😱 Ethereum plunges: -9% in just a few hours

Welcome to the Daily for Tuesday, August 26, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, August 26, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the last 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

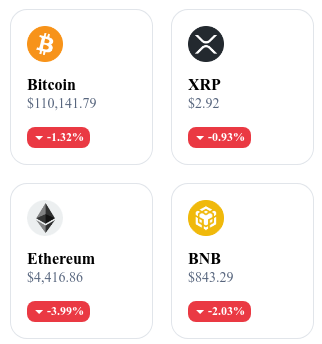

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🟣 ETH drops 9% in hours, wiping out $60B in market cap

ETH fell by about 9% after peaking at $4,955 on August 24, erasing nearly $60B. Liquidations reached ~$266M over 24h, while BTC touched $110,584 before recovering above $112,000.

👉 Read the full article

🏦 MicroStrategy adds $357M in bitcoin, continues accumulation strategy

The company purchased 3,081 BTC for $356.9M at an average price of $115,829, bringing total holdings to 632,457 BTC (cumulative cost $46.5B). This follows two smaller August purchases and supports a revised 2025 target of 30% “BTC yield.”

👉 Read the full article

📉 Crypto ETPs face $1.43B in weekly outflows

Exchange-traded products recorded $1.43B in withdrawals, the lowest since March. BTC accounted for ≈ $1B in outflows and ETH ≈ $430M, while XRP (+$25M) and SOL (+$12M) saw net inflows.

👉 Read the full article

🛡️ Apple issues emergency patches for exploit used to steal crypto

Apple released updates for iOS/iPadOS 18.6.2 and macOS (Ventura 13.7.8, Sonoma 14.7.8, Sequoia 15.6.1) fixing CVE-2025-43300, a “zero-click” ImageIO flaw. The vulnerability allows code execution via image files and specifically targets recovery phrases stored as photos, prompting recommendations to use a cold wallet and restrict gallery access.

👉 Read the full article

🎁 Over €2,000 in rewards to win with the Read2Earn Qubic quest!

CoinTribune is launching a new Read2Earn quest in partnership with Qubic, from August 25 to September 29, 2025.

The goal: discover a groundbreaking blockchain while winning exclusive prizes.

Qubic stands out as the fastest blockchain in the world, with 15.52 million transactions per second certified by CertiK. It combines extreme scalability and artificial general intelligence (AGI), placing it far beyond traditional blockchains.

🎮 Prizes at stake:

1 PlayStation 5

5 lots of 20 million Qubic tokens (≈ €800 each)

1 five-star stay in Strasbourg (≈ €500)

extra $QUBIC tokens to top up the prize pool

💡 Total rewards: over €2,000.

👉 To participate, simply take on the quest on CoinTribune: read, share, and complete the missions.

Crypto of the Day: Sei (SEI)

🧠 Innovation and added value

Sei is a Layer 1 blockchain ultra-optimized for decentralized trading, built with the Cosmos SDK. It stands out thanks to its robust architecture featuring a native order-matching engine, ultra-high throughput (up to ~12,500 TPS), lightning-fast finality (~400 ms with the Giga upgrade), and interoperability via IBC.

This infrastructure makes Sei an ideal platform for DEXs, NFTs, and high-frequency GameFi applications, supported by major institutional partnerships and over $120 million invested in the ecosystem.

💰 The SEI token: utility and benefits for holders

The SEI token is used to cover transaction fees, secure the network through staking, and participate in governance. Its economic model is designed to effectively align network security, performance, and adoption.

📊 Real-time performance (August 26, 2025)

Current price: $0.2897 USD

24h change: –2.31 %

Market capitalization: ≈ $1.740 billion USD

Rank on CoinMarketCap: #52

Circulating supply: ≈ 6,006,666,666 SEI

24h trading volume: ≈ $206.4 million USD

XRP under pressure: the decisive 10 days that could change everything

As XRP seems stuck in a waiting zone, technical indicators point to an imminent turning point. Between resistance and support, the next sessions could shape a decisive trajectory for Ripple’s cryptocurrency.

XRP facing a critical technical setup

For several days, XRP has been moving within a symmetrical triangle pattern — a typical formation of equilibrium between buyers and sellers. Current support stands at $2.80, while resistance is capped at $3.10. This structure, marked by progressively tightening price action, suggests an upcoming breakout.

The Relative Strength Index (RSI) shows a value of 49, signaling a market in wait-and-see mode, neither overbought nor oversold. At the same time, declining volumes reflect reduced volatility, often a precursor to a sudden burst of market activity.

The 50-day and 100-day moving averages also act as key pivots. They could reinforce an upward move if resistance is broken, or serve as support in case of a pullback. This relative stability heightens the tension on XRP’s chart, making any future breakout especially significant.

Two opposing scenarios and a 10-day horizon

The bullish scenario would materialize if XRP breaks through the $3.10 resistance. Such a move could unlock potential towards $3.30–$3.50, areas that coincide with previous consolidation phases. If accompanied by a pickup in volume, this could reignite buying interest and start a new short-term uptrend.

Conversely, a drop below $2.80 would pave the way for a deeper correction, with an initial target around $2.70. The 200-day EMA, often viewed as a long-term trend gauge, is also located in this zone, reinforcing its importance as a defensive threshold.

This dual scenario fits within a narrow window: the next 10 days. Analysts highlight this timeframe, which could coincide with regulatory announcements, macroeconomic shifts, or simply a technical market trigger. Either way, this period looks like a pivotal moment when XRP will have to choose a clear direction.