📈Ether captures a growing share of capital and surpasses Bitcoin

Welcome to the Daily Tribune of Wednesday, July 30, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, July 30, 2025 and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours you shouldn't have missed!

But first…

✍️ Cartoon of the day:

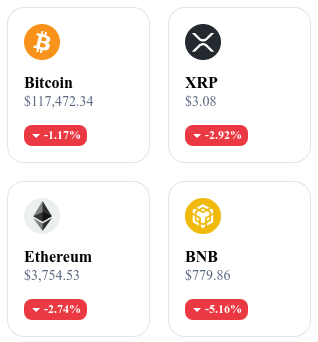

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🌊 XRP and Dogecoin suffer a severe correction despite a recent rebound

After a spectacular rally, XRP lost 12% and Dogecoin 18% in one week, completely erasing their weekly gains.

⏳ The SEC delays its decision on the Bitcoin ETF supported by Trump

The SEC deferred to September 18, 2025 the review of the Bitcoin ETF application filed by Truth Social, citing an "in-depth study" of the proposed mechanisms. This delay reflects regulatory caution given risks of conflicts of interest and political pressures.

💧 15th consecutive week of inflows into crypto funds, led by Ether

Crypto funds recorded net inflows for the 15th consecutive week, totaling $1.9 billion and bringing annual flows to $29.5 billion. Ether-based products captured $1.59 billion, while Bitcoin experienced $175 million in outflows.

🚀 Strategy raises $2.5 billion and acquires 21,021 BTC

Following a historic $2.5 billion IPO for its STRC vehicle, Strategy bought 21,021 BTC at $117,256 per unit, bringing its holdings to 628,791 BTC (≈ $74 billion). STRC shares pay a monthly dividend, offering investors a steady yield coupled with indirect exposure to Bitcoin.

Crypto of the day: NEAR Protocol (NEAR)

🧠 What innovation and added value?

NEAR Protocol is a layer 1 blockchain designed to solve classic Web3 limitations in scalability, accessibility, and adoption. Its main innovation lies in dynamic sharding via the Nightshade system, which enables parallel transaction execution while maintaining a high level of security and decentralization.

Thanks to this design, NEAR can process several thousand transactions per second with latency below one second, all while keeping fees negligible. The protocol also features an accessible development environment (contracts in Rust/JS), compatibility with Ethereum via the Aurora virtual machine, and a vision geared toward decentralized artificial intelligence through "intention chains" and "user agents."

NEAR thus aims to become a central platform for Web3/AI dApps, DAOs, DeFi solutions, NFTs, and cross-chain interoperable tools with Web2.

💰 The NEAR token: utility and benefits for holders

The NEAR token plays a central role in the protocol's functioning. It is used to pay transaction and storage fees, fuels network security via staking mechanisms, and supports ecosystem growth. Users can delegate their tokens to validators to receive rewards, promoting decentralization while generating passive income.

NEAR is also used within network applications: DeFi interactions, NFT minting, in-app purchases, and more broadly as a value token in the protocol's economy. Its inflationary model remains moderate and regulated, with issuance oriented to finance long-term development.

📊 Recent performance (July 30, 2025)

Current price: $2.64 USD

24h variation: – 4.80 %

Market capitalization: ≈ $3.27 billion USD

Rank on CoinMarketCap: #33

Circulating supply: 1,239,028,931 NEAR

24h trading volume: ≈ $211,066,000 USD

Is the euro weakened against Bitcoin? Alerts from Max Keiser and the ECB

As Bitcoin crosses new technical thresholds against the euro, the question of loss of monetary sovereignty in Europe becomes more pressing. Max Keiser, a controversial figure in the crypto world, predicts a total collapse of the single currency. Meanwhile, the European Central Bank is concerned about the growing influence of dollar stablecoins. Do these converging signals mark a structural turning point for the European currency?

Max Keiser predicts the collapse of the euro against Bitcoin

Max Keiser, former Wall Street trader and ardent Bitcoin advocate, does not mince words. In a recent statement, he declared that "the euro will fall to zero against Bitcoin", a blunt position nonetheless supported by concrete market elements.

Indeed, the BTC/EUR pair recently broke through a technical resistance zone located between €95,000 and €98,000, a level closely monitored by analysts. This technical threshold, considered a significant ceiling, was surpassed, propelling Bitcoin above €102,000. According to projections, the next target lies between €110,000 and €115,000, a progression which, if confirmed, would further widen the gap between the cryptocurrency and the European currency.

For Keiser, this bullish move reflects more than a simple market effect: he sees it as a symptom of a structural weakening of the euro. This reading, though extreme, raises questions in a context of global monetary tensions.

Dollar stablecoins and threats to European monetary sovereignty

Beyond Max Keiser's shocking forecasts, the European Central Bank also warns about risks linked to the rise of dollar-backed stablecoins. These digital assets, increasingly used for payments and exchanges in the crypto ecosystem, contribute to strengthening the dollar's influence in the global digital economy.

The ECB points to a worrying consequence: dollar dominance via stablecoins could erode the euro’s ability to play a central role in the digital financial system, thereby reducing the European Union's monetary maneuvering room.

This gradual shift towards digital dollarization, combined with Bitcoin's growing dynamic against the euro, poses a strategic question for European monetary authorities. Between pressure from crypto markets and competition among digital currencies, the euro could find itself at a crossroads.