💶 Digital Euro: the ECB launches the technical phase and prepares for rollout by 2029

Welcome to the Daily for Friday, October 31, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, October 31, 2025, and as every day from Tuesday to Saturday, here’s a summary of the last 24 hours of news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

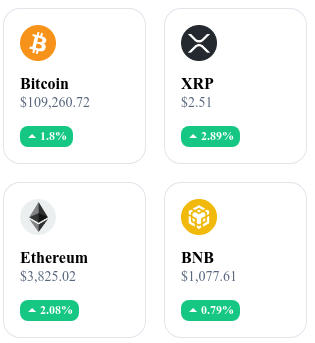

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📊 Bitcoin surpasses $300 B in spot volume for October

Bitcoin recorded over $300 billion in spot trading volume in October, according to data from The Block Research. This is the highest monthly activity since April 2024, reflecting renewed institutional interest driven by spot ETFs and a surge in global liquidity. 👉 Read the full article

🤖 OpenAI prepares $1 trillion IPO for 2026

OpenAI is planning an initial public offering in 2026, targeting a valuation of around $1 trillion, according to sources close to the matter. Led by Sam Altman, the company aims to strengthen its leadership in the global AI race against Google DeepMind and Anthropic. 👉 Read the full article

🧱 Ethereum: Fusaka upgrade scheduled for December 3

Ethereum developers have confirmed the deployment of the Fusaka upgrade for December 3. This version introduces major improvements to staking, reduces gas fees, and enhances compatibility between the network’s L1 and L2 layers. 👉 Read the full article

💳 Visa expands stablecoin payments across four blockchains

Visa has expanded its stablecoin payment program to four blockchains — Solana, Ethereum, Avalanche, and Polygon. The payments giant is now partnering with Circle (USDC) and World Liberty Financial (USDPT) to facilitate cross-border settlements in digital assets. 👉 Read the full article

Crypto of the Day: Arbitrum (ARB)

Innovation and Added Value 🧠

Arbitrum is an Ethereum Layer-2 solution based on optimistic rollup technology, designed to offer faster and cheaper transactions while maintaining Ethereum’s security.

Fully compatible with the Ethereum Virtual Machine (EVM), Arbitrum allows developers to deploy decentralized applications (dApps) without modifying their existing smart contracts. Its ecosystem is divided into two complementary networks:

Arbitrum One, used for DeFi and high-volume dApps.

Arbitrum Nova, optimized for gaming, social apps, and micropayments.

With a Total Value Locked (TVL) exceeding $5 billion, Arbitrum stands as Ethereum’s leading scalability infrastructure, powering major protocols such as Uniswap, Aave, GMX, and Sushiswap.

The Token 💰

The ARB token serves as Arbitrum’s governance asset, allowing holders to participate in the Arbitrum DAO, which oversees network development, community budgeting, and incentive programs.

Unlike Ethereum, ARB is not used for gas fees but plays a key role in decentralizing decision-making power. The token was distributed in March 2023 through a historic airdrop, marking the transition to an open, community-led governance model.

With a total supply of 10 billion ARB, Arbitrum continues its path toward mass adoption, supported by a thriving DeFi ecosystem.

Real-Time Performance 📊

💵 Current Price: $0.982

📉 24h Change: − 1.64 %

💰 Market Cap: $2.67 B

🏅 CoinMarketCap Rank: #45

🪙 Circulating Supply: 2.72 B ARB

📊 24h Trading Volume: $231.42 M

The digital euro enters its technical phase: what is the ECB preparing?

The European Central Bank (ECB) has entered a decisive stage in the development of its digital currency. By moving into the technical phase, the digital euro becomes more concrete — entering the implementation field, with key structural choices now being defined. While this stage opens promising prospects, it also brings numerous challenges for institutions, banks, and citizens.

The ECB launches the technical phase of the digital euro

On October 29, 2025, the ECB’s Governing Council officially launched the “preparation” phase of the digital euro project. This long-awaited step follows the end of the investigation phase and marks the beginning of tangible development work. The goal? To define and build the infrastructures required for the functioning of the future digital currency.

This new phase focuses on several areas: technical architecture, distribution conditions, system security, and the establishment of use cases for pilot testing. It will also lay the groundwork for a large-scale pilot, expected around mid-2027, with a potential rollout starting in 2029 — provided that the European legislative framework is adopted by 2026.

According to Piero Cipollone, a member of the ECB’s Executive Board, this progress fits within a logic of strategic resilience: “The digital euro would guarantee all Europeans access to a digital means of payment accepted everywhere, even in times of war or cyberattacks.” The vision of a Central Bank Digital Currency (CBDC) thus aims to ensure continuity of payments under all circumstances — even extreme ones.

What does it mean for citizens and banks?

This shift raises important questions. On one hand, the ECB insists that the digital euro will not replace cash but will complement existing payment methods. On the other, critics are already voicing concerns — particularly about privacy. How will the confidentiality of digital transactions be guaranteed? Who will have access to the data? The upcoming technical framework will need to address these issues to maintain public trust.

Another major challenge lies in distribution. Rather than creating direct ECB accounts for individuals, the preferred model involves mediation through commercial banks. These banks would play a central role in providing access to the digital euro, while potentially facing a decline in traditional deposits if citizens opt to store funds in official digital wallets.

Such a shift could impact the business models of banks, already under pressure from private digital payment providers. The debate also extends to governance: some warn that excessive centralization could lead to increased state control over financial flows.

In this context, the ECB must not only prove its technical credibility but also secure political and social support for a project still largely unknown to the general public.