Hello Cointribe! 🚀

Today is Tuesday, August 6, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

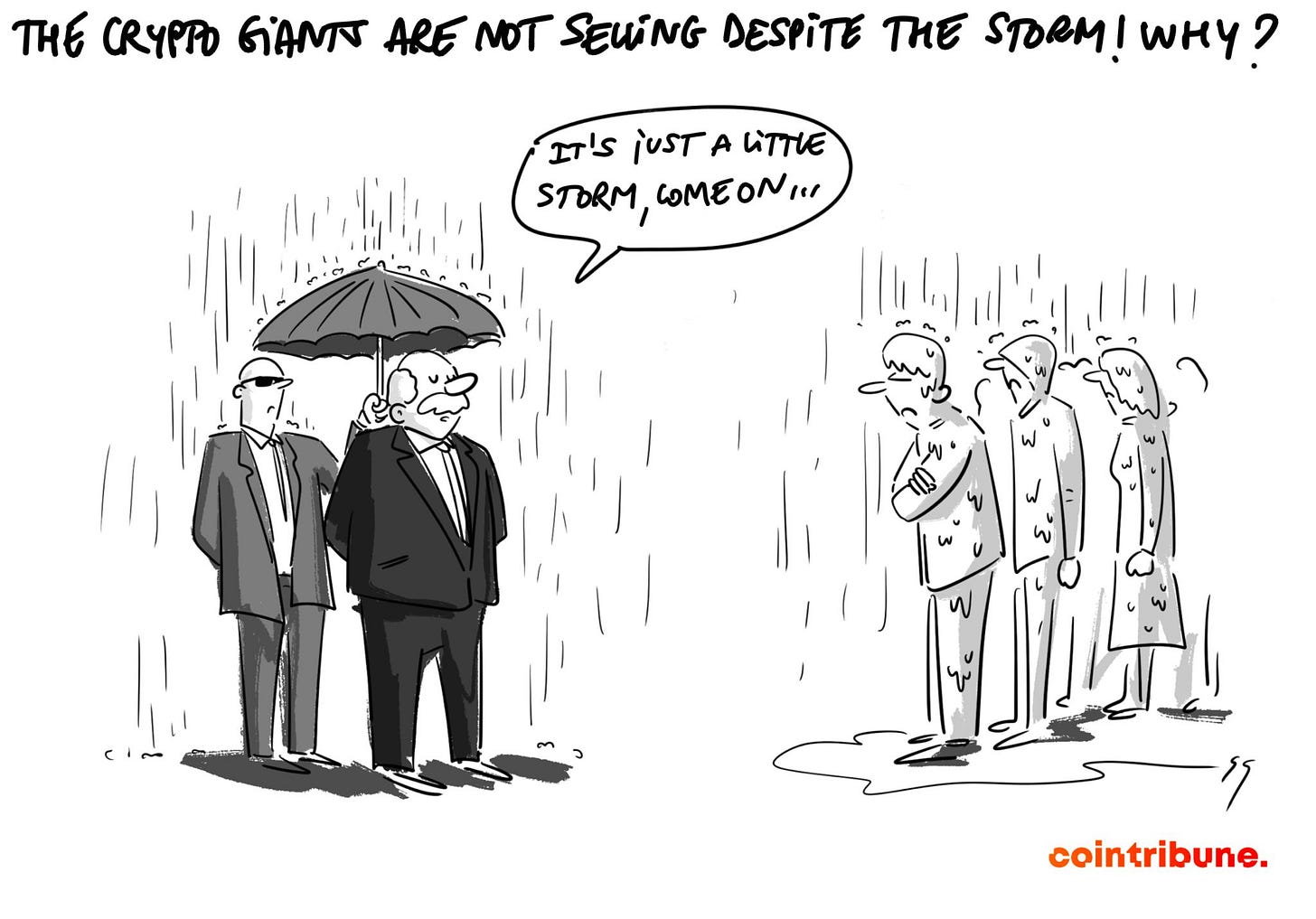

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

Crypto giants don't sell despite the storm 🌪️

Major asset management players such as BlackRock, Fidelity, Grayscale, and MicroStrategy did not panic despite a marked drop in the crypto market. Unlike many individual investors, these institutions held onto their positions, showing unwavering confidence in the long-term potential of cryptocurrencies. The rapid market recovery, with significant increases in Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) following the introduction of a Bitcoin ETF in the United States, has reinforced this confidence. However, cautious movements of significant funds to Binance indicate that some whales remain vigilant. The impressive figures of the assets held by these financial giants highlight their long-term strategy and could inspire other investors to follow this stable and confident approach. 🔗 Read the full article here.

Solana leads the recovery after Monday's rout 🚀

The cryptocurrency market started the week in a tumultuous manner, but Solana stood out with remarkable resilience. After a significant drop on Monday, Solana rebounded with an impressive 16% increase on Tuesday, surpassing other major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), which increased by 6% and 8% respectively. This performance highlights renewed investor confidence in the Solana ecosystem. The market recovery was driven by anticipation of interest rate cuts by the US Federal Reserve, which eased concerns of a recession and encouraged a return to risky assets. Nevertheless, some analysts remain cautious, pointing out that this recovery could be temporary due to persistent geopolitical tensions and other macroeconomic uncertainties. 🔗 Read the full article here.

Tokyo Stock Exchange rises 10% after crash 📈

After a historic drop on Monday, the Tokyo Stock Exchange experienced a remarkable rebound on Tuesday's opening. The Nikkei index, after plunging 12.4% the day before, rose 10.02% to reach 34,610.65 points. This spectacular turnaround was fueled by the weakening of the yen against the dollar and a technical reaction to the sharp previous drop. The Topix also increased by 10.05%, settling at 2,451.08 points. This rebound comes after the yen, which had contributed to the panic in the markets on Monday, became a stabilizing factor. Analysts point out that this volatility is related to complex speculative movements such as the "carry trade." Despite this recovery, caution remains due to persistent volatility in global markets, exacerbated by macroeconomic and geopolitical factors. 🔗 Read the full article here.

XRP in crisis: Between selling pressure and crypto market volatility 📉

XRP has experienced a drastic drop in August, falling below the $0.50 mark after reaching $0.657 in July. In one week, its value has decreased by nearly 34%, stabilizing around $0.491. This decline occurred despite high expectations from traders, particularly due to the imminent end of Ripple's lawsuit against the US SEC. The situation was exacerbated by the recent release of one billion XRP tokens by Ripple, increasing selling pressure. XRP's decline comes amid a widespread crash in the crypto market, influenced by geopolitical uncertainty and high interest rates. The strong correlation of XRP with Bitcoin, which has also recently dropped, amplifies the fluctuations in its price. 🔗 Read the full article here.

Coin of the day: Solana (SOL)

The Solana blockchain stands out for its innovation in scalability and speed, using a consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS). PoH creates a historical record proving that an event occurred at a specific time, improving network efficiency by increasing transaction speed. Solana can process thousands of transactions per second, surpassing many other blockchains.

Solana's native cryptocurrency, SOL, is used for transaction fees, staking, and accessing decentralized services and applications on the platform. It was initially distributed through an ICO, offering benefits such as staking rewards and usage in various dApps, making it attractive to investors and users.

Recent performances:

Current price: €153.59

Percentage increase/decrease: 10.63% (1-day increase)

Market capitalization: €71,457,111,048

Rank on CoinMarketCap: 5

Ethereum: Analysis of the crypto market downturn on August 7, 2024

Ethereum experiences a weekly decline of 37% following the overall drop in the crypto market. After the launch of Ethereum spot ETFs, ETH plunged 40% in two weeks, dropping from $3,600 to $2,100. This drop is due to disappointing global economic results and geopolitical tensions, particularly in Iran. Currently, ETH is trading just below $2,500 but remains vulnerable below its 50-day and 200-day moving averages. Volatility is increased by massive liquidations and a decrease in speculative interest. Uncertainty prevails regarding the future of Ethereum, which displays lower and lower lows and is below its annual VWAP.

The outlook for Ethereum is uncertain. If the price of Ethereum manages to stay above $2,100, a recovery towards $2,800 could be considered, with the next resistance around $3,100. However, if ETH falls below $2,100, further decline towards $1,900 or less is possible. Significant liquidation zones are between $3,400 and $4,100, which could lead to increased volatility. The price's reaction at key support and resistance levels will be crucial in determining Ethereum's future trend.

🔗 Read the full analysis here.