🚀 Bitcoin: The Star Financial Asset of 2023 🌟

Welcome to the Daily Tribune of Wednesday, December 27, 2023 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 27, 2023, and like every day from Tuesday to Saturday, we summarize the news from the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

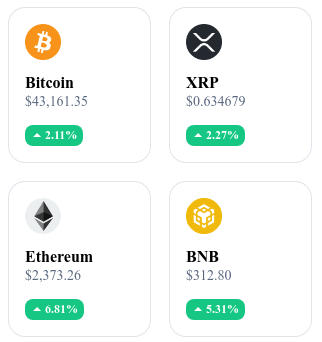

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

🌐 Mt. Gox: The End of a Decade of Waiting 🕒

Mt. Gox has finally started repaying its creditors after a long ten-year wait. The platform, whose bankruptcy in 2014 caused a significant drop in the price of Bitcoin, has begun distributing payments in crypto via PayPal, confirmed by screenshots of yen payments shared on Reddit. Although the payments represent only a fraction of the initial claims, they mark an important milestone for the creditors who have been waiting since the beginning of 2023.

The first signs of repayments emerged on December 21. These payments, scheduled in several stages, are expected to continue throughout 2024. Despite the lack of a specific timeline, this wave of repayments adds a layer of transparency to a long-awaited process, signaling the closure of a decade-long saga.

The repayment of Mt. Gox is not only a victory for the creditors, but also a milestone for trust in the crypto ecosystem.

🚀 Bitcoin: The Star Financial Asset of 2023 🌟

Bitcoin (BTC) emerges as one of the top-performing financial assets of 2023. According to a study by Kaiko Research, despite a challenging macroeconomic environment, Bitcoin has surged more than 160% this year, outperforming most traditional assets. Only a few assets, such as NVIDIA, have recorded better performances. The report also highlights Bitcoin's Sharpe ratio, an indicator of risk-adjusted returns, as one of the best in 2023.

Bitcoin's performance is attributed to its unwavering dynamism. Kaiko Research identifies three key moments in the year for Bitcoin: an early rally, a mid-year slump, and a year-end rally. Despite a recent slight decline, Bitcoin has experienced a significant rise, particularly following a false rumor about the approval of a Bitcoin Spot ETF, illustrating its potential for continued growth.

Bitcoin's outstanding performance in 2023 illustrates its resilience and growing disconnection from traditional markets, reinforcing its status as a safe haven asset.

🤝 Solana & Ethereum: Toward a New Era of Collaboration 🌉

Anatoly Yakovenko, co-founder of Solana, envisions an era of collaboration with Ethereum. Contrary to the misconception of Solana as an \"Ethereum killer,\" Yakovenko proposes a vision where Solana would act as a layer 2 for Ethereum. This perspective is made possible by \"Danksharding,\" an Ethereum scalability upgrade that would pave the way for unexpected cooperation between the two blockchain giants.

Danksharding could be the key to interoperability between Solana and Ethereum. Yakovenko suggests that extending danksharding would facilitate the integration of Solana blocks into a validation relay contract on Ethereum. Despite differences in consensus mechanisms, a bilateral agreement is needed for seamless integration. This bold statement marks a turning point in the perception of Solana and promises a collaborative future in the blockchain universe.

Yakovenko's proposition of Solana as a layer 2 for Ethereum is not just a vision of interoperability; it is a bold strategy that could redefine power dynamics in the blockchain space. By leveraging the strengths of each platform, this collaboration could catalyze a new wave of innovation and improved performance.

💸 Massive Ethereum Withdrawal by Justin Sun: Concerns and Speculations 🧐

Justin Sun, founder of Tron, has withdrawn a significant amount of Ether from Binance. Equivalent to approximately $13.8 million, this massive withdrawal has surprised and concerned the crypto community. This is not the first time Sun has made such withdrawals, having previously withdrawn huge amounts of Shiba Inu, fueling speculation about his motivations.

The community is questioning the reasons behind these massive withdrawals. Sun's actions, including his announcement of actively engaging in meme coin trading, mark a turning point in his investment strategy. The community eagerly awaits new statements or actions that could shed light on the intentions behind these substantial Ethereum withdrawals from Binance.

The substantial Ethereum withdrawals made by Justin Sun on Binance are not just capital movements; they are symptomatic of market dynamics and investor psychology in the crypto ecosystem. These withdrawals may reflect a diversification strategy or a reaction to anticipated regulatory changes.

Crypto of the Day: Mina (MINA)

Mina is known for its lightweight blockchain and innovative use of Zero-Knowledge Proofs. This technology allows Mina to maintain a constant blockchain size of about 22 KB, making it extremely accessible and easy to verify even on mobile devices. This approach significantly reduces storage and computing requirements, offering increased decentralization and security. The added value lies in its ability to provide a secure and efficient platform for decentralized applications, while remaining accessible and scalable.

Mina's native crypto, MINA, is used for several key functions within the network, including staking rewards, transaction fees, and participation in governance. MINA has been distributed through a public sale, staking rewards, and allocations to the community and developers. MINA holders have the opportunity to participate in the security and governance of the network while having the chance to earn staking rewards. Additionally, MINA can be used to develop and interact with decentralized applications on the platform, benefiting from its privacy and efficiency.

Recent Performances

Current price: $1.34 (approximately €1.24)

Percentage increase/decrease: +20.22% (1-day increase)

Market capitalization: Approximately $1.38 billion (approximately €1.27 billion)

Rank on CoinMarketCap: 56

Tokenization of Artworks

As we stand at the dawn of a new economic cycle, one of the most captivating narratives likely to drive the next bull run is the tokenization of Real World Assets (RWA). This innovation, which involves converting tangible assets into digital tokens on the blockchain, promises to revolutionize not only the art market but also many other sectors by offering increased liquidity, accessibility, and transparency. In this dynamic context, we are exploring today how the tokenization of artworks perfectly illustrates the transformative potential of this trend and paves the way for a new era of investment and artistic appreciation.

But what exactly is tokenization? It is the process of converting the rights to an artwork or any other asset into a digital token on a blockchain. These tokens act as fractionalized shares of the asset, allowing for easier and more accessible ownership, exchange, and traceability. Essentially, tokenization transforms physical assets into secure and easily tradable digital assets, opening new avenues for investment and value preservation.

This revolution is not limited to the art market; it extends to many sectors, offering increased liquidity, accessibility, and transparency. The tokenization of artworks perfectly exemplifies the transformative potential of this trend. It opens new monetization channels for artists and makes art more accessible to investors. Through the blockchain, each token becomes a non-fungible token (NFT), enabling purchase, sale, or exchange on various platforms. This process begins with the careful selection of the artwork to be tokenized, followed by professional valuation to determine its market value. A reliable and secure tokenization platform is then selected for the creation and issuance of the token.

The advantages of tokenization are manifold. It offers increased accessibility and improved liquidity, allowing previously inaccessible artworks to be easily shared and traded. Furthermore, each token contains detailed information ensuring the authenticity and traceability of the artwork. However, this innovation is not without challenges. Technical complexity and legal and regulatory issues are significant considerations for anyone looking to venture into tokenization.

Notable examples such as the sale of Beeple's artwork for $69 million and the CryptoPunks collection showcase the enormous potential of this practice. Even prestigious institutions such as the Louvre Museum have begun exploring this path, signaling a growing trend and wider acceptance of tokenization in the art world.

In conclusion, tokenization is reshaping our interaction with art, making it more accessible, liquid, and traceable. This is a revolution that breaks down traditional barriers and opens new possibilities for artists and investors.