Bitcoin, the secret weapon of the BRICS against the dollar? 🌐

Welcome to the Daily Tribune on Wednesday, January 31, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, January 31, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

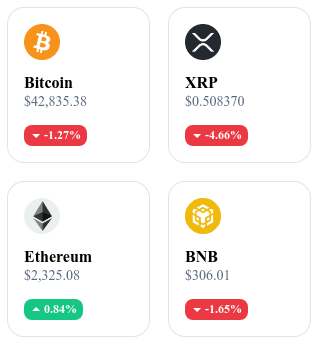

A quick look at the market…

🌡️ Temperature:

Partly cloudy ⛅

24-hour crypto summary ! ⏱️

Bitcoin, the secret weapon of the BRICS against the dollar? 🌐

The BRICS (Brazil, Russia, India, China, South Africa) are considering using Bitcoin (BTC) as a potential tool to counter the hegemony of the US dollar. This initiative comes at a time when the first Bitcoin Spot ETF has been approved by the SEC, fueling discussions about the practical use of cryptocurrencies in daily transactions. The BRICS, seeking to reform international financial institutions, see Bitcoin as an opportunity to reduce their dependence on Western-dominated financial structures.

Bitcoin, with its decentralized nature, offers a unique opportunity for BRICS nations to gain financial sovereignty. By adopting this digital currency, they could bypass the constraints of the current financial system while benefiting from the transparency, security, and efficiency of blockchain technology. This strategy could particularly benefit countries like Russia and Iran, which are subject to Western sanctions.

The BRICS' intention to use Bitcoin as a tool for dedollarization is revolutionary. This could not only undermine the dominance of the dollar but also legitimize Bitcoin as a sovereign financial instrument. However, this strategy raises questions about the stability and liquidity of Bitcoin in the face of such scales of adoption.

Ethereum ETF: Approval postponed to 2026? 🌟

TD Cowen, an investment bank, predicts that the approval of Ethereum spot ETFs by the US Securities and Exchange Commission (SEC) will not happen before 2025 at the earliest. This prediction reflects the political and regulatory challenges faced by cryptocurrencies. The SEC, under the leadership of Gary Gensler, appears to be adopting a cautious approach, possibly to avoid internal political conflicts, especially with the left wing of the Democratic Party, which remains skeptical of cryptocurrency.

This prediction contrasts sharply with the recent approval of Bitcoin ETFs by the SEC. Gensler, despite criticism, has given the green light to Bitcoin ETFs but seems to be taking lessons from this experience by adopting a more cautious position with Ethereum.

The postponement of the Ethereum ETF indicates significant regulatory hesitation, revealing the challenges of integrating cryptocurrencies into the traditional financial framework. This delay could be seen as a barrier to innovation, but it also offers an opportunity for Ethereum to consolidate its position as a mature platform before the arrival of institutional investors. In the long term, this could promote a more sustainable and thoughtful adoption of Ethereum, avoiding the pitfalls of excessive speculation.

Bitcoin targeted by a DDoS attack 🚨

The Bitcoin network is currently under a Distributed Denial of Service (DDoS) attack, which is causing pain to its nodes. This attack comes at a time when the Bitcoin protocol is regularly updated, sometimes with controversial soft forks like SegWit and Taproot. These updates, while necessary, can introduce unexpected bugs, as illustrated by the recent problems with ordinals, files that bypass limitations by embedding themselves in transaction scripts.

The DDoS attack raises questions about the growing centralization of the Bitcoin network, exacerbated by the increasing size of the blockchain and the number of UTXOs. To counter these attacks, measures such as transaction filtering in the Bitcoin Core mempool are being considered. These filters would distinguish between standard and non-standard transactions, thus reducing the impact of DDoS attacks.

As Bitcoin strives to stay at the forefront of technology, it also becomes more vulnerable to new forms of attacks. This situation highlights the imperative need for a balance between adopting new features and preserving the network's robustness.

CFTC warns of AI scams in crypto ⚠️

The US Commodity Futures Trading Commission (CFTC) warns of an increase in scams using artificial intelligence (AI) in the cryptocurrency sector. These increasingly sophisticated scams exploit the popularity of AI and crypto to attract investors with promises of high returns. Scammers claim to possess revolutionary trading algorithms and robots, playing on the public's ignorance of the real limits of AI.

Despite their sophistication, these AIs do not guarantee extraordinary profits or the ability to predict market fluctuations with certainty. The promises of scammers are therefore false and solely aim to extort money. These scams have already caused losses amounting to billions of dollars. The CFTC advises investors to remain cautious and skeptical of promises that seem too good to be true, especially when they involve AI.

The rise of AI scams in the cryptocurrency field highlights the need for more sophisticated regulation and greater transparency to protect investors while preserving innovation and growth in the sector.

Crypto of the day: Theta Network (THETA)

Theta Network stands out in the blockchain universe with its innovative approach focused on streaming video content. By using blockchain technology, Theta enables decentralized distribution of videos, reducing bandwidth costs and improving streaming quality, especially in remote or underserved regions.

Its native cryptocurrency, THETA, plays a crucial role in this ecosystem by rewarding both content creators and users who share their bandwidth resources. THETA holders not only benefit from rewards for participating in the network but also have governance power, allowing them to vote on protocol changes. This approach creates an ecosystem where users are incentivized to actively contribute to the health and growth of the network.

Recent performance of Theta Network

Current price: €0.976 (approximately, based on the current exchange rate)

Percentage variation: -6.80% (decrease over 24 hours)

Market capitalization: Approximately €976 million

Rank on CoinMarketCap: 64th

Daily crypto analysis: Cardano (ADA)

Today, we will dive into the world of Cardano (ADA) and decrypt its recent journey together. You know, in the crypto world, things often move at a fast pace, but ADA shows us that it is possible to move \"slowly but surely.\" So, hold on, here we go!

In late 2023, ADA experienced a spectacular increase of nearly 180%. This upward movement started from a crucial support level at $0.24, reaching $0.68. But beware, after such a rise, a correction was inevitable. ADA then declined by 33%, falling back to $0.45. This is where things get interesting: this level corresponds to the 50% Fibonacci retracement, a tool that we often use to predict price movements.

Currently, ADA seems to be forming a "double bottom," a pattern that, in our jargon, suggests a potential bullish reversal. But, there is always a 'but' in crypto, right? The recent decline pushed ADA below its 50-day moving average, which could indicate a trend change. The oscillators, these tools that measure momentum, also show that Cardano's bullish momentum is waning. This could mean that ADA is currently undervalued, or conversely, heading towards a bearish trend. It's a bit like looking at the clouds and trying to predict tomorrow's weather!

For ADA enthusiasts, keep an eye on key levels. If ADA holds above $0.45, we could expect a bullish recovery. But if not, be prepared for a possible return to lower levels. And remember, cryptos are a dynamic playing field, where changes can happen quickly.