Hello Cointribe! 🚀

Today is Wednesday, October 15, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ top news you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

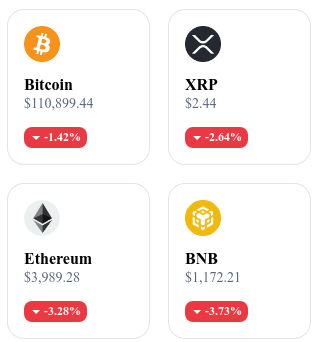

A quick look at the market…

🌡 Weather:

🌧️ Stormy

24h crypto recap! ⏱

🏙️ New York mayor creates a blockchain office before leaving office

Mayor Eric Adams has officially announced the creation of the New York Blockchain Office, responsible for overseeing blockchain adoption in municipal services and private partnerships. The initiative aims to attract Web3 companies and strengthen the city’s position as a major U.S. technology hub.

👉 Read the full article

💸 Binance unlocks an additional $400M to support traders hit by the crash

Binance has announced a new $400 million relief fund to compensate traders affected by the recent market collapse. The funds come from the SAFU Fund, an internal protection mechanism financed by the platform’s revenues.

👉 Read the full article

🪙 Bitcoin–Gold correlation hits 0.85

The correlation between Bitcoin and gold has reached 0.85, its highest level since 2020. This convergence reflects the growing perception of BTC as a safe-haven asset amid market volatility and uncertain monetary policies.

👉 Read the full article

⚙️ Hyperliquid reaches a key milestone with HIP-3: perpetual markets open to everyone

The Hyperliquid protocol has approved proposal HIP-3, granting open access to its perpetual markets through a decentralized architecture. This upgrade strengthens community governance and marks a turning point in the platform’s competitiveness against centralized exchanges.

👉 Read the full article

Crypto of the Day: Beam (BEAM)

Innovation and Added Value 🧠

Beam is a decentralized gaming ecosystem built on the Avalanche blockchain, designed to provide a complete infrastructure for Web3 games. The project enables studios and developers to easily integrate blockchain features — such as digital asset management, in-game marketplaces, and payment systems — without technical complexity.

Beam operates on the Avalanche Beam Subnet, optimized for fast transactions and micro-payments. Its goal is to create a seamless environment where players maintain full ownership of their virtual items and studios can sustainably monetize their universes through tokenization.

The Token 💰

BEAM is the native token of the ecosystem. It is used to pay transaction fees, purchase in-game assets, and participate in network governance. Developers can also use it to fund campaigns or tournaments, while players earn BEAM by joining community events.

A portion of the revenue from games built on Beam is redistributed to the network treasury, creating a circular model in which users, creators, and validators collectively benefit from the ecosystem’s growth.

Real-Time Performance 📊

💵 Current Price: 0.0192 USD

📈 24-Hour Change: + 2.13 %

💰 Market Cap: 1 010 000 000 USD

🏅 Rank on CoinMarketCap: #91

🪙 Circulating Supply: 52 618 000 000 BEAM

📊 24-Hour Trading Volume: 10 800 000 USD

Crash? The hidden side of a “planned deleveraging”

The cryptocurrency market suffered a sharp $19 billion drop in just a few hours, triggering a chain reaction across the ecosystem. Behind what appears to be a collapse, some analysts suggest a more structured hypothesis: a voluntary deleveraging, orchestrated in advance by market players. Here’s a breakdown of an event that’s reshaping how risk is managed in crypto.

A massive — yet controlled — pullback

On October 11, aggregated derivatives data showed a steep contraction in open interest, the total sum of open positions on futures contracts. This decline reached $19 billion, a figure that might normally indicate a typical crash. But a closer look paints a different picture.

According to Axel Adler Jr, analyst at CryptoQuant, 93% of this reduction was not caused by forced liquidations, but by voluntary position closures. Only about $1 billion in long Bitcoin positions were liquidated — relatively modest compared to the overall pullback.

In other words, most traders chose to reduce exposure at what they deemed an opportune moment. This suggests a planned deleveraging, likely driven by a desire to adjust leverage ahead of an uncertain phase.

A mechanism orchestrated by market makers?

The coordinated nature of this deleveraging has caught attention. While trading volumes across spot, derivatives, and decentralized exchanges (DEXs) were unusually high, the lending sector saw a sharp contraction. This implies that borrowing — the main source of leverage — declined alongside the trading spike, signaling a deliberate market reset.

Coinwatch also noted a 98% drop in Binance’s order book depth, the largest crypto exchange globally. This extreme liquidity shortage is thought to have stemmed from the temporary deactivation of certain market-making algorithms. By partially withdrawing, these entities may have unintentionally amplified price swings.

This disengagement coincided with a geopolitical catalyst: Donald Trump’s announcement of new tariffs, made just before 9 p.m. UTC, precisely when markets began to turn. The idea of a strategic response to macroeconomic conditions appears increasingly plausible.

This backdrop reignites debate about crypto market governance. Should market makers be required to maintain liquidity at all times? Should liquidity withdrawals be more tightly regulated? Some propose enhanced supervision mechanisms to prevent a handful of players from — even unintentionally — triggering systemic shocks.