycles is changing—likely under pressure from traditional finance (ETFs) which dampen volatility at the cost of explosive gains.

The Two Forces Suppressing Price

Why isn’t Bitcoin soaring despite mass adoption? Two key obstacles:

The options wall ($24 billion): A record amount of BTC options is set to expire this Friday. Market makers have every incentive to keep the price in the zone that maximizes losses for options buyers (“max pain price”), artificially capping any “Santa Rally.”

Macroeconomic tensions: Investors are wary of early 2026 decisions around tariffs and inflation. Institutions prefer to “sell the news” and lock in profits before committing to a new fiscal year.

The Accumulation Paradox: Whales Are Not Selling

Despite prices stuck below $90,000, on-chain data tells a different story. As seen with MicroStrategy’s massive 1,229 BTC purchase this week, large wallets are taking advantage of uncertainty to absorb available supply.

A massive value transfer is underway: short-term speculators are selling out of fear of a red year, while institutions accumulate at what they see as “low” prices ahead of 2026’s expected supply squeeze.

Scenarios for Q1 2026

This week’s close will set the tone for the next three months:

Scenario A (Bullish): A last-minute surge above $93,500 triggers a strong technical buy signal (annual “hammer candle”), with targets near $110,000 as early as January.

Scenario B (Bearish): A close below $85,000 could push BTC toward lower support zones. The $80,000 level would be the final defense before a sharp drop toward $74,000 — the 2024 peak — wiping out excessive leverage.

We’re in a transition. Bitcoin is evolving from a speculative, cyclical asset into an institutional reserve asset. This shift is painful, as it breaks old patterns (like the 4-year cycle).

But remember: price is an opinion, volume is a fact. And institutional accumulation volume has never been higher. Whether this week’s candle closes red or green, the foundations for 2026 are paradoxically strong.