🔥 Ethereum finally breaks the $4,000 mark after 8 months of silence

Welcome to the Daily for Saturday, August 9, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, August 9, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the last 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

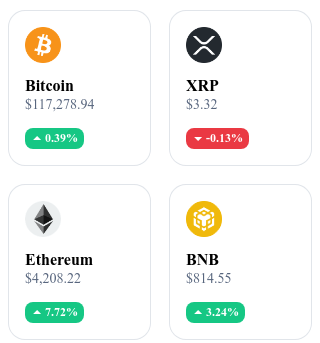

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🎓 Harvard gains Bitcoin exposure through BlackRock’s ETF

Investment filings reveal a position in the IBIT ETF, signaling a measured openness to digital assets.

👉 Read the full article

🟣 Ethereum climbs back above $4,000 for the first time in 8 months

The $4,000 threshold has been breached amid rising volumes and optimism around ETF inflows and staking revenues. Traders are watching the $4,100–$4,300 range and ETH’s performance gap against BTC.

👉 Read the full article

🤖 ChatGPT-5 divides opinion: measured progress, high expectations

Early feedback points to modest gains in planning and multimodality, with only slight improvements across several benchmarks. Critics cite uneven creativity and occasional instability despite promised enhancements.

👉 Read the full article

⚖️ Ripple and SEC close the chapter after appeal withdrawal

The end of proceedings resolves a long-running dispute and removes a major source of uncertainty for XRP. Markets anticipate clearer rules for future offerings and reduced legal risk.

👉 Read the full article

Crypto of the Day: Arweave (AR)

🧠 Innovation and Added Value

Arweave is a decentralized permanent storage solution that enables data to be preserved forever with a one-time upfront payment. Built on a proprietary blockweave technology, Arweave stores data redundantly across a distributed network, ensuring its integrity and perpetual availability. This makes it ideal for archiving documents, websites, multimedia files, or historical data with superior security and resilience compared to traditional cloud solutions.

💰 The AR Token: Utility and Holder Benefits

The AR token is used to pay for lifetime storage on the network. Miners/nodes earn AR for providing disk space and bandwidth, creating a sustainable economic incentive. The token’s scarcity, combined with growing demand for permanent and tamper-proof storage, positions AR as a strategic asset in the Web3 and digital archiving economy.

📊 Real-Time Performance (August 9, 2025)

Current Price: $22.47 USD

24h Change: +1.32%

Market Cap: ≈ $1.46 billion USD

CoinMarketCap Rank: #55

Circulating Supply: ≈ 65.02 million AR

24h Trading Volume: ≈ $41.5 million USD

💡 Bitcoin: Why Investing Early Doesn’t Guarantee Wealth

As Bitcoin hit a new all-time high of over $123,000 on July 14, one recurring idea resurfaces: if you had bought just a few dozen dollars’ worth of BTC in the early 2010s, you’d be a billionaire today. Behind this seductive vision, trader Techdev and several industry figures remind us that the reality is far more complex. Extreme volatility, tough decisions, and relentless psychological pressure mean the story of Bitcoin’s early holders is anything but a simple “stroke of genius.”

Bitcoin’s Roller Coaster: Over a Decade of Trials

In theory, an early investment of $100 in Bitcoin in 2010 could have turned into $2.8 billion today. But Techdev is clear: “No.” The reason is simple — holding BTC for over a decade through market turbulence was almost an impossible feat.

The theoretical evolution of that initial stake shows the magnitude of the swings:

A surge to $1.7 million, followed by a drop to $170,000.

A rebound to $110 million, then a collapse to $18 million.

Daily price swings sometimes exceeding 10%.

According to Curvo’s data, Bitcoin’s compound annual growth rate (CAGR) stands at 102.79% over 13 years. Behind that impressive performance lies such intense volatility that most investors would have sold long before reaching astronomical sums.

Psychology, Luck, and Discipline: The Real Price of Bitcoin Fortune

For Anthony Pompliano, entrepreneur and prominent industry voice, Techdev’s analysis is clear-cut: “Everyone thinks they would have held their Bitcoin from a few cents to billions of dollars. It’s easier said than done.”

Plenty of real-life stories prove the point:

BTC spent on trivial purchases, now worth millions.

Lost private keys taking entire fortunes with them.

Panic selling after market crashes, out of fear of losing even more.

Erick Pinos, head of ecosystem at Nibiru Chain, sums up the challenge: “Making the choice every day, every hour, not to sell — for years.”

Luck has often played a decisive role. Some early investors simply forgot about their wallets, only discovering the astronomical value of their holdings after Bitcoin’s mass adoption. This underlines the fact that today’s BTC billionaires make up a tiny minority of early buyers.

A Lesson for Long-Term Investing

Today’s Bitcoin billionaires represent a very small fraction of the first adopters. The vast majority didn’t hold on through the entire period, mainly because of:

Corrections exceeding 80%, such as in 2013–2015 (-83%), 2017–2018 (-84%), or 2021–2022 (-77%).

Frequent daily swings above 10%, making any “hold” strategy emotionally draining.

Technical risks: lost private keys, hacks, or transfer errors.

These hurdles show that long-term success depends not only on getting in early but on meeting four cumulative conditions:

Psychological resilience – the ability to hold through massive temporary losses.

Strategic discipline – sticking to a predefined investment plan and resisting impulsive moves.

Operational security – protecting assets via reliable, offline storage solutions.

Liquidity management – avoiding forced sales to cover urgent financial needs.

These lessons go beyond Bitcoin itself. They apply to any volatile asset class where high potential returns come with equally high risks.