Hello Cointribe! 🚀

Today is Wednesday, May 14, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you should not have missed!

But first…

✍️ Cartoon of the day:

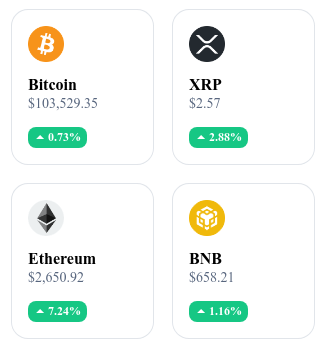

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🔄 PumpSwap unveils a model that could shake everything up

PumpSwap introduces a transaction fee redistribution mechanism, returning 50% of these fees to memecoin creators. This model aims to encourage the creation of new tokens on the platform.

🚨 France: the daughter of a crypto big name escapes an abduction in central Paris

On May 13, 2025, the daughter of a crypto entrepreneur was the victim of an attempted kidnapping in the 11th arrondissement of Paris. Three masked men tried to force her into a utility vehicle. The intervention of the child's father allowed the attackers to flee. The suspects' vehicle was found abandoned nearby.

💵 Tether reaches 150 billion dollars in market capitalization

On May 12, 2025, Tether (USDT) passed the threshold of 150 billion dollars in market capitalization. This progress marks a significant milestone for the stablecoin.

📈 A historic first: Coinbase joins the S&P 500

Coinbase joins the S&P 500, replacing Discover Financial Services as of May 19, 2025. This inclusion follows the announcement of the acquisition of Deribit for 2.9 billion dollars.

Crypto of the day: Maker (MKR)

MakerDAO is a decentralized finance (DeFi) protocol running on the Ethereum blockchain. It allows the creation of DAI, a decentralized stablecoin pegged to the US dollar. The system is based on collateralized debt positions (CDP), where users deposit digital assets as collateral to generate DAI. This approach ensures stability without relying on centralized entities.

The MKR token is used for the governance of the MakerDAO protocol. MKR holders can vote on proposals affecting the system, such as the types of accepted collateral or interest rates. Moreover, in case of system under-collateralization, MKR can be issued and sold to cover the deficit, incentivizing holders to manage prudently.

Recent performance:

Current price: $1,945.66 USD

24-hour change: +12.02%

Market capitalization: around 1.61 billion dollars

Rank on CoinMarketCap: #58

Bitcoin: why selling now would be a strategic mistake?

While Bitcoin is trading around $103,000 after a moderate pullback linked to profit-taking and awaiting US inflation figures, some investors are tempted to secure recent gains. However, several technical signals and advanced cycle indicators suggest that disengaging at this stage could prove premature or even counterproductive. One indicator particularly draws attention: the MVRV ratio (Market Value to Realized Value), closely monitored by Glassnode analysts.

The MVRV ratio: a key indicator still far from its critical zone

MVRV compares Bitcoin's current market value to its realized value, i.e., the average acquisition price of held tokens. Historically, this indicator serves as a cycle beacon: when it exceeds 3.5 to 4, it signals excess euphoria, often a precursor to a market peak. Today, it oscillates around 2.1 — a level considered healthy, compatible with a continued bullish trend.

In other words: we are not yet in the terminal phase of the bullish cycle, where profit-taking becomes rational. On the contrary, the market shows a structure under construction, with the majority of investors still in accumulation or consolidation phases. Other metrics, such as on-chain activity, low selling pressure from "whales," and net inflows into ETFs, corroborate this reading.

Technical pullback, but fundamentals intact

The pullback below $101,000 recorded on Monday remains limited in amplitude and occurs after an acceleration of more than 20% in three weeks. It reflects a natural adjustment linked to macro: awaiting US inflation data and profit-taking before publication.

But fundamentally, nothing has changed in the engine of the bullish dynamic. Supply remains structurally constrained post-halving, inflows via ETFs continue to support prices, and overall liquidity conditions (moderation of rates, geopolitical relaxation) remain favorable to non-correlated assets like BTC.

At this stage of the cycle, selling one's bitcoins could be a misjudgment rather than a prudent strategy. Technical and behavioral data show neither euphoria nor market saturation. Conversely, cycle signals indicate that a broader upward movement could still unfold in the coming quarters.