📡 Crypto Payments Without Connection: Sui Opens a New Era of Offline Transactions!

Welcome to the Daily Tribune Thursday, September 5, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, September 5, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

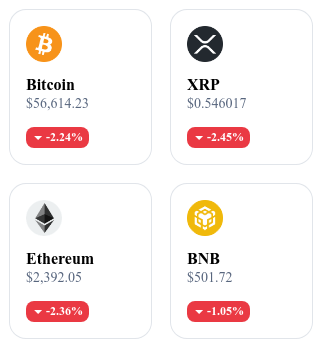

A quick look at the market…

🌡️ Temperature:

Stormy ⛈️

24h crypto recap! ⏱

🚀 Sui: Revolutionizing Payments Without Internet

Sui, a blockchain developed by Mysten Labs, introduces a revolutionary solution allowing crypto payments without Internet connection, using radio waves and other alternative channels such as mobile networks or short messaging. This technology aims to address Internet outages and facilitate transactions in underserved areas or during disasters. By integrating this innovation into the Internet of Things (IoT), Sui transforms not only the financial sector but also the management of decentralized infrastructure. The project also explores the concept of DePIN (Decentralized Physical Infrastructure), which proposes a collective and economic management of public infrastructure, facilitated by communication technologies without Internet like mesh networks or GSM. Sui collaborates with players like Chip Wireless to test these technologies, with goals of financial inclusion in markets like Africa, where access to financial services and the Internet is limited.🔗Read the full article here.

🔄 Polygon: $MATIC Becomes $POL, A New Era Begins

Polygon undergoes a major change by replacing its native token $MATIC with $POL, aimed at enhancing efficiency and user experience on its blockchain. For $MATIC holders on Polygon, the conversion happens automatically without any intervention required, while those using the Ethereum network will need to migrate their tokens via the Polygon portal. The new token $POL promises better scalability and reduced transaction fees, consolidating Polygon's position in the crypto ecosystem by attracting more users and developers. This transition reflects Polygon's commitment to continually innovate to meet community needs and provide a high-performing infrastructure for decentralized applications. 🔗 Read the full article here.

🌐 TON Exceeds One Billion Transactions: A Feat Despite Challenges

The Open Network (TON), the blockchain linked to Telegram, has crossed the threshold of one billion transactions, demonstrating its rapid adoption despite notable challenges. Integration with Telegram and the launch of smart wallets facilitating zero gas fee transactions have driven this growth. However, the network was recently disrupted by an airdrop of memecoins, DOGS, which caused overloads and outages on the network. Despite these challenges, TON continues to attract interest with around 280,000 daily active users and 800,000 transactions per day, positioning it as a blockchain with promising prospects, but requiring improvements to ensure its future resilience.🔗 Read the full article here.

🛒 Carrefour Express Accepts Bitcoin Payments

Carrefour Express in Rouen becomes one of the first French supermarkets to accept Bitcoin payments via the Lightning network. Using the Bridge Wallet application from Mt Pelerin, the platform enables instant and low-cost transactions, meeting the speed and efficiency needs of retail businesses. This initiative follows a growing global trend, where the number of businesses accepting Bitcoin has tripled in a year. Although Bitcoin's volatility and regulatory questions still pose challenges, Carrefour Express's adoption could influence other retailers to follow suit, promoting the democratization of cryptocurrency payments in France.🔗 Read the full article here.

Crypto of the Day: Injective (INJ)

Injective stands out with its blockchain specialized for decentralized financial applications, offering a highly scalable and interoperable infrastructure within the Cosmos ecosystem. It allows fast and gas-free transactions, providing added value for developers of decentralized applications and traders. Injective innovates by integrating advanced functions for derivative trading, perpetual contracts, and spot markets, while ensuring complete decentralization of operations.

The INJ token is primarily used for staking, governance, and payment of transaction fees on the Injective network. Initially distributed through private sales and a community airdrop, it offers holders staking rewards and the ability to participate in governance decisions of the protocol. INJ can be used to secure trading positions on the platform, participate in liquidity pools, and access advanced features of the Injective blockchain.

Recent Performance:

Current Price: €17.16

Percentage Increase/Decrease: +7.37% (increase over 1 day)

Market Capitalization: €1,666,981,708

Rank on CoinMarketCap: #45

📉 Ethereum Under Pressure: Technical Analysis and Outlook Amid Increased Volatility

Ethereum has recently gone through a period of high volatility, marked by a significant correction followed by a rebound on the support at $2,800, before facing new selling pressure. The price fell to a new low of $2,100, a level corresponding to a support set in 2023. Although buying interest has allowed Ethereum to rise towards $2,800, the momentum remains fragile with a current price around $2,400. Technical indicators show a bearish structure in the short term, and the downward crossing of the 50 and 200-day moving averages highlights uncertainty in the medium and long-term trend. Analysis of ETH/USDT derivatives reveals a balanced market, albeit under selling pressure, with crucial liquidation zones between $2,500 and $3,700 likely to influence future volatility.

Forecasts for Ethereum indicate that if the price remains above $2,300, a recovery towards resistance levels of $2,800 to $3,400 is possible, potentially followed by a rise to $3,500. On the other hand, failure to maintain this level could lead to a drop towards support levels of $2,100 or even $1,900, corresponding to a 20% drop risk. The current situation requires heightened vigilance, particularly regarding reactions to key levels and risks of sharp movements caused by liquidation orders.

🔗 Read the full analysis here.