🏦 BlackRock now holds more BTC than Coinbase and Binance combined

Welcome to the Daily for Friday, August 29, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, August 29, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the past 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

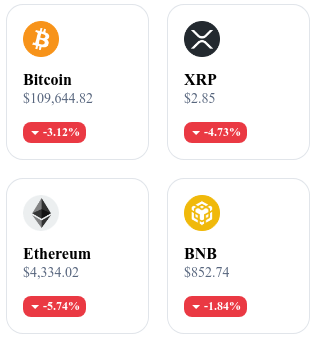

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

⛰ Solana prepares a consensus overhaul with "Alpenglow", now subject to community vote

Developers are proposing "Alpenglow" (SIMD-0326) to replace TowerBFT, reduce finality to 100-150 ms via Rotor, and optimize block propagation. Validator voting runs from epochs 840 to 842 with a quorum set at 33%, marking a decisive step in network governance.

👉 Read the full article

🏦 BlackRock surpasses Coinbase and Binance in BTC held within its ETF

BlackRock’s iShares Bitcoin ETF (IBIT) now holds 745,357 BTC, overtaking Coinbase (706,150) and Binance (584,557), according to CryptoQuant. Its Ethereum ETF subsidiary holds 3.6 m ETH, just 200,000 ETH behind Coinbase, highlighting growing institutional dominance.

👉 Read the full article

🪙 VanEck designates Ethereum as “Wall Street’s token” amid stablecoin growth

Jan van Eck argues that banks will need blockchain to manage stablecoins, and Ethereum is the best-positioned platform to meet this need. The emergence of a federal framework through the Genius Act reinforces its role as a technological backbone.

👉 Read the full article

📊 US now publishes economic data on-chain via Chainlink and Pyth

The Department of Commerce releases indicators such as GDP, PCE inflation, and final sales through Chainlink and Pyth across networks like Ethereum, Avalanche, and Optimism. The initiative aims to boost transparency in macroeconomic data and support on-chain use cases like DeFi or prediction markets.

Crypto of the Day: Conflux (CFX)

🧠 What innovation and added value?

Conflux is a Layer 1 public blockchain that aims to solve the blockchain trilemma through a hybrid Proof of Work + Proof of Stake consensus, combined with a unique architecture called Tree-Graph. This model enables parallel block processing while maintaining security through the GHAST algorithm, ensuring high throughput (several thousand TPS) and fast confirmations (~1 minute).

Fully EVM-compatible, Conflux also integrates ShuttleFlow, a multi-chain bridge protocol that facilitates interoperability with Ethereum and other networks, while remaining compliant with China’s regulatory requirements.

💰 The CFX token: utility and benefits for holders

The CFX token is used to pay transaction fees, execute smart contracts, stake to secure the network, and participate in on-chain governance. Holders can actively contribute to the ecosystem’s security and development. This model strengthens both the protocol’s sustainability and its adoption in real-world use cases such as finance, NFTs, or supply chain.

📊 Real-time performance (August 29, 2025)

Current price: $0.1788 USD

24h change: +0.69 %

Market capitalization: ≈ $917.3 million USD

CoinMarketCap rank: #82

Circulating supply: ≈ 5.130 billion CFX

24h trading volume: ≈ $184.0 million USD

Nvidia and Bitcoin: A Correlation Falling Apart?

Despite exceptional financial performance, Nvidia has failed to pull Bitcoin into its bullish momentum. While traders scrutinize every quarterly report from the AI giant to anticipate crypto market moves, this lack of reaction raises questions about the robustness of a correlation often presented as obvious.

Nvidia beats expectations, Bitcoin stays flat

On August 27, 2025, Nvidia reported impressive financial results: revenue growth of 56%, far above market forecasts. In a context where stock markets are heavily driven by the AI theme, this performance could have—according to some traders—acted as a catalyst for digital assets, especially Bitcoin.

Yet Nvidia’s stock (NVDA) fell 1.7% after the announcement, and major cryptocurrencies, including Bitcoin, Ether, and XRP, showed puzzling inertia. Since 2023, Bitcoin has risen in seven out of ten quarters following Nvidia’s earnings releases.

A psychological rather than structural correlation?

Bitcoin’s lack of reaction to Nvidia’s latest report invites a rethink of this correlation. The coincidence of several positive quarters does not establish causality. While investors may have been influenced by a halo effect surrounding emerging technologies such as AI, blockchain, or semiconductors, this dynamic now seems less convincing.

Bitcoin’s stability could reflect a form of market maturity, less prone to impulsive reactions to companies unrelated to cryptocurrency. It could also signal a temporary decoupling, driven by external factors such as macroeconomic pressures, regulatory expectations, or crypto-specific technical positioning.

Instead of seeking external catalysts, it may be more relevant to focus on variables internal to the blockchain ecosystem: technical innovations, regulations, or economic cycles specific to cryptocurrencies.