📉 Ethereum and Solana in full recovery, Cardano losing ground with plummeting addresses!

Welcome to the Daily Tribune Thursday, August 15th, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, August 15th, 2024, and like every day from Tuesday to Saturday, we summarize the latest news from the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

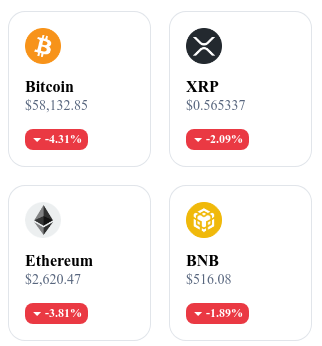

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🌍 Dollar sidelined for oil: Can XRP come to the rescue?

India and the United Arab Emirates reportedly conducted a major oil transaction using the cryptocurrency XRP, bypassing the U.S. dollar. This symbolic move could mark a turning point in international trade and challenge the hegemony of the greenback. Although not officially confirmed, this operation seems to be part of a broader trend of de-dollarization observed among BRICS countries. This maneuver could strengthen the economic independence of these nations while illustrating the potential of blockchain in traditionally sovereign currency-dominated sectors. Nevertheless, the lack of concrete evidence calls for caution regarding the veracity of this information. 🔗Read the full article here.

🌱 Ethereum and Solana reborn: Investors repositioning

After a difficult period marked by a brutal correction, Ethereum and Solana have regained the trust of investors, attracting substantial investment inflows. Over the past week, these two cryptocurrencies have seen a net influx of $176 million, with the majority directed towards Ethereum, which has captured $155 million. This global enthusiasm for these digital assets reflects the resilience of the crypto market and the return of optimistic sentiment among institutional investors. 🔗 Read the full article here.

⚠️ Cardano in peril: Declining active addresses and growing concerns

Cardano (ADA) is going through a turbulent period as activity on its network experiences a worrying drop. The number of active addresses, those that perform at least one transaction, has plunged by 36% in just one week, while new addresses created for exchanging ADA have dropped by 46%. This decline comes despite a recent increase in the price of ADA, a phenomenon that could indicate an imbalance between the valuation of the crypto and the commitment of its users. In addition, whale transactions, key market indicators, have decreased by 244% in the past month, reinforcing fears of a possible price correction to $0.27. If this trend were to be confirmed, Cardano could be in danger, despite its seemingly solid fundamentals. 🔗 Read the full article here.

🚀 Bitcoin on the brink of a revival: Could the stablecoin boom change everything?

The recent rise of stablecoins, with a massive injection of over $1.5 billion in just three days, could serve as a catalyst for a new Bitcoin rally. Major players like Tether and Circle have intensified their issuances and are fueling hopes of a crypto market recovery, according to Markus Thielen of 10x Research. However, this increase must be sustained for a lasting impact on Bitcoin. Despite this optimism, market volatility remains influenced by various external factors, including U.S. economic decisions. While stablecoins can play a crucial role, their effect does not guarantee an immediate bull run. 🔗 Read the full article here.

Crypto of the day: Aave (AAVE)

Aave is a decentralized finance (DeFi) platform that allows users to lend and borrow cryptocurrencies without traditional intermediaries, using smart contracts on the Ethereum blockchain. Aave's main innovation lies in its ability to offer flash loans, which allow borrowing without collateral, as long as the loan is repaid in the same transaction.

The platform's native crypto, AAVE, is used for governance, enabling holders to vote on protocol development proposals, and for transaction fee reductions. AAVE was initially distributed through a token swap from the previous version, LEND, and offers benefits such as passive income for holders who participate in staking.

Recent Performances

Current Price: €95.65

Percentage Increase/Decrease: +7.14% (decrease over 1 day)

Market Cap: €1,447,812,936

Rank on CoinMarketCap: #47

Fantom Crypto down by -78%, opportunity to seize? Analysis of August 14th, 2024

Fantom (FTM) has experienced a dramatic 78% drop since its peak of $1.20 in March, falling to $0.26 before bouncing back slightly at around $0.37. This decline, despite an attempted recovery, reflects a significant loss of momentum and low demand in the market. Technical indicators, such as the 50 and 200-day moving averages, remain downward-oriented, illustrating a persistent bearish trend. The current situation, where support and resistance levels are closely monitored, suggests a market in a consolidation phase with key levels to watch, particularly around $0.30 for a potential trend reversal or further decline.

Despite this gloomy context, some see this drop as a buying opportunity, especially for contrarian investors. Perpetual contracts on FTM/USDT show a slight resurgence of interest, although the general sentiment remains undecided. Analysis of liquidation zones indicates an increased risk of volatility if the price approaches certain critical levels, such as $0.48 or $0.32. All in all, Fantom is at a critical crossroads, where every market movement could have significant implications for investors, whether for a bullish rebound or further decline.

🔗 Read the full analysis here.