🤔 Crypto market under pressure: Time to flee or to buy?

Welcome to the Daily for Friday, December 19, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, December 19, 2025, and as we do every day from Tuesday to Saturday, here’s a recap of the last 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

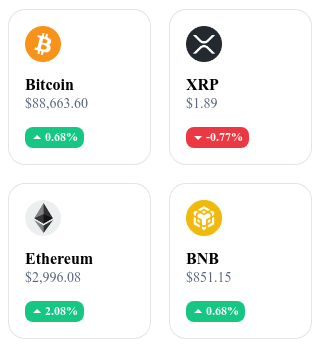

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

🤝 JPMorgan migrates its JPM Coin to Coinbase’s public blockchain Base

JPMorgan announces the deployment of JPM Coin on Base, the public blockchain developed by Coinbase, to enable real-time transfers. The token represents U.S. dollars held in reserve by the bank to facilitate digital payments. Partners such as Mastercard, Coinbase, and B2C2 are involved in this pilot project aimed at institutional use.

👉 Read the full article

📈 XRP’s popularity helps push ETFs beyond the $1 billion mark

ETFs exposed to XRP have surpassed a cumulative $1 billion in assets under management, according to market data cited in the article. This milestone comes as several XRP-based ETF products continue to attract inflows. The total amount across XRP ETFs thus exceeds a symbolic threshold for these investment vehicles.

👉 Read the full article

⚠️ Crypto 2025: $3.4 billion stolen — a dark year for cybersecurity

In 2025, losses from hacks, thefts, and attacks targeting crypto projects total $3.4 billion. These incidents include smart contract exploits, exchange attacks, and wallet compromises. Published figures show an increase in losses compared to previous years, with several large-scale thefts reported.

👉 Read the full article

🎯 Kraken launches a new Read2Earn quest with $1,000 in BTC and a collector PS5

The challenge involves reading 7 articles published on Cointribune and completing a final quiz to validate participation. Prizes include 20 rewards of $50 in bitcoin and a Kraken-themed PS5 console for the top participant. Registration requires an active Kraken account and UID validation via a dedicated marketplace.

👉 Read the full article

Crypto of the Day: Jupiter (JUP)

🧠 Innovation and Added Value

Jupiter is the central liquidity infrastructure of the Solana ecosystem. The protocol aggregates liquidity pools and order books to offer users the best possible prices for swaps. This approach reduces slippage and improves trading efficiency on Solana.

Jupiter plays a key role in Solana’s DeFi, as many applications rely on its engine to execute transactions. The project is gradually expanding its scope with advanced trading solutions, derivatives features, and tools for both active users and developers.

💰 The Token

The JUP token is primarily used for governance within the Jupiter ecosystem. Holders take part in strategic decisions regarding protocol evolution, development priorities, and allocation of community resources.

JUP also supports incentive mechanisms to boost adoption and liquidity on the platform. The token’s utility grows in line with Jupiter’s trading volume and its increasing role as a key infrastructure layer on Solana.

📊 Live Performance (CMC)

💵 Current price: €0.1631

📈 24h change: +4.97%

💰 Market cap: €511.67M

🏅 CoinMarketCap rank: #76

🪙 Circulating supply: 3.13B JUP

📊 24h trading volume: €28.26M

Bitcoin under pressure: Could extreme fear signal a rare opportunity?

Bitcoin’s recent correction has reignited investor anxiety, fuelling fear and crash predictions across social platforms. Yet, according to analysis by Santiment, history tends to favour the patient. Could this climate of uncertainty be setting the stage for a major rebound?

Extreme fear in the markets: a historic signal of reversal?

Since its October peak, Bitcoin has shed around 30% of its value. The drop intensified after a sharp rejection below $90,000—a level many consider psychologically critical. This break triggered a flood of pessimistic commentary on platforms like X, Reddit, and Telegram.

Santiment data shows a surge in negative sentiment, with hashtags like #bearish, #selloff, and #crash multiplying rapidly. However, past cycles reveal that such spikes in social anxiety often coincide with trend reversals. In other words, when the majority fears a collapse, the conditions may actually be ripe for stabilization—or even an unexpected rally.

A different Bitcoin cycle, driven by ETFs and strong hands

This cycle might represent a structural shift in Bitcoin’s history. Unlike previous years, the current momentum is influenced by new drivers—most notably the emergence of spot Bitcoin ETFs. These products, aimed at institutional investors, provide direct exposure to BTC without the need to hold it directly. Their gradual adoption is reshaping the Bitcoin holder profile, with an increasing share of long-term holders.

Meanwhile, exchange data shows a steady decline in BTC reserves, suggesting a move toward cold storage—often a sign of long-term conviction. This trend can act as a cushion against volatility, reducing sell pressure during market panics.

While volatility fuels short-term nervousness, some contrarian indicators suggest the market may be nearing an inflection point. Social sentiment, though alarming now, echoes past moments when patience proved rewarding. Could this anxious atmosphere be masking the very opportunity investors have been waiting for?