🔥 Ethereum burns billions… but its supply keeps rising

Welcome to the Monday, December 8, 2025 Daily ☕️

Hello Cointribe! 🚀

Today is Monday, December 8, 2025, and as every day from Tuesday to Saturday, we summarize the key news from the last 24 hours you shouldn’t miss!

But first…

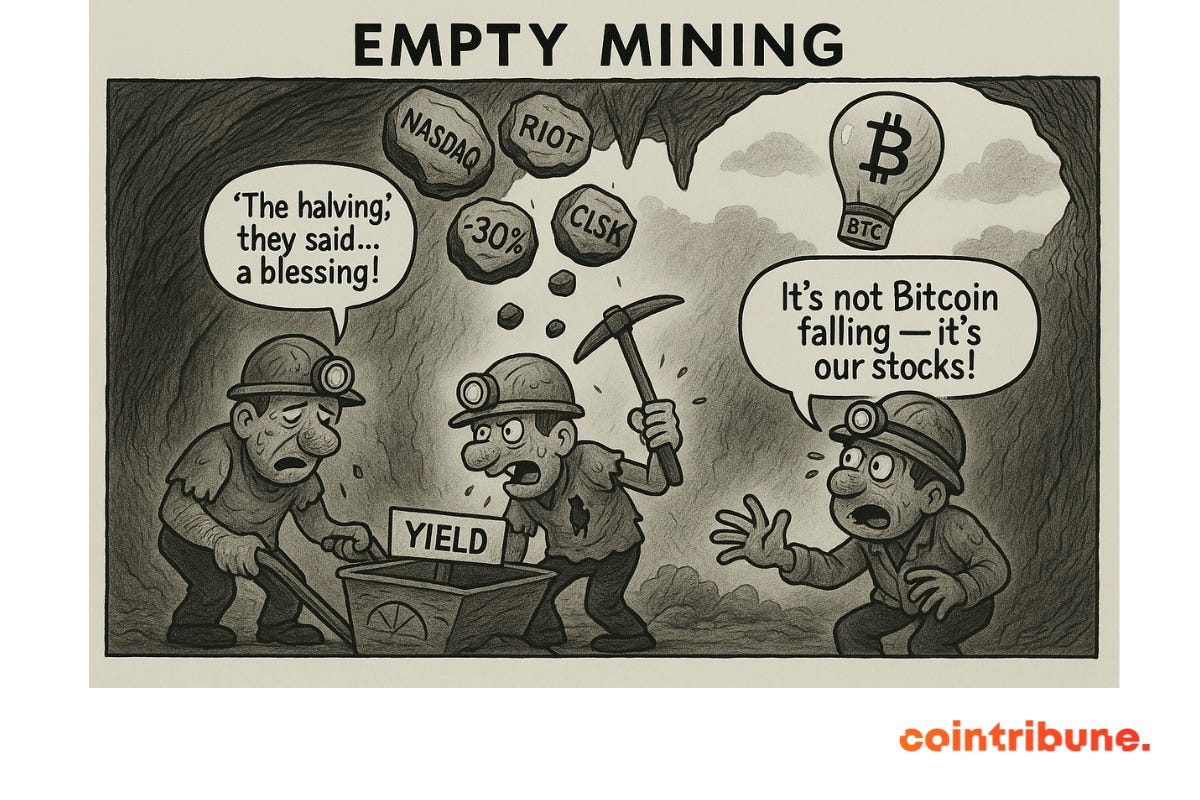

✍️ Cartoon of the day:

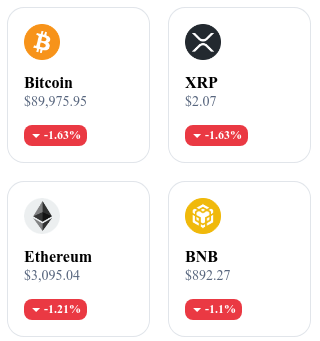

A quick look at the market…

🌡 Weather:

🌧️Rainy

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

🏦 JPMorgan denies politically targeting crypto users in its account closures

The bank states that it does not target any clients for ideological reasons or in connection with their opinions, after several accusations of “debanking” against pro-crypto or pro-Donald Trump figures. 👉 Read the full article

📈 Ethereum sees its network activity surge while stablecoins exceed $6 trillion

Traffic on the Ethereum network reaches record levels as the market capitalization of stablecoins appears above $6 trillion, indicating increased use of stable cryptos and smart contracts. The price of ETH remains around $3,100 despite this surge in activity. 👉 Read the full article

