🚀 BTC at $94,000: Simple rebound or the start of a surge toward $100,000?

Welcome to the Daily of Tuesday, December 9, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, December 09, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

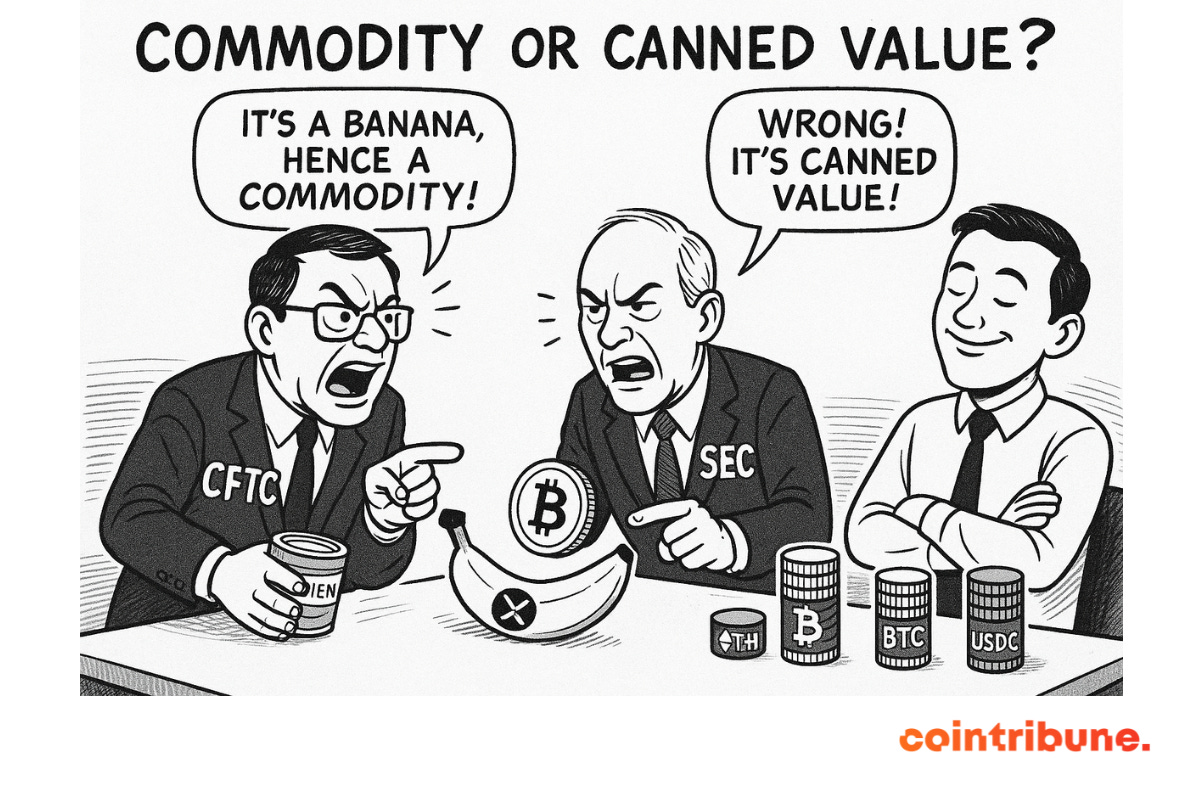

✍️ Cartoon of the day:

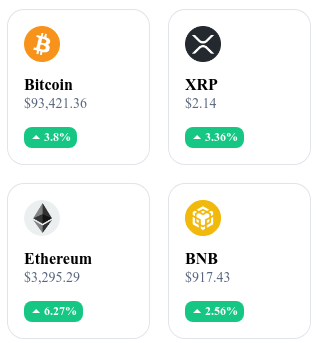

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

🔐 CFTC launches crypto pilot: Bitcoin, ETH and USDC accepted as collateral on derivatives markets

The CFTC has implemented a pilot program allowing the use of Bitcoin, Ethereum and USDC as collateral for regulated derivatives products in the United States. This decision could accelerate institutional integration of crypto assets by giving them an official status in the traditional financial infrastructure. 👉 Read the full article

💡 Vitalik Buterin proposes a futures market on Ethereum “gas” to calm fee volatility

To stabilize transaction fees, Vitalik Buterin suggests creating an on-chain futures market for Ethereum gas, allowing users to hedge against future fee increases. This approach, still conceptual, aims to provide visibility and protection to developers and users of decentralized applications. 👉 Read the full article

💼 Tether invests in Generative Bionics’ humanoid AI via a €70 M funding round

Tether is participating in a €70 million fundraising led by Generative Bionics, a startup developing a humanoid AI named Lia, marking a closer link between stablecoins and artificial intelligence technologies. 👉 Read the full article

🏦 Michael Saylor proposes a banking system guaranteed by Bitcoin in the United States

Michael Saylor puts forward the idea of a banking infrastructure backed by Bitcoin as collateral, which he believes would offer an alternative to traditional systems and strengthen resilience against monetary inflation. 👉 Read the full article

Crypto of the Day: Filecoin (FIL)

🧠 Innovation & Added Value

Filecoin offers a decentralized storage solution based on a global network of independent providers. The protocol relies on a cryptographic proof that certifies the actual storage of data, creating an open market where users set their own pricing and available capacity.

The system improves data resilience by eliminating the single point of failure found in centralized solutions. Filecoin attracts businesses, developers and Web3 projects looking for a credible alternative to traditional cloud services. The ecosystem is expanding with AI solutions, data verification tools, and integrations with major blockchains.

💰 The Token

The FIL token plays a key role in the network economy. It is used as a medium of exchange between users renting storage and miners providing capacity. Staking and storage commitments strengthen provider reliability, as each commitment requires a deposit that guarantees proper service execution.

FIL is also used in penalty mechanisms, rewards, and in the economic balance of the protocol. Miners earn rewards proportional to the capacity they provide, while users pay for their storage needs in FIL, creating a dynamic tied to effective demand.

📊 Real-Time Performance (CMC)

💵 Current price: 1.49 $

📉 24h change: –0.29 %

💰 Market cap: 1.08 B $

🏅 Rank on CoinMarketCap: #61

🪙 Circulating supply: 724.82 M FIL

📊 Trading volume (24h): 108.11 M $

Bitcoin breaks back above $94,000: simple rebound or start of a new trend?

Bitcoin has moved back above $94,000 after a period of indecision. While this bullish recovery revives investor optimism, some key indicators call for caution. Between encouraging technical signals and persistent liquidity weakness, what should we really understand from this movement?

A technical recovery confirmed… but fragile

On lower timeframes, Bitcoin validated a clear bullish breakout by surpassing $93,500, erasing the hesitation of previous days. This level represents an important technical resistance zone. By breaking it, the cryptocurrency has printed a new local high, restoring a market structure favorable to buyers.

This rebound follows the complete absorption of the fair value gap between $87,500 and $90,000, which had previously slowed momentum. The price now trades near its monthly VWAP, often used to assess fair market value. Holding above this average — especially after the upcoming Fed meeting (FOMC) — could confirm a new upward trend.

However, this rise is not supported by a clear improvement in liquidity. The bid-ask ratio remains low, indicating that buyers are not positioning aggressively. In other words, the price is rising without the usual strength in order flow.

Mixed signals on real demand

The strength of a trend is not judged solely by price. Other indicators reveal who is driving the market.

The Korea Premium Index, a measure of retail investor enthusiasm, remains neutral to slightly negative. South Korea — often known for speculative surges — is not yet following the move.

In contrast, the Coinbase Premium Index has turned positive again, suggesting renewed demand in the U.S. market — typically linked to institutional activity. Although still modest, this signal could become a key driver.

This divergence shows a contrasting dynamic: the rebound appears supported by renewed U.S. demand, while retail traders remain cautious.

Bitcoin recovering above $94,000 is encouraging — but not enough yet to confirm a true trend reversal. The next sessions, especially ahead of the Fed announcement, will be decisive.