Hello Cointribe! 🚀

Today is Wednesday, November 29, 2023 and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

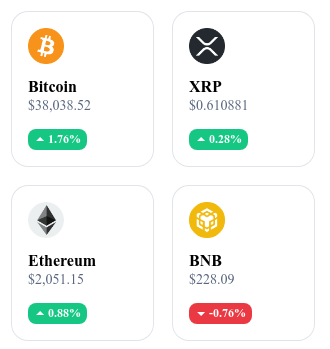

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24-hour crypto summary ! ⏱️

🧬 CZ from Binance: New venture into crypto-biotechnology

Changpeng Zhao (CZ), after being ousted from the head of Binance, turns to a new challenge: financing biotechnology through cryptocurrencies. He recently shared his interest in biotechnology on Twitter and his thoughts on using cryptocurrencies to boost funding in this sector.

The project has been positively received by Etica, a crypto project dedicated to open-source medical research without intellectual property. Indeed, the combination of blockchain and biotechnology is seen as a promising combination, and could offer more flexible and innovative funding options for a sector often faced with limitations in traditional funding avenues.

Changpeng Zhao's project to combine cryptocurrency and biotechnology could represent an attempt to legitimize and normalize cryptocurrencies in traditionally conservative sectors. By targeting biotechnology, a field at the forefront of innovation but often hindered by financing and regulatory constraints, CZ may be seeking to demonstrate the intrinsic value of blockchain as a financing and data management tool.

⏳ 11 years of Bitcoin Halving: A constant impact on value

November 28, 2023 marks the 11th anniversary of Bitcoin's first halving, a crucial event in the cryptocurrency ecosystem. Halving, which occurs every 210,000 mined blocks, cuts miners' rewards in half, directly impacting the supply of Bitcoin and, consequently, its price. The first halving, which occurred on November 28, 2012, reduced miners' rewards to 25 BTC per block, while the second one, on July 9, 2016, lowered them to 12.5 BTC.

These events have had a significant impact on the price of Bitcoin. After the first halving, the price of BTC went from $12 to $1,217 in a year. Similarly, after the second halving, the price rose from $650 to $2,500 in a year. Halving plays a key role in increasing the value of Bitcoin by creating a scarcity effect, especially if demand remains stable or increases. It also contributes to controlling inflation and limiting the total quantity of BTC in circulation to 21 million units. The next halving is scheduled for April 2024 and is eagerly anticipated by investors, fully aware of its potential impact on the price of Bitcoin.

Bitcoin halving, by reducing the supply of new units, not only increases the rarity and potentially the value of Bitcoin; it also symbolizes a radically different economic approach from that of fiat currencies. This mechanism illustrates the deflationary nature of Bitcoin, contrasting with the inflationary monetary policies of traditional currencies. It highlights the underlying philosophy of Bitcoin as a store of value and its potential as an alternative to traditional monetary systems.

📜 Binance and the DOJ: Why does the SEC remain on the sidelines?

Binance recently reached an agreement with the US Department of Justice (DOJ), settling investigations against the company. But the fact that the Securities and Exchange Commission (SEC) did not participate in this agreement is quite intriguing. Analysts interpret this absence as a deliberate strategy by the SEC to maintain regulatory pressure on Binance. By abstaining from the agreement, the SEC reserves the possibility to establish an important legal precedent regarding the classification of cryptocurrencies as securities.

The SEC, under the leadership of Gary Gensler, seems to favor extended regulatory jurisdiction over cryptocurrencies rather than individual agreements with platforms like Binance. Moreover, the SEC's absence in the agreement with Binance also serves to strengthen its position in a jurisdictional power struggle with the Commodity Futures Trading Commission (CFTC), notably in the regulation of digital assets.

The SEC's non-participation in the Binance-DOJ agreement suggests a calculated tactic to maintain regulatory pressure on Binance while reserving the right to establish legal precedents. This move reflects a broader strategy by the SEC to expand its influence in the cryptocurrency market, highlighting a potential future regulatory confrontation between different government entities.

Crypto of the day: JasmyCoin (JASMY)

JasmyCoin (JASMY) is an innovative crypto project developed by Jasmy Corporation, a Japanese provider specializing on the Internet of Things (IoT). The project combines IoT technology with blockchain to restore and protect the sovereignty of personal data. Jasmy aims to create a secure environment where users can exchange data in a trustless manner between IoT devices and decentralized protocols. The main objective is to provide a powerful and intuitive infrastructure for storing and securely sharing data, thereby transforming information into a personal asset. Jasmy decentralizes the workflow with edge computing and stores data on the IPFS (InterPlanetary File System), promoting a decentralized model where data is protected and owned by users.

JASMY holders benefit from several advantages, including the ability to participate in the Jasmy ecosystem by using the token for transactions and data exchanges. Additionally, as holders, they have a role in the governance of the ecosystem, being able to influence the project's decisions and future directions.

Recent Performances

Current price: €0.004504

Percentage increase/decrease: -0.22%

Market capitalization: €222,059,631

Rank on CoinMarketCap: #153

Please note that this information is provided for informational purposes only and does not constitute investment advice. Always do your own research before making a financial decision.

Crypto analysis of the day: AVAX

Avalanche has made an impressive leap, reaching a new annual high of $24. Imagine, after a long period of decline, AVAX has increased by over 180% in just over a month. It's like seeing an athlete come back from an injury and win a gold medal! This increase has been driven by technical factors but also by positive news related to giants like Alibaba and J.P. Morgan.

Technically, things are also interesting. The 50-day and 200-day moving averages show a shift in the upward trend. But beware, there are signs of weakness that could be worrisome. In the derivatives world, AVAX's open interest has increased by 272% since the beginning of the month, indicating increased trader participation. However, liquidations are not very significant, which could indicate caution among traders.

Now, let's talk about future scenarios. If AVAX manages to stay above $23, we could see a continuation of the upward trend, potentially up to $30 or even $38-40. But if AVAX does not break through this threshold, we could see a drop, with potential levels around $16-15 or even $13-12.

In conclusion, Avalanche shows signs of a possible reversal of the upward trend, but a corrective phase cannot be ruled out. As always, it is crucial to carefully observe the price reaction at different levels to confirm or refute these hypotheses. And remember, the crypto world is a dynamic environment where things can change quickly!