🌍 Canada hardens its stance, miners panic, Trump bets on stablecoins…

Welcome to the Daily Tribune of Saturday, February 8, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Saturday, February 8, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

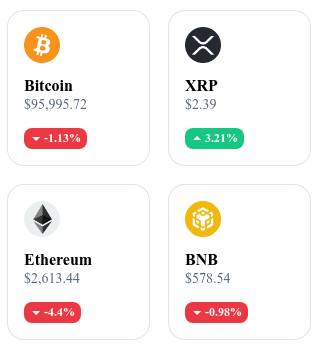

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

🇨🇦 Canada hardens its stance against crypto!

Canada tightens its regulation by excluding crypto funds from eligible margin securities and thus complicates access to leverage for investors. This decision by the CIRO (Canadian Securities Regulator) comes as Canadian Bitcoin ETFs face massive withdrawals exceeding 1.1 billion dollars, victims of competition from spot Bitcoin ETFs in the United States. Ironically, this strict regulation arrives as Pierre Poilievre, pro-Bitcoin candidate, is favored to become Prime Minister, which could reverse the trend in the coming months. 🔗 Read the full article

⛏️ Bitcoin: Miners in crisis, a major turning point for the industry!

Bitcoin miners are sounding the alarm after an unprecedented drop in mining difficulty, which fell from 110 T to 108 T. This decline comes as the hashrate remains at a record level of 832 EH/s, and continues to put increasing pressure on the least profitable miners. Riot Platforms and Hut 8 are modernizing their infrastructures to survive, while others like Bitfarms are liquidating sites to finance their expansion. Some miners are even considering diversification into AI and high-performance computing to leverage their energy infrastructures. A paradigm shift is starting in mining, and only the most resilient will survive. 🔗 Read the full article

💵 Trump wants to regulate stablecoins to strengthen the dollar!

The Trump administration is accelerating on stablecoin regulation, with a bill introduced by Republicans aiming to establish a clear framework for dollar-backed stablecoins. The goal is twofold: to bring these assets under U.S. regulation and to reinforce the dominance of the dollar in the global market. This initiative follows the appointment of David Sacks as "Crypto Czar", who sees stablecoins as a means to extend the hegemony of the greenback. If this plan succeeds, the United States could establish itself as the undisputed leader of regulated stablecoins, relegating the initiatives of BRICS and other nations to the shadows. 🔗 Read the full article

🤖 AI tokens crash: -90% in just a few months!

The euphoria surrounding AI cryptos has given way to a brutal correction, with some values plummeting by 90%. Leading projects like AI Rig Complex (ARC) and ElizaOS (AI16Z) have seen their market capitalization shrink, while the global AI tokens market is undergoing a massive liquidity exodus. The skyrocketing memecoin TRUMP, which captured $80 billion in 24h, absorbed some of the capital, accelerating the decline of these assets. Some experts believe that this purge was inevitable after the excessive speculation of 2024, but that solid projects may rebound in the long term, particularly with the rise of autonomous AIs on blockchain. 🔗 Read the full article

Today's crypto: PulseX (PLSX)

PulseX is a decentralized exchange (DEX) operating on the PulseChain network. It allows users to trade PRC20 tokens on PulseChain, similar to how Uniswap operates on Ethereum. PulseX also provides gateways to other blockchains, thus facilitating the trading of currencies from different networks. This interoperability expands trading possibilities for users while maintaining a decentralized and secure experience.

The native token of PulseX, PLSX, is primarily used to facilitate transactions on the PulseX platform. PLSX holders can participate in yield farming programs, where they provide liquidity to the platform's pools in exchange for rewards in the form of transaction fees. This incentive encourages active participation and liquidity on the platform.

Recent performance:

Current price: $0.00003934 (approximately €0.000036)

24-hour change: +38.4%

Market capitalization: $5.6 billion

Rank on CoinMarketCap: #3112

Decline in the net flow of Ethereum derivatives: a bullish signal?

The market for Ethereum derivatives has just recorded its largest ETH withdrawal in 18 months, with 300,000 ETH ($817 million) pulled from exchanges on February 6, 2025.

This massive outflow immediately reduces the available supply for sale, which could mitigate the downward pressure on the price of ETH. Moreover, this dynamic suggests a closing of leveraged positions and a transfer of funds to cold storage solutions, signaling a long-term investment approach. These elements occur in a context of increased volatility, as Ethereum shows a decline of 19.42% over the last 30 days, falling below $3,000 since February 3.

This movement of funds comes as some influential market players express growing optimism regarding Ethereum. World Liberty Financial, a crypto project associated with Donald Trump, continues to increase its positions in ETH, and Eric Trump recently stated that it was "the perfect time to acquire ETH". Meanwhile, 52% of Ethereum validators support an increase in the gas limit, a change that could improve the network's capacity and reduce transaction fees, a frequently criticized factor. These signals indicate a strengthened institutional and technical support that could catalyze a rebound in ETH's price in the coming weeks.

At a crossroads, Ethereum benefits from a favorable alignment of several technical and fundamental indicators. The drop in supply on exchanges, combined with a growing interest from institutional investors, could create a bullish effect if demand were to rebound. Some analysts even estimate that this situation could allow Ethereum to regain its all-time high of $4,878, reached in 2021. It remains to be seen whether this trend will materialize or if the market will face further turbulence before a potential rebound.