🚀 Bitcoin: Why $280,000 is Becoming a Credible Target?

Welcome to the Daily for Tuesday, August 19, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, August 19, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the past 24 hours’ news you shouldn’t miss!

But first…

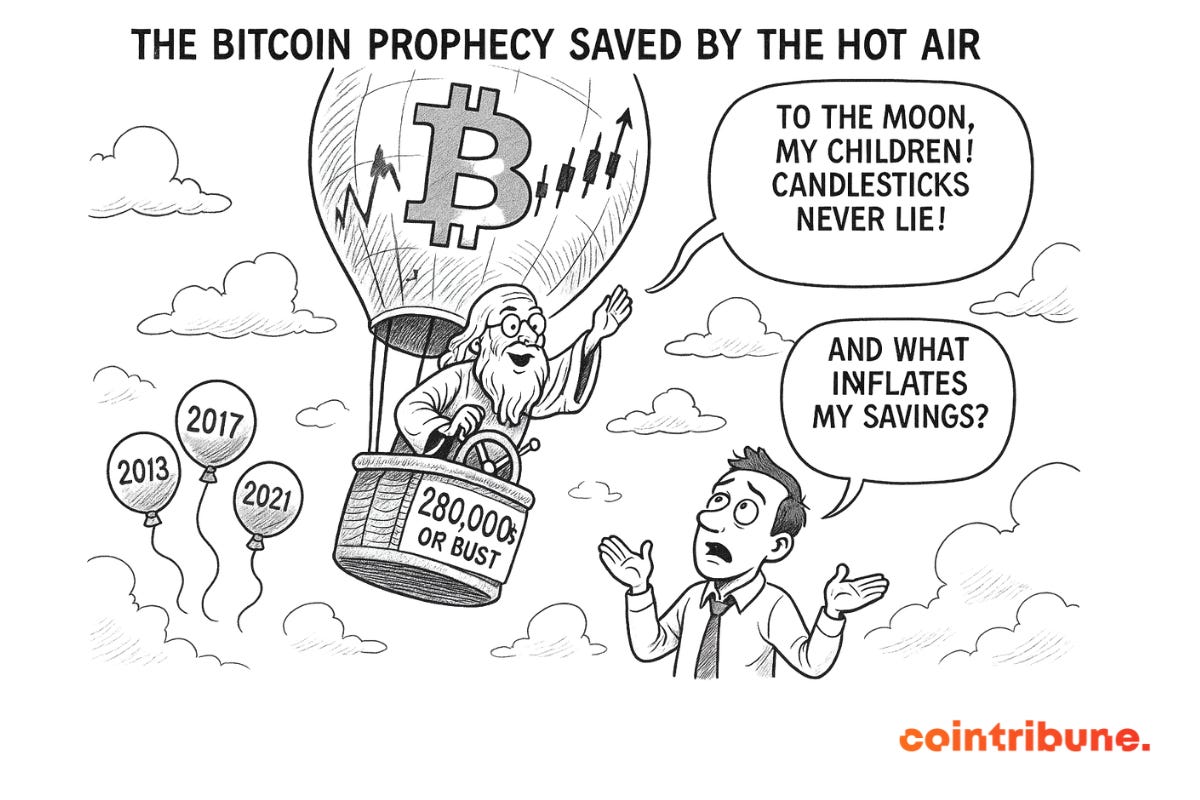

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

☁️ Cloudy

24h crypto recap! ⏱

💵 Tether reaches $165B in a $273B stablecoin market

USDT accounts for ~60.5% of the sector with $165.25B, while the total stablecoin market cap stands at $273.17B. USDC follows with $66.8B, while USDe nears ~$11B, signaling fiercer competition under regulatory scrutiny.

👉 Read full article

⚖️ United States launches DeFi overhaul

The Treasury has opened a public consultation until October 17, 2025, proposing to require identity verification directly in protocol code. The initiative builds on the GENIUS Act and leverages digital identity, AI, and monitoring APIs — at the risk of reducing user anonymity.

👉 Read full article

⚡ Solana prepares “Alpenglow” for near-100 ms finality

The SIMD-0326 upgrade introduces Votor for one-to-two round finality and plans Rotor to speed up data propagation. The community vote spans epochs 840 to 842 and could establish Alpenglow as the network’s new finalization standard.

👉 Read full article

🏦 Strategy buys 430 BTC for $51.4M, raising holdings to 629,376 BTC

The purchase was made at an average price of ~$119,666/BTC and follows recent preferred stock sales. The operation aligns with the “42/42 Plan,” targeting $84B invested in bitcoin by 2027.

👉 Read full article

Crypto of the Day: Internet Computer (ICP)

🧠 Innovation and Added Value

Internet Computer (ICP), developed by the DFINITY Foundation, introduces a next-generation blockchain capable of hosting full Web3 applications (UX, computation, data) directly on a decentralized, serverless architecture. Leveraging chain-key cryptography and the Network Nervous System (NNS) for automated governance, ICP acts as a true “world computer,” providing speed, scalability, and autonomy for Web3 developers.

💰 The ICP Token: Utility and Benefits for Holders

The ICP token is multifunctional: it powers governance through the NNS, is converted into cycles to run canisters (autonomous smart contracts), and rewards network validators. This reverse-gas model fosters a sustainable, decentralized, and efficient ecosystem, aligning the incentives of developers and the network.

📊 Real-Time Performance (August 19, 2025)

Current Price: $5.17 USD

24h Change: –2.32 %

Market Cap: ≈ $2.77B USD

Rank on CoinMarketCap: #38

Circulating Supply: ≈ 536.9M ICP

24h Trading Volume: ≈ $55.88M USD

Bitcoin Could Reach $280,000 in 2025 According to Peter Brandt

The crypto community is buzzing over a new ambitious Bitcoin projection: up to $280,000 by the end of 2025. This forecast comes not from an unknown source, but from renowned trader Peter Brandt, who relies on a cyclical model validated by analyst Bobby Hall. What’s behind this bold scenario? Is it credible? Let’s break it down.

A Cyclical Model Backed by Peter Brandt

The core of the scenario is based on a charting model developed by Bobby Hall, known as “Bitcoin Live.” It identifies recurring patterns in post-halving bull cycles, marked by exponential growth phases followed by sharp corrections.

According to this reading, two price ranges are projected by December 2025: a moderate target between $150,000 and $180,000, and a potential peak reaching $250,000–$280,000. Peter Brandt has publicly endorsed the model, calling it “compelling” and noting that current data suggest a possible alignment with past cycles.

In this light, Bitcoin’s current evolution around $119,000, marked by a consolidation phase, is interpreted as a potential base for the next bullish impulse. The success of this hypothesis, however, depends on the market’s ability to replicate past dynamics — particularly in terms of volume, collective psychology, and macroeconomic conditions.

Implications and Limits of the Projection

If confirmed, such a projection would mean more than doubling Bitcoin’s current price in just over a year. While appealing due to historical alignment, it also raises critical questions. Market conditions have evolved significantly: institutional adoption, tighter regulation, and sector financialization introduce new dynamics.

Compared with other analyses, this forecast stands out for its boldness. Some technical analysts, such as Elliott Wave theorists, see a more moderate peak around $140,000, followed by a major reversal in 2026. Others argue macro headwinds like geopolitical tensions, high interest rates, or regulatory reforms could restrain upside potential.

A key limitation is the model’s reliance on past events. As every investor knows, historical performance never guarantees future results. If the cyclical structure repeats, it may signal market maturity and predictability. Conversely, a major deviation would suggest a deeper paradigm shift.