Hello Cointribe! 🚀

Today is Friday, December 05, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

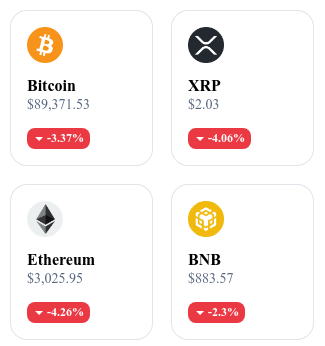

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🏛️ MiCA: the EU plans to extend ESMA’s powers over crypto markets

The European Commission proposes expanding ESMA’s authority to supervise crypto assets in a harmonized way, in order to strengthen consistency between financial markets and crypto assets. 👉 Read the full article

⚠️ The International Monetary Fund warns about the global impact of dollar-based stablecoins

The IMF warns about the risks linked to the rise of dollar-denominated stablecoins, including threats to monetary sovereignty and global financial stability. The institution notes that the dominance of dollar stablecoins could weaken the monetary policies of central banks, especially in vulnerable economies. 👉 Read the full article

📊 Ethereum attracts more capital than Bitcoin over the past two weeks

According to reported data, Ethereum (ETH) has recorded higher investment flows than Bitcoin (BTC) over the past fifteen days, reflecting renewed confidence or interest in the smart-contracts ecosystem. This dynamic could indicate a repositioning of investors toward crypto assets considered more promising. 👉 Read the full article

📉 Cryptos lose attractiveness among U.S. investors according to FINRA study

A recent FINRA study reveals a decline in interest from U.S. retail investors for cryptocurrencies, with a significant drop in purchasing and holding intentions. This trend raises questions about the market’s ability to maintain retail support amid fluctuations and regulatory uncertainty.

Crypto of the Day: Arbitrum (ARB)

🧠 Innovation and added value

Arbitrum is an Ethereum layer-2 designed to offer fast and low-cost transactions thanks to optimistic rollup technology. The network executes transactions off-chain and then batches them before submitting them to Ethereum, which drastically reduces fees.

Arbitrum appeals to developers with full EVM compatibility and enhanced execution capacity. It hosts numerous DeFi applications, derivatives platforms, gaming projects and infrastructure services. Its roadmap includes the expansion of Arbitrum Orbit, a framework that enables the deployment of customized chains built on the protocol’s technology.

💰 The token

The ARB token plays a key role in network governance. Holders participate in decisions affecting protocol parameters, ecosystem financing and technological development.

The token also supports the autonomy model of the Arbitrum DAO, which manages the network treasury and oversees infrastructure-related proposals. Activity from applications built on Arbitrum mechanically increases demand for transactions, making the ecosystem one of the most active in Web3.

📊 Real-time performance (CMC)

💵 Current price: $0.2015

📉 24h change: –7.51 %

💰 Market cap: $1.13 B

🏅 CoinMarketCap rank: #58

🪙 Circulating supply: 5.61 B ARB

📊 Trading volume (24h): $125.03 M

Ethereum narrowly avoided a shutdown: what happened after the Fusaka upgrade?

One of Ethereum’s technical pillars was shaken shortly after the activation of Fusaka, an upgrade meant to strengthen the network’s robustness. A quarter of validators suddenly disconnected, pushing the blockchain into a critical zone where transaction finality was threatened. How could a simple software bug endanger one of the world’s largest blockchains? This situation highlights both the technical challenges and the strategic choices of an ecosystem that still relies too heavily on a single software solution.

The Prysm bug: one quarter of Ethereum’s validators taken offline

On December 5, 2025, just as the Fusaka upgrade was activated, a critical incident occurred on Ethereum. The Prysm consensus client, used by a large majority of validators, encountered a technical failure. As a result, around 25% of validators were unable to participate in block validation. This drop in participation pushed the global voting rate below 75%, a threshold under which Ethereum loses the ability to guarantee block finality.

Finality represents a state where transactions are considered irreversible because they are sufficiently validated by the network. If this threshold falls too low — typically below 66.6% — the blockchain becomes vulnerable to attacks or block reorganizations. The Ethereum network did not reach that breaking point, but it came dangerously close.

Fortunately, the Prysm teams quickly provided a temporary solution. Adding the parameter --disable-last-epoch-targets in the client configuration allowed affected nodes to regain synchronization. Participation then rose back to nearly 99%, removing the risk of loss of finality and restoring network stability.

Diversifying consensus clients: an urgent need for network resilience

This technical incident raises a fundamental issue: the network’s excessive reliance on a single consensus client. Prysm, developed by Prysmatic Labs, is used by a disproportionate share of validators. This concentration goes against the decentralization principle that the blockchain aims to embody.

The Ethereum Foundation and several ecosystem players have long encouraged client diversity. Alternatives such as Teku, Nimbus or Lodestar are available and functional. Yet Prysm continues to dominate, often due to deployment convenience or habit.

This situation creates a systemic risk: a bug in Prysm should not be able to affect a quarter of the network. If most validators used different clients, the impact of a software flaw would be far more limited. The Fusaka incident shows that a better distribution of clients is essential to strengthen Ethereum’s resilience.

This is not just a debate between developers: end users, especially those interacting with decentralized finance (DeFi) protocols, cross-chain bridges or rollups, are also affected. In the event of a loss of finality, exchanges could be blocked, funds frozen, or arbitrages distorted. The reliability of the entire ecosystem depends on this often invisible technical layer.

The incident triggered by the Prysm bug, although quickly resolved, is a warning signal for the Ethereum community. It reminds us that the robustness of a decentralized network is not measured only by its size or market capitalization, but also by the diversity and solidity of its software foundations. The Fusaka upgrade did not directly cause the outage, but it revealed a structural weakness: too many validators rely on a single point of failure. To prevent such a scenario from recurring with more serious consequences, it is urgent to promote true diversity in consensus clients. This is the price Ethereum must pay to continue evolving while remaining reliable.