🚀 Crypto ETFs in Booming: Over $1 Billion Injected in 24h

Welcome to the Daily tribune of Saturday, July 12, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, July 12, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you couldn’t miss!

But first…

✍️ Cartoon of the day:

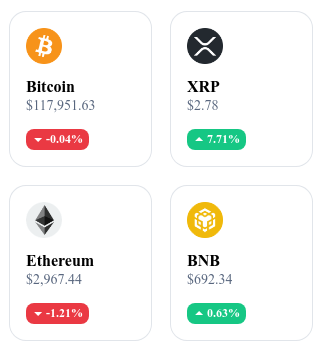

A quick look at the market…

🌡 Weather:

🌤️ Partly sunny

24h crypto recap! ⏱

📈 +1 billion USD injected into Bitcoin and Ethereum ETFs

Spot Bitcoin and Ethereum ETFs recorded $1.5 billion USD in inflows in a single day, including $448M USD for BlackRock and $383M USD for Ethereum ETFs.

🌍 US tariffs on BRICS: is the dollar threatened?

Donald Trump is considering a 10% tax on imports from BRICS countries. Economist Igbal Guliyev warns: this intervention could trigger an accelerated dedollarization, with BRICS responding with alternative payment systems.

🔼 Ethereum consolidates at $3,000 thanks to institutions

Ethereum reaches $3,000 USD, driven by strengthening institutional flows and a record of futures positions (> 8 million ETH in open interest). The volume on ETH derivatives markets slightly exceeded that of BTC at $62.1 billion USD in 24 h.

🤖 Coinbase integrates AI with Perplexity AI

Coinbase partners with Perplexity AI to integrate its market data (COIN50 index) in real time into the Comet AI engine. The goal: to offer an optimized trading experience, where AI could soon automatically execute certain operations.

Crypto of the day: Injective (INJ)

🧠 Technology & innovation

Injective is an ultra-efficient layer 1 blockchain designed for decentralized trading of complex financial assets, such as futures, options, perpetual swaps and other derivatives. Built on the Cosmos SDK, it enables fast transactions with no gas fees for the end user, while ensuring a transparent on-chain order book. Thanks to interoperability via the IBC protocol, Injective is compatible with Ethereum, Cosmos, Solana ecosystems, etc.

It positions itself as a comprehensive infrastructure for institutional DeFi, focusing on performance, modularity, and user experience.

💰 Main utility and advantages of the crypto

The INJ token plays a strategic role in the Injective ecosystem:

It is used for staking, ensuring network security and validation.

It is used to pay transaction fees on Injective trading protocols.

It grants governance rights to holders, allowing them to influence protocol developments.

It rewards liquidity providers and fuels DeFi incentive programs.

📊 Market data (July 12, 2025)

Current price: $12.67 USD

24h change: –0.49%

Market capitalization: ≈ $1.761 billion

CoinMarketCap rank: #31

Circulating supply: 138,952,360 INJ

24h trading volume: ≈ $75.8 million

Bitcoin surpasses $118,000: Between massive liquidations and monetary uncertainties

The cryptocurrency market experienced a spectacular surge as the bitcoin price exploded beyond $118,000. This sudden rise, occurring in less than 24 hours, raises questions and analyses. Chain liquidations, unstable political climate in the United States, and speculations about movements of major investors: several factors seem to have converged to fuel this sharp increase. Decryption.

A movement amplified by short position liquidations

One of the first explanations for bitcoin’s spike lies in a well-known trader phenomenon: short position liquidation. According to reported data, more than $500 million USD of bearish positions were wiped from the market during the day. This mechanism, which forces sellers to urgently buy back assets they bet against, generated a bullish leverage effect. This technical setup favored a vertical acceleration of prices, surpassing $112,000 in record time, before stabilizing around $118,000.

Such a movement is characteristic of highly volatile markets, where the domino effect of liquidation orders triggers an overreaction in prices. The absence of clear resistance at these price levels left free rein for a rapid rise, amplified by reduced liquidity on some exchanges.

Between macroeconomic uncertainty and speculative influence

Beyond internal market dynamics, macroeconomic signals also seem to have played a role. The persistence of the U.S. budget deficit, combined with the possibility of Jerome Powell’s resignation as head of the Federal Reserve, fueled speculations on a shift in U.S. monetary policy. In this context, some investors perceive bitcoin as a hedge against dollar depreciation or renewed inflation.

At the same time, unconfirmed rumors mention possible massive purchases by iconic figures such as Elon Musk or Jeff Bezos. Although no official source supports these claims, they have been enough to fuel bullish sentiment on social media and among investor circles. The psychological dimension, often underestimated, remains a powerful lever in cryptocurrency markets.