Ethereum reaches one million validators : What risks ? 🧨

Welcome to the Daily Tribune Saturday, March 30, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, March 30, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

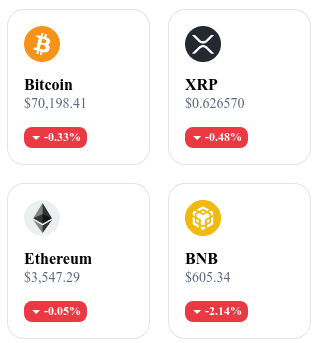

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24-hour crypto summary ! ⏱️

Bitcoin ATM: A New Momentum with BTC's Rise 🚀

The landscape of cryptocurrency ATMs (Crypto ATM) is on the verge of a true revival, driven by Bitcoin's recent positive momentum. Brandon Mintz, CEO of Bitcoin Depot, forecasts a global expansion of Crypto ATM installations, based on the rise of FOMO (Fear of Missing Out) around Bitcoin and its upcoming halving. This optimistic outlook emerges despite a significant decline in the deployment of new Crypto ATMs in the previous year, a situation that has significantly improved in the first quarter of 2024 with the installation of 1,469 new ATMs.

The upward trend in the number of Crypto ATM installations is seen as a positive indicator and should reflect a renewed interest in cash cryptocurrency transactions. This resurgence is even more significant since it comes after a period of slowdown marked by the bankruptcy of several cryptocurrency companies. With Bitcoin Depot's announcement of its intention to install 940 new ATMs in convenience stores in the United States, and the ongoing commitment of other major operators, such as Coinflip and Bitstop, the Crypto ATM sector seems to be heading towards a new phase of growth, demonstrating renewed confidence in the potential of cryptocurrencies.

Google Indexes Bitcoin: Mass Adoption in Progress 🌐

Google has begun indexing Bitcoin addresses, marking a giant step towards wider adoption of Bitcoin. This initiative aims to simplify access to information about the world's first cryptocurrency, thereby facilitating its understanding and democratization among a global audience. With its 3.5 billion daily searches, Google could play a crucial role in educating the general public about Bitcoin, potentially contributing to widespread acceptance of this digital currency. This move by Google makes Bitcoin-related data more accessible, which could be seen as a catalyst for its mass adoption.

However, this newfound accessibility also raises questions about privacy and anonymity, two fundamental principles upon which Bitcