🚨 CZ still free, 🏛️ Senate challenges the SEC

Welcome to the Daily Tribune on Saturday, May 18, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, May 18, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

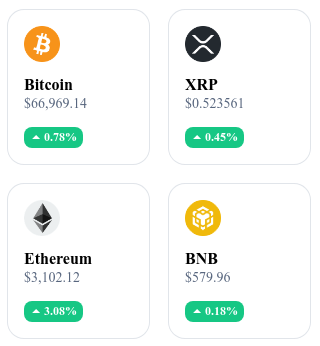

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

CZ still not in jail🚨

Despite being sentenced to 4 months in prison for his actions as the head of Binance, Changpeng Zhao (CZ) is still not incarcerated. This situation is mainly due to complex legal procedures and a strong defense orchestrated by a team of seven renowned lawyers. The final decision regarding his incarceration depends on several criteria, including prison resources and the profile of the convict, criteria that have not yet been fully evaluated. Furthermore, his lawyers are exploiting the principle of "due process" to potentially overturn the sentence. The situation remains tense, with an intense legal battle that keeps the crypto ecosystem on edge. Read the full article

The Senate challenges the SEC on crypto regulation 🏛️

The US Senate dealt a significant blow to the Securities and Exchange Commission (SEC) by repealing accounting standard SAB 121, which imposed strict constraints on cryptocurrency actors. This decision marks a clear opposition to the repressive approach of Gary Gensler, the chairman of the SEC, who sought to curb the development of the crypto industry. Far from discouraging enthusiasm for cryptocurrencies, this approach has strengthened support from lawmakers, institutional investors, and banks in favor of a more favorable regulatory framework. This Senate vote represents a major turning point, paving the way for wider adoption of crypto within financial institutions. Read the full article

Chainlink innovates in fund tokenization 🚀

The Depository Trust and Clearing Corporation (DTCC), in partnership with Chainlink and several major US banks including JPMorgan and BNY Mellon, has successfully conducted a pilot project on fund tokenization. This project, named Smart NAV, aims to standardize and accelerate the tokenization of traditional assets using blockchain technology. Chainlink's cross-chain interoperability protocol (CCIP) played a crucial role in enabling seamless integration of net asset value (NAV) data across different blockchains. The project has sparked interest from major financial institutions and demonstrates the potential of the technology to improve operational efficiency, settlement speed, and transparency. Read the full article

AMF issues a warning against Bybit 🚨

The French Financial Markets Authority (AMF) is warning investors about the cryptocurrency platform Bybit, which operates without authorization in France. Bybit, which has been on the AMF blacklist since May 2022, does not comply with French legal requirements, including registration as a Digital Asset Service Provider (PSAN). The AMF urges users to withdraw their funds quickly to avoid potential losses as it is considering legal action to block the site. This warning is part of the ongoing efforts of the AMF to protect investors from non-compliant and risky platforms. Read the full article

Crypto of the day: Reserve Rights (RSR)

The Reserve Rights (RSR) blockchain stands out for its innovation in currency stabilization and payment management. Its main goal is to enable smooth transition between different currencies through a stable coin, RSV. The native crypto RSR is primarily used to maintain the stability of RSV and participate in network governance. Initially distributed through ICOs and decentralized exchanges, RSR offers advantages such as voting rights for holders and financial incentives. It can be used to stabilize RSV, fund projects in the Reserve ecosystem, and participate in staking programs.

Recent Performances

Current Price: €0.0077

Percentage Increase/Decrease: +17.56% (1-day increase)

Market Cap: €422,233,477

Rank on CoinMarketCap: 157

Bitcoin surpasses $66,000: A new era for altcoins?

Bitcoin recently surpassed the $66,000 threshold, fueled by favorable US economic data. This increase comes after the release of a lower-than-expected Consumer Price Index (CPI) for April, easing concerns of rampant inflation. This rebound in Bitcoin has revived investor optimism and could lead to an increase in the value of altcoins, as investors seek to diversify their portfolios in a booming market.

The future prospects for Bitcoin are promising, with analysts such as those from QCP Capital predicting a possible rise to $74,000 in the weeks ahead. This anticipation is supported by positive macroeconomic factors, such as gradually declining inflation and lower interest rates, favoring risk assets. This bullish momentum could also benefit altcoins, prompting investors to closely monitor market developments to adjust their strategies accordingly.