🛡 Christine Lagarde takes a tougher stance on foreign stablecoins

Welcome to the Daily for Friday, September 05, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, September 05, 2025, and just like every day from Tuesday to Saturday, we're bringing you a summary of the top news from the past 24 hours you shouldn't miss!

But first…

✍️ Cartoon of the day:

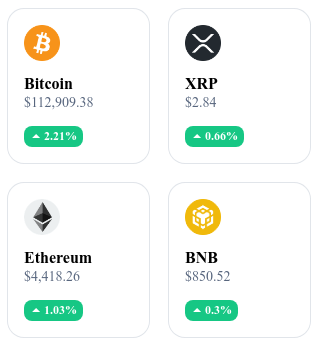

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

💶 Digital euro: The ECB plays its last card

Piero Cipollone presents the digital euro as a backup solution against cyberattacks and payment outages, enabling offline transactions with later synchronization. The project aims to ensure continuity of public services and strengthen European monetary sovereignty in the face of PayPal, Apple Pay, and Google Pay.

👉 Read the full article

🚫 Justin Sun blacklisted after a sharp WLFI token crash

WLFI collapses by 61% in a few days and Justin Sun sees his address blocked, with nearly 595M tokens frozen—over $100M—amid manipulation suspicions. Sun claims his actions were merely technical tests with no market impact, but the episode could damage his reputation, especially as he is a known supporter of the project.

👉 Read the full article

🤖 Coinbase bets on AI to write half of its code by October

Brian Armstrong announces that 40% of Coinbase's code already comes from AI, targeting 50% by October using tools like Copilot, Cursor, Claude Code, and Cody. Over 1,500 engineers use these assistants, sometimes under performance pressure, redefining productivity in the crypto environment.

👉 Read the full article

⚖️ Lagarde takes a tougher stance on foreign stablecoins: Europe wants to take back control

Christine Lagarde insists that any stablecoin operating in the EU must strictly comply with European standards, to counter the dominance of U.S. assets like USDT and USDC ($290B in market cap). She positions the digital euro as a strategic response to ensure monetary autonomy in the digital age.

👉 Read the full article

Crypto of the Day: Starknet (STRK)

🧠 What innovation and added value?

Starknet is a Layer 2 solution on Ethereum using ZK-Rollups (validity rollups). It executes transactions off-chain and generates cryptographic proofs (STARKs) verified on-chain, enabling high scalability, reduced fees, and security inherited from Ethereum.

The network runs on its own virtual machine, Cairo, and introduces account abstraction, enabling modern UX features (biometric authentication, gasless UX, social recovery). These elements make Starknet a robust platform for DeFi, NFTs, and advanced dApps.

The STRK Token: Utility and Benefits for Holders

The STRK token is used for governance (via the Starknet Foundation), securing the network, and providing incentives within the ecosystem. It allows holders to participate in decisions regarding the network’s technological and economic directions, reinforcing decentralization at the protocol's core.

📊 Real-time Performance (September 5, 2025)

Current price: $0.1255 USD

24h change: +3.56 %

Market capitalization: ≈ $511.5 million USD

CoinMarketCap rank: #116

Circulating supply: ≈ 4.077 billion STRK

24h trading volume: ≈ $34.6 million USD

XRP: Is a new bull run realistic in 2025?

Long-time investors haven’t forgotten XRP’s historic bull run in 2017. While some analysts are spotting similar technical signals this year, does the comparison hold up? Between chart-based hope and macroeconomic reality, XRP’s trajectory deserves a closer look.

Chart analysis vs fundamental reality

Technical patterns observed across multiple timeframes suggest prolonged accumulation followed by a bullish breakout. This scenario also preceded XRP’s meteoric rise in 2017. Based on this, some are envisioning XRP at $20—an ambitious projection relying entirely on chart analogies.

However, the validity of such a parallel is undermined by several fundamental indicators. The NUPL (Net Unrealized Profit/Loss) developed by Glassnode illustrates a significant shift in investor sentiment. While euphoria prevailed in 2017, 2025 appears marked by a mix of residual conviction and latent denial—reflecting long-term loss of confidence.

Another key data point is the XRP/BTC ratio, still 90% below its historical high. While it soared over 3,700% during the previous bull cycle, it now remains stuck in a distribution zone between 0.000025 and 0.000030 BTC, indicating strong market resistance to any return of dominance.

A fundamentally changed market context

The dynamics that once propelled XRP in 2017 are no longer in play. Back then, Ripple held a near-monopoly in the narrative surrounding cross-border payments. This technological promise, once tied to institutional adoption, has since been diluted by the emergence of newer, more robust alternatives better integrated into the ecosystem.

Projects like Ethereum, Solana, Sui, and stablecoins now dominate this strategic segment. The ecosystem has become more complex, and XRP’s position has been weakened by the fragmentation of solutions and the rise of interoperable applications.

Moreover, institutional investor interest is now turning to assets with stronger roots in decentralized finance. This strategic shift widens the gap between chart-based projections and the structural reality of the market. XRP, which hasn’t evolved significantly in terms of real-world usage or use cases in recent years, is struggling to regain the central role that once ensured its success.

The temptation to compare 2025 with 2017 is based on seductive chart similarities. Yet behavioral indicators, relative performance, and today’s crypto market structure call for a more realistic interpretation. Even if a bullish scenario remains possible, a repeat of the 2017 bull run seems unsupported by fundamental data. At this point, technical analysis alone is no longer enough to convince, and only a major catalyst could trigger a massive move in XRP.