😨 Crypto market plunges into extreme fear

Welcome to the Daily for Tuesday, November 4, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, November 4, 2025, and as every day from Tuesday to Saturday, here’s a summary of the top news from the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

⛈️ Stormy

24h crypto recap! ⏱

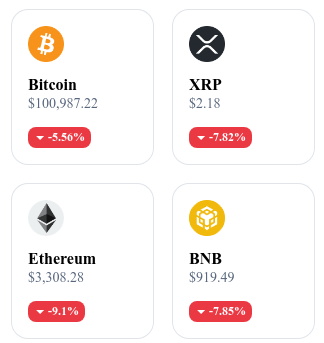

😨 The crypto market plunges into extreme fear as Bitcoin falls

Bitcoin dropped more than 6 %, reaching around $100 000, pushing the Fear & Greed Index into the extreme fear zone. Other major cryptocurrencies followed: Ethereum (– 5.7 %), Solana (– 8.2 %) and BNB (– 7 %), reflecting widespread tension across the market.

🔓 Balancer hit by a massive hack despite 11 security audits

DeFi protocol Balancer suffered a $116 million hack even after undergoing 11 independent audits. The exploit targeted a smart-contract vulnerability, reigniting debate about the limits of on-chain security within DeFi protocols.

👉 Read the full article

📉 Over $1.1 billion liquidated in 24 hours as Bitcoin, Ethereum and Dogecoin fall

Crypto markets saw more than $1.1 billion in liquidations within 24 hours, triggering a sharp drop in Bitcoin, Ethereum and Dogecoin. The sell-off is linked to excessive leverage in derivatives and heightened volatility after new U.S. macroeconomic data was released.

👉 Read the full article

🟧 Michael Saylor adds 397 more BTC to Strategy Inc.

Yesterday, Strategy Inc., led by Michael Saylor, purchased 397 additional bitcoins worth about $45 million. The company’s total holdings now exceed 640 000 BTC, reaffirming its accumulation strategy despite market volatility.

👉 Read the full article

💬 Tom Lee predicts Bitcoin at $3 million by 2030

Analyst Tom Lee, co-founder of Fundstrat Global Advisors, expects Bitcoin to reach $3 million by 2030, driven by institutional demand and post-halving scarcity. He believes the combination of spot ETFs and looser monetary policies could spark an unprecedented bull cycle.

👉 Read the full article

Crypto of the Day: Oasis Network (ROSE)

Innovation and Added Value 🧠

Oasis Network is a Layer-1 blockchain designed to bring privacy, scalability, and sustainability to DeFi and artificial intelligence.

Its dual-layer architecture includes:

Consensus Layer, dedicated to validation and security;

ParaTime Layer, enabling the parallel execution of multiple application environments (smart contracts, AI dApps, DeFi).

This model delivers fast and confidential transactions through Trusted Execution Environments (TEE).

Oasis is also a pioneer of the “Responsible Data Economy”, empowering users to retain ownership of their data while monetizing it securely.

The network hosts key components like Oasis Sapphire (a confidential EVM) and Oasis Privacy Layer, which makes privacy interoperable across blockchains.

The Token 💰

The ROSE token powers the Oasis Network and is used to:

Pay transaction fees,

Participate in staking and network security,

Vote on governance proposals.

Holders can delegate tokens to validators to earn rewards.

ROSE also fuels ParaTimes focused on privacy and AI.

With a total supply capped at 10 billion tokens, Oasis aims to become the go-to Web3 network for privacy-centric and AI-driven applications.

Real-Time Performance 📊

💵 Current price: $0.097

📉 24 h change: − 0.58 %

💰 Market cap: $661 million

🏅 CoinMarketCap rank: #123

🪙 Circulating supply: 6.81 billion ROSE

📊 24 h volume: $31.48 million

Standard Chartered: Toward the Planned Disappearance of Cash

The statement by Standard Chartered’s CEO marks a decisive turning point in global monetary history. Speaking at a major event in Hong Kong, Bill Winters declared that the future of money will be entirely digital. His remarks reflect not only the technological evolution of payments but also the deep structural shifts reshaping the global financial system.

A Predicted End to Cash, According to Standard Chartered

During the 2025 Hong Kong FinTech Week, Bill Winters, CEO of Standard Chartered, made a bold statement: “Money will be entirely digital.” His vision aligns with a growing global shift toward the digital transformation of finance. Winters believes that all global payments will eventually take place on blockchains, rendering traditional cash-based systems obsolete.

He emphasized that blockchain transaction recording will become the global norm — ushering in transparency, efficiency, and total traceability. This represents a fundamental redefinition of how trust operates in financial exchanges.

Positioning Hong Kong as the epicenter of this transition, Winters highlighted its strategic importance as a hub for regulatory and technological experimentation — a “living lab” for the monetary systems of the future.

Between Innovation and Global Overhaul: The Stakes of a Digital Transition

Standard Chartered’s announcement fits into a broader reflection on the transformation of global monetary systems. Winters referred to a “global overhaul” involving commercial banks, central banks, and governments. In this new landscape, central bank digital currencies (CBDCs), such as the digital euro, are emerging as key components.

However, this transition brings complex challenges. On the technical side, ensuring reliability, security, and interoperability across blockchains remains an open issue. On the regulatory front, balancing innovation with privacy and sovereignty concerns raises critical debates.

For traditional banks, the disappearance of cash may reduce physical handling costs but could also accelerate disintermediation in favor of tech giants or decentralized systems. Cryptocurrencies and stablecoins could either strengthen their role or be sidelined, depending on future regulation.

Through this vision, Standard Chartered sparks a major conversation about the future of cash. Far from being a mere technological shift, it represents a structural transformation of economic balances, institutional roles, and everyday financial behavior.