Hello Cointribe! 🚀

Today is Friday, December 8, 2023, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

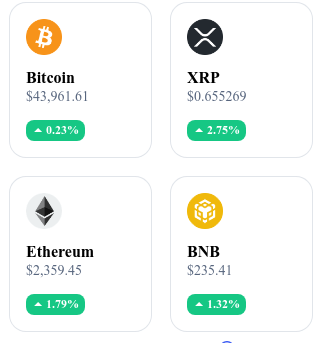

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

📉 Bitcoin at its peak? The warning from John Bollinger

John Bollinger, a recognized figure in the trading world, recently reassessed his outlook on Bitcoin. On December 5, he observed notable strength in the Bitcoin market, noting that its price exceeded the daily and weekly Bollinger Bands without major divergences. However, the next day, he expressed increased caution, suggesting that the market may have reached its peak.

Bitcoin is known for its volatility, and despite a recent stabilization around $44,000, the market remains unpredictable. Current analysis indicates a state of "greed “among investors, but not "extreme greed". Bollinger's often accurate forecasts suggest that the market may be approaching a turning point. In the long term, Bitcoin has shown impressive growth despite its fluctuations.

John Bollinger's analysis of Bitcoin suggests a possible plateau in its value. This could indicate a turning point in the Bitcoin market cycle, where consolidation could replace rapid growth.

🌩️ Jamie Dimon of J.P. Morgan advocates for the end of crypto

Jamie Dimon, CEO of J.P. Morgan, recently shook the crypto world with controversial statements. During a hearing before the US Senate, he suggested closing down the entire crypto sector, a position that reflects his historical skepticism towards Bitcoin, which he has previously called an exaggerated fraud and a pet rock.

Dimon cited money laundering and tax evasion risks as the main arguments against Bitcoin. Despite Dimon's alarming remarks, Bitcoin remains a key player in the financial sector, with a future that is both uncertain and promising.

Jamie Dimon's statement, although apparently radical, can be interpreted as an implicit recognition of the threat that cryptocurrencies pose to the traditional financial system. His proposal to close down the crypto sector could be seen as an attempt to preserve the financial status quo, while highlighting the lack of understanding and resistance of traditional financial institutions to disruptive innovation.

🚀 Ethereum challenges Bitcoin: The dawn of altcoins?

Ethereum, long considered the younger sibling of Bitcoin, shows signs of remarkable ascent. Ethereum reached a new annual record of $2,312, with a 10.28% increase in one week. This performance suggests that Ethereum may no longer be simply a follower of Bitcoin, but rather a potential rival.

The upward trajectory of Ethereum is illustrated by a triangle pattern on the markets, indicating a potential bullish target of $2,780. The Ichimoku indicators, known for their ability to predict market trends, also support this rise. However, the inherent volatility of the cryptocurrency market makes it uncertain whether Ethereum can maintain this trend and reach the $2,780 target.

The recent rise of Ethereum should be interpreted with caution. The inherent volatility of the market and the growing competition from other altcoins could influence the sustainability of this increase.

⚖️ Binance: Changpeng Zhao risks prison after his confession

Changpeng Zhao, the founder of Binance, is at the center of a legal saga in the United States. The US District Court in Seattle accepted his guilty plea for violating US anti-money laundering laws. Following his confession in November, Zhao, known as "CZ", faces up to 18 months in prison. The US Department of Justice had sought a record fine of $4 billion, but the final decision on whether CZ can leave US territory remains pending.

CZ's situation in the United States could reveal further irregularities within Binance, marking a turning point in the regulation of cryptocurrencies. The concrete sanctions against CZ will be decided on February 23 and will be a crucial moment for the future of cryptocurrency regulation.

Despite his confession, CZ's continued presence in the United States reflects a stricter and more uncompromising approach by authorities towards regulatory violations in the crypto space.

Crypto of the day: JITO (JTO)

JITO Network stands out in the Solana ecosystem with its JitoSOL liquid staking pool and Maximum Extractable Value (MEV) products. This innovation allows users to exchange their SOL for JitoSOL, thus maintaining the liquidity of SOL while benefiting from decentralized finance (DeFi) opportunities and staking yields. The unique appeal of JitoSOL lies in its additional rewards derived from transaction revenues related to MEV extraction on Solana. The Jito Foundation, by minimizing the negative impacts of MEV and promoting equitable distribution of profits, brings significant added value in terms of transparency and fairness to the ecosystem.

Recent Performance

Current Price: €02.77

Percentage Increase/Decrease: 79.48% (1-day increase)

Market Cap: €318,825,760

Rank on CoinMarketCap: #134

Note that this information is provided for informational purposes only and does not constitute investment advice. Always do your own research before making a financial decision.

Why use CoinMarketCap when starting out in crypto?

When starting out in the world of cryptocurrencies, it is important to have reliable and informative tools to navigate this complex and ever-changing sector. CoinMarketCap presents itself as an essential resource for various reasons. Here are six:

Comprehensive cryptocurrency information: CoinMarketCap provides detailed data on thousands of cryptocurrencies, including their current price, market cap, trading volume, and price variation. This information is essential for understanding market trends and making informed decisions.

User-friendly and intuitive interface: The platform is designed to be accessible even to beginners. With a clear user interface and intuitive features, CoinMarketCap allows new users to easily navigate the world of cryptocurrencies.

Real-time updates: The cryptocurrency market is extremely volatile. CoinMarketCap offers real-time updates, which is perfect for tracking rapid price fluctuations and reacting accordingly.

Educational tool: CoinMarketCap is not just a price-tracking tool; it also offers a wealth of educational information. Articles, guides, and explanations of key terms help beginners understand the fundamentals of cryptocurrencies.

Comparison and analysis: Users can compare different cryptocurrencies, view historical price trends, and analyze performance over different periods. This feature is essential for assessing the long-term potential of a cryptocurrency.

Community and network: CoinMarketCap is more than just a platform; it is a community where users can share ideas, follow news, and learn from experts. This community interaction is valuable for beginners looking to familiarize themselves with the cryptocurrency culture.

In summary, CoinMarketCap is an indispensable tool for anyone looking to venture into cryptocurrency investing or trading. It offers a unique combination of detailed information, analysis tools, educational resources, and an active community, making it an ideal platform for beginners.