🤝 Solana Foundation gets involved in the growing conflict between Kamino and Jupiter Lend

Facing tensions between the Kamino and Jupiter Lend protocols, the Solana Foundation steps in to guide the debate and protect the associated DeFi ecosystem. 👉 Read the full article

📉 Bitcoin mining company stocks fall sharply

Companies active in Bitcoin mining record a strong drop in valuation, reflecting pressure on mining profitability due to rising energy costs and decreasing returns. This trend raises doubts about the long-term viability of certain sector players. 👉 Read the full article

Crypto of the Day: Gnosis (GNO)

🧠 Innovation and value proposition

Gnosis is built on an infrastructure focused on governance, security and professional Web3 tools. The project develops Gnosis Chain, an Ethereum-compatible blockchain designed to offer fast, low-cost transactions suited to decentralized governance applications.

Gnosis also stands out with Safe, the most widely used standard for multisig management and crypto treasuries. Thousands of organizations, DAOs and companies rely on Gnosis to secure their operations. The protocol positions itself as a reliable technical foundation for critical services: voting, fund management, decentralized identity and community coordination.

💰 The token

The GNO token plays a central role in the operation of Gnosis Chain. Users use it to secure the network through staking, a method that strengthens stability and resistance to attacks. GNO is also used in governance: holders influence decisions related to the chain’s evolution and the resources mobilized for the ecosystem.

The network’s operation generates continuous demand for GNO, as many professional tools rely on Gnosis’ technical structure. The success of Safe and governance solutions reinforces the token’s utility.

📊 Real-time performance (CMC)

💵 Current price: $126.71

📉 24h change: –1.47 %

💰 Market cap: $334.42 M

🏅 Rank on CoinMarketCap: #126

🪙 Circulating supply: 2.63 M GNO

📊 Trading volume (24h): $4.3 M

Ethereum burns billions… but its supply keeps growing

The Ethereum network has removed more than 18 billion dollars worth of ETH from circulation thanks to its “burn” mechanism. Yet, the total amount of tokens in circulation continues to rise. An apparent contradiction that deserves a clear explanation.

Burning 6.1 million ETH: how does this mechanism work?

Since the implementation of proposal EIP-1559 in August 2021, Ethereum has introduced a mechanism for partially destroying transaction fees. Concretely, each time a transaction is made on the network, a portion of the fees is automatically “burned”, meaning permanently removed from the circulating supply. This process aims to limit Ethereum’s inflation by regularly eliminating units of ETH from the market.

In figures, this represents more than 6.1 million ETH destroyed in just over three years. At current market value, that corresponds to around 18 billion dollars. This “burn” system has been welcomed by many Ethereum supporters, who saw it as a step toward a scarcer and more robust digital asset economy.

But this dynamic has not yet been enough to make Ethereum truly deflationary. Because at the same time, the issuance of new tokens continues at a steady pace.

Why Ethereum’s supply keeps rising anyway

Since the transition to the Proof-of-Stake (PoS) consensus, Ethereum has replaced miners with validators to secure its network. These validators are rewarded in ETH for their work, which means new tokens are constantly being issued.

Thus, even though the network destroys ETH through burning, it also creates ETH to reward validation participants. This dual mechanism results in a net inflation rate — the difference between the amount created and the amount destroyed.

In 2025, this rate is estimated at approximately +0.8 % per year. This means that, despite billions of dollars burned, the total supply of ETH continues to increase, although at a moderate pace. For now, this situation prevents Ethereum from being classified as a truly deflationary cryptocurrency.

There are still hopes, especially with the latest protocol upgrades. The Fusaka upgrade and the development of scalability solutions such as rollups could increase activity on the network. If this activity drives transaction fees higher — and therefore burn volume — Ethereum could one day shift into a deflationary mode, where more tokens are destroyed than issued.

Between burn, inflation and protocol upgrades, Ethereum is still seeking balance

The Ethereum paradox highlights the complexity of designing a stable and sustainable digital monetary system. The massive ETH burn, impressive in scale, is still not enough to counter residual inflation caused by validator rewards. The challenge is not simply to burn more, but to stimulate network activity to naturally increase burn volumes.

Recent developments, such as Fusaka and Layer 2 solutions, may help achieve this goal. But the balance between security, economic incentives and scarcity remains delicate.