Elon Musk loses big, Europe takes on Bitcoin mining 🚨

Welcome to the Daily Tribune on Thursday, February 1, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, February 1, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

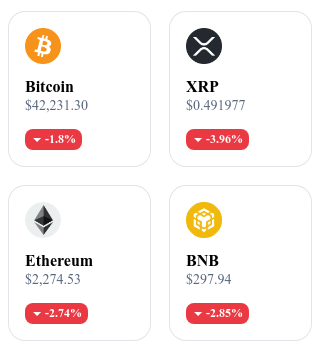

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24-hour crypto summary ! ⏱️

📉 Elon Musk loses 56 billion: Earthquake in the crypto market

Elon Musk's colossal loss shakes the crypto world: Elon Musk, an iconic figure in innovation, has suffered a monumental financial loss of 56 billion dollars. This situation is the result of a judicial decision canceling his salary package at Tesla. This setback for Musk has repercussions far beyond his personal fortune, as it shakes investors' confidence in the crypto ecosystem. Speculation is running rampant about a possible massive sale of bitcoins held by Tesla, exacerbating uncertainty in the market.

The uncertain future of the crypto market: Tesla, with its 9,720 BTC, is in a position to potentially disrupt the market. Bitcoin, already unstable, is hovering around $43,000 and could experience strong fluctuations following Musk's future actions. Investors, already on edge, are closely monitoring the market. This situation raises questions about the long-term viability of cryptocurrencies as reliable investment assets, although history has shown the resilience of the crypto world in the face of significant declines.

This situation simply reveals the fragility and volatility of the market, where the actions of a single influential figure can trigger chain reactions.

🌊 Ripple accused of selling dreams to investors

Ripple under criticism: Yassin Mobarak, a Ripple shareholder and founder of investment funds, accuses the crypto company of having \"sold a dream\" to XRP holders. With XRP trading below $0.50, this attack resonates painfully for investors. Mobarak criticizes Ripple's management of the XRP ecosystem, including the departure of key validators and the opaque use of the escrow by the company. These criticisms reflect a growing disillusionment within the XRP community.

Contradictory technical signals: Despite these criticisms, some observers note promising technical signals for XRP, similar to those preceding the price surge in 2017. Ripple is at a crossroads, with governance issues affecting the trust of XRP holders on one side, and technical signals that could herald a significant increase on the other. XRP's future will likely depend as much on external factors as on Ripple's internal policies.

The criticisms against Ripple and XRP reflect a broader challenge faced by many cryptocurrencies: balancing technological promises with tangible results.

🚀 Solana achieves record volume of 951.9 billion

Solana records spectacular growth: Solana has reached a record transaction volume of 951.9 billion, marking an increase of 30% since December. This historical peak reflects Solana's rapid rise, supported by the success of its affiliated projects. The number of registered addresses on Solana has also reached a record level, surpassing 10 million in January, the highest since May 2022.

The SOL token continues its rise: Solana's native crypto, SOL, shows steady growth, with an approximately 12% price increase in the past week. This surge is attributed to the growing interest in WEN, a crypto based on the Solana blockchain. However, this high volatility has led to significant liquidations of short positions, with $8 million coming from these short positions out of the $9.9 million liquidated on centralized exchanges.

The dramatic increase in transaction volume on Solana not only indicates the growing popularity of this blockchain, but also a broader trend towards diversification in the crypto ecosystem. It demonstrates the increasing interest in alternatives to Ethereum, particularly for solutions offering lower transaction fees and greater energy efficiency.

⚠️ Europe heading towards a ban on Bitcoin mining?

EU considers strict regulations: The European Union (EU) is planning to impose stringent measures to regulate Bitcoin mining activities, potentially leading to a total ban. The European Commission is considering carbon taxes and could give the European Central Bank the power to regulate or even prohibit institutional investments in Bitcoin. These measures could mean the prohibition of BTC mining activities in Europe.

Major implications for the crypto sector: The implications of these regulatory measures are significant, not only for Europe but also for the global Bitcoin mining landscape. If adopted, they could set a precedent for other countries to take similar actions, increasing regulatory oversight on global miners and investors. These rules raise questions about the future of cryptocurrencies in an increasingly regulated financial environment, challenging the decentralized nature and absence of government control that have fostered the prosperity of Bitcoin.

The potential European ban on Bitcoin mining can be seen as a microcosm of the growing tension between technological innovation and regulation. This approach illustrates a conflict between the decentralized aspirations of blockchain and the imperatives of global governance, particularly in terms of environmental sustainability.

Crypto of the day: Jupiter (JUP)

Jupiter (JUP) is a recently launched cryptocurrency operating on the Solana platform. It stands out for its innovative approach in the decentralized exchange (DEX) and decentralized finance (DeFi) ecosystem. Jupiter aims to provide a smooth exchange platform with advanced derivatives trading features while being integrated into the Solana ecosystem.

The native crypto JUP has been distributed to support these objectives, offering holders various benefits such as reduced transaction fees, participation in network governance, and potentially staking rewards. The main utility of JUP lies in its ability to facilitate efficient and secure transactions on its platform, while providing a gateway to derivatives trading opportunities in the DeFi space.

Recent performance of Jupiter (JUP)

Current price: $0.5792 (approximately €0.51)

Percentage increase/decrease: -63.78% (decrease in 1 day)

Market capitalization: Approximately $781.95 million (approximately €690 million)

Rank on CoinMarketCap: 78

These data reflect significant recent volatility for Jupiter (JUP), typical of new assets in the crypto space. The notable price decrease in one day suggests a market reaction to external factors or adjustments after its launch. The relatively high position of JUP in CoinMarketCap's ranking indicates notable interest from investors despite this volatility. Jupiter appears to be positioning itself as a promising player in the DeFi space, particularly within the Solana ecosystem.

Crypto analysis of the day: Celestia (TIA)

Today, we will dive into the analysis of Celestia (TIA), a crypto that is generating a lot of buzz. So, hold on tight, and let's decrypt it together!

Since its listing on Binance in late October 2023, TIA has experienced explosive growth, with an increase of over 830% in less than three months. Imagine, the price went from $2.5 to a historical peak of $20.36! This is the kind of performance that makes every investor dream. But be careful, after such a rise, TIA entered a corrective phase, falling to $13.9. This is typical of the crypto market: roller coasters where timing and strategy are crucial.

Currently, TIA is trading around $16.3. What's interesting is that TIA's rebound occurred at the 61.8% Fibonacci retracement level, calculated from its previous rise. For the uninitiated, Fibonacci is a super useful technical analysis tool for predicting potential support and resistance levels. However, despite this upward trend, oscillators show weakening buying momentum. This could mean that TIA is currently undervalued or, conversely, heading towards a downward trend. In trading, it's essential to keep a critical eye on these indicators!

If TIA remains above $13, we could expect the upward trend to continue, with a potential target around $18.5, or even its all-time high. But if it drops below $13, we could see a retreat towards $12 or $11. And if the decline continues, the next support level would be around $8. Remember, "trees don't grow to the sky" - no growth is infinite, especially in the volatile world of cryptos. So, keep an eye open and be ready to adjust your strategies!