Bitcoin towards 500K? Undervalued Ethereum? 🔥

Welcome to the Daily of Wednesday, December 6, 2023 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 6, 2023, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

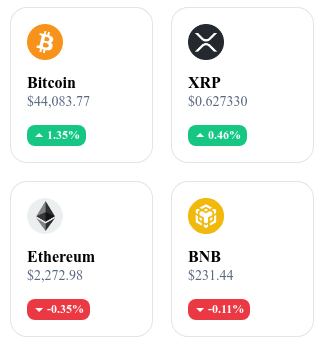

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

🚀 Bitcoin at $500,000: The new monetary order in sight

Bitcoin is oscillating between 41,000 and 43,000 euros and is approaching its historical record of $69,000 reached in November 2021. This bullish trend has led some analysts to anticipate a meteoric rise, with Bloomberg predicting a \"crypto supercycle\" that could propel Bitcoin beyond $500,000.

After a challenging 2022 for cryptocurrencies, 2023 marks a resurgence, with a return to pre-April 2022 levels. Influential figures in the field, such as the former CEO of Binance, regard market fluctuations as a natural and cyclical cycle and advise not to be discouraged by temporary downturns. Various factors, such as inflation, liquidity, economic growth, the Bitcoin halving, and geopolitical issues, are likely to influence this bull run.

Bloomberg's forecast on Bitcoin reflects the growing acceptance of cryptocurrencies as viable alternatives to traditional currencies. However, this optimistic projection must be tempered by the inherent volatility of the cryptocurrency market and potential regulatory challenges.

💎 Ethereum at $2200: An undervalued gem

While Bitcoin has experienced a spectacular increase of over 140% since January 2023, Ethereum (ETH) seems to be lagging behind, with a growth of about 30% since mid-October. Despite this, Ethereum fundamentals remain strong. With annualized profits of $2.7 billion and an impressive price-to-earnings ratio, the current price of around $2200 is considered undervalued, particularly compared to Bitcoin's performance.

Since the September 2022 merger, Ethereum has followed a deflationary trajectory, reducing its supply and offering attractive rewards for staking. These factors, combined with its energy efficiency and the prospect of an Ether-backed ETF in 2024, position Ethereum as an asset with significant growth potential. Some analysts even predict a surge towards $10,000, suggesting that now is the perfect time to invest before an expected increase.

The undervaluation of Ethereum, despite strong fundamentals, reflects a market that has not fully integrated the impact of Ethereum's transition to Proof of Stake.

🌊 XRP booming: Historical record of transactions

Ripple (XRP) is attracting attention with record transaction activity, reaching 1.38 million transactions, an unprecedented peak since mid-August 2023. This increase in activity coincides with the ongoing lawsuit between Ripple and the SEC and fuels speculation of an imminent rise in the price of XRP. Investors and analysts anticipate a surge in price, despite the current price being below $0.64.

The Ripple vs SEC lawsuit extends beyond the legal framework to influence the market. If Ripple were to win, it could not only trigger a rally for XRP, but also establish favorable jurisprudence for cryptocurrencies. Currently, XRP maintains a bullish trend, with optimistic predictions of surpassing the $0.75 mark again.

The record increase in XRP transactions indicates growing investor confidence in a favorable outcome of the Ripple vs SEC lawsuit. A positive verdict could not only boost the price of XRP, but also establish favorable legal precedent for the entire cryptocurrency industry.

⚠️ Bitcoin: Hashrate drop, a phantom threat?

Bitcoin's hashrate has recently reached an all-time high, exceeding 500 million terahashes per second. However, this performance hides a potential vulnerability: the concentration of hashrate among a few major players and its dependence on seasonal energy sources, such as hydroelectricity. A sudden drop in hashrate, due, for example, to a reduction in cheap electricity production, could weaken the security of the Bitcoin network and negatively impact its price.

Despite an increasing market capitalization and a favorable context marked by growing interest in Bitcoin ETFs, a significant drop in hashrate could erode confidence in Bitcoin and decrease its value. Experts remain divided on the short-term future of Bitcoin, with some anticipating fluctuations, while others see bullish potential due to institutional adoption. To strengthen its long-term resilience, the Bitcoin network must improve its geographical and energy distribution.

The volatility of Bitcoin's hashrate highlights a critical dependence on centralized infrastructure and fluctuating energy sources. It highlights the tension between Bitcoin's ideological decentralization and the practical centralization of its mining. A drop in hashrate could not only affect the network's security but also its perception as a safe asset.

🌐 Rayn redefines personal finance

Rayn, formerly Akt.io, is a company registered with the AMF that positions itself at the forefront of financial management. Founded in 2019, Rayn has transformed to revolutionize savings management in France and Europe. The company uses blockchain and artificial intelligence to offer an innovative financial experience, focusing on savings rather than consumption. Rayn stands out for its ability to democratize access to wealth management, offering solutions tailored to various investor profiles.

Rayn integrates blockchain to ensure transparency and security in its financial solutions. It offers automated allocations, minimizing risks and adapting investment strategies to each user's profile. Furthermore, Rayn plans to expand its offering in 2024 to include more traditional markets such as stocks and ETFs, thus marking its ambition to become a major player in the finance of tomorrow.

Crypto of the day: Brickken (BKN)

Brickken is revolutionizing asset tokenization and management with its comprehensive suite of tokens. This platform facilitates the creation, sale, and management of tokenized digital assets. It offers an extensive market reach, accepts crypto and fiat currency, creates dedicated sales pages, verifies investor KYC, and tracks campaign progress in real-time. In short, it enables businesses to easily tokenize their assets.

Brickken's native cryptocurrency, BKN, is used for seamless and efficient creation of digital assets, designing unique token economies, and ensuring global compliance. It enables efficient management on the blockchain, including profit distribution, streamlining corporate actions, performance analysis, and treasury management.

Recent performances

Current price: €0.4121

Percentage increase/decrease: +27.35% (in 1 day)

Market capitalization: €1,761,756

Rank on CoinMarketCap: #2477

Please note that this information is provided for informational purposes only and does not constitute investment advice. Always do your own research before making any financial decisions.

Crypto analysis of the day: Ethereum (ETH)

Ethereum has recently reached an impressive annual high, breaking through the $2,300 threshold. This is a level we haven't seen since May 2022. This remarkable increase, about 13% in November and already more than 11% in December, is partly due to positive Bitcoin momentum. What's fascinating is the \"bullish gap\" observed on Ethereum futures contracts, located between $2,220 and $2,120. For traders, this is a zone to closely monitor, as it plays a crucial role in determining ETH's future trend.

Currently, Ethereum is trading around $2,280, staying above its 50-day and 200-day moving averages. These indicators suggest a bullish trend in the medium and long term. However, a divergence is emerging on the RSI (Relative Strength Index), indicating a possible period of consolidation or correction. This is a signal for investors to remain vigilant and prepare strategies for different eventualities.

If ETH surpasses and maintains above $2,300, we could see a continuation of the bullish trend, potentially up to $2,500 - $2,700, or even $3,000. However, if ETH fails to break through this threshold, a return to $2,100, or even $2,000, could be considered. It is crucial to remember that these scenarios are based on technical analysis and that the cryptocurrency market is influenced by many other factors. So, stay attentive and be ready to adjust your strategies!

In conclusion, Ethereum continues to show signs of strength, but as always in the world of cryptocurrencies, caution is advised. Keep an eye on key levels and be prepared to act based on market developments.