🎩 End of an Era: Warren Buffett Bows Out

Welcome to the Daily for Wednesday, December 31, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 31, 2025, and as we do every day from Tuesday to Saturday, we bring you a summary of the last 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

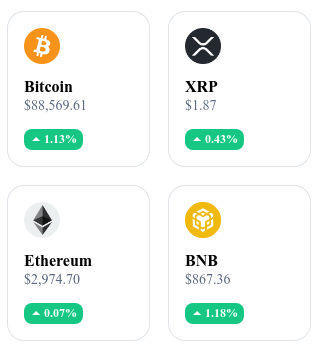

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📊 BitMine seizes the chaos to accumulate Ethereum

BitMine has invested $97M in Ethereum, significantly increasing its holdings. This accumulation comes amid ongoing price uncertainty, as other institutions monitor ETH capital flows. BitMine’s aggressive buying strategy positions the company among the notable institutional holders of Ethereum.

👉 Read the full article

🛠️ XRP supply collapses on exchanges

The amount of XRP available on trading platforms has dropped to its lowest level in 8 years, reducing the token’s visible liquidity. This contraction coincides with a massive pullback of short-term positions and a shift toward off-exchange custody solutions.

👉 Read the full article

🚀 Ethereum sets a record for smart contract deployments

In Q4 2025, 8.7 million smart contracts were deployed on the Ethereum network—a historic level according to Token Terminal. This record comes despite Ether’s price hovering around $3,000. The surge is driven by real-world asset tokenization, stablecoin usage, and ongoing development of tools and frameworks on Ethereum.

👉 Read the full article

📈 Grayscale files with SEC for a Bittensor ETF

Grayscale has filed an S-1 form with the U.S. Securities and Exchange Commission for a potential spot ETF based on the Bittensor (TAO) token. The proposed product, under the ticker GTAO, aims to provide regulated access to TAO via a publicly traded investment vehicle.

👉 Read the full article

Crypto of the Day: Bittensor (TAO)

🧠 Innovation and Added Value

Bittensor is building a decentralized network dedicated to artificial intelligence. The protocol enables an open marketplace where AI models provide predictions and services, continuously evaluated by the network. This architecture creates a direct economic incentive for model quality.

Bittensor brings a unique concept to Web3: value is based on actual intelligence contributions, not just computing power. The project aims to decentralize access to AI, reduce reliance on centralized players, and promote open innovation in machine learning.

💰 The Token

The TAO token is the backbone of the network’s economic mechanism. It rewards participants who provide high-quality models and penalizes those with declining relevance.

TAO also supports coordination and governance: reward distribution reflects the perceived value of each contributor’s services. Its capped supply enhances scarcity, while its utility grows with the network’s adoption and the demand for decentralized AI services.

📊 Real-Time Performance (CMC)

💵 Current price: €188.98

📉 24h change: –0.28%

💰 Market cap: €1.99B

🏅 CoinMarketCap rank: #35

🪙 Circulating supply: 10.55M TAO

📊 24h trading volume: €57.03M

🎩 End of an Era: Warren Buffett Bows Out

On this December 31st, 2025, while the crypto world keeps a close eye on Bitcoin’s annual close, a monumental chapter in financial history comes to an end. Today marks Warren Buffett’s final day as CEO of Berkshire Hathaway.

At 95, the man known as the “Oracle of Omaha” is stepping down after six decades of absolute dominance on Wall Street. For crypto investors, this departure is more than a retirement—it symbolizes a passing of the torch from the “Old Economy” to the age of digital assets.

🕰️ 60 Years of Value Investing Comes to a Close

Since 1965, Buffett turned a modest textile company into a trillion-dollar conglomerate. His philosophy was simple: only buy what you understand, focus on cash flow, and avoid speculation.

Track record: A historic performance that beat the S&P 500 in nearly every decade... until the blockchain era arrived.

Legacy: Buffett leaves behind a financial fortress, but also some bitterness among tech investors for ignoring (or criticizing) the greatest revolutions of the past 20 years—from Amazon to Apple (bought late), and of course, Bitcoin.

💀 The “Rat Poison” Debate: A Philosophical Divide

You can’t talk about Buffett in a crypto newsletter without mentioning his infamous punchline: to him, Bitcoin was “rat poison squared.”

Buffett’s argument: Bitcoin is a non-productive asset. Unlike a farm or a factory, it “produces” nothing. Its value depends solely on what the next buyer is willing to pay.

The Berkshire paradox: Despite his criticism, Berkshire Hathaway became one of the biggest indirect crypto investors through its stake in Brazil’s Nubank—highly active in digital assets. Proof that even under Buffett’s leadership, the ground reality forced some crypto exposure.

👔 Greg Abel Takes Over: A New Era Begins

On January 1st, 2026, Greg Abel officially becomes CEO. The challenge is massive: he inherits a record $325 billion cash pile.

A more flexible stance? Though trained in Buffett’s school, Abel is from a younger generation. Wall Street now wonders how long Berkshire can stay on the sidelines while rivals like BlackRock and Fidelity load up on Bitcoin.

Shareholder pressure: Without Buffett’s near-religious aura, investors may demand higher returns, pushing Abel toward growth assets—including crypto infrastructure and Bitcoin ETFs.

⚔️ A Clash of Financial Civilizations

Buffett’s retirement coincides with Bitcoin’s battle for its yearly close (see previous article). The timing couldn’t be more symbolic:

Buffett’s world: Fiat currency, industrial growth, and centralized banking.

Bitcoin’s world: Digital scarcity, decentralization, and an exit from the traditional monetary system.

That Berkshire holds a record $325B in cash suggests Buffett no longer believed in the value of US equities at current prices. To Bitcoin maximalists, this is proof that the old system is running on fumes.

Buffett will be remembered as one of the greatest financial minds in history—but his exit marks the end of institutional resistance to digital assets.

Berkshire may not become the next MicroStrategy overnight. But with the most vocal crypto critic now gone, institutional adoption just became a lot easier.

Do you think Berkshire Hathaway will buy its first Bitcoins under Greg Abel before 2030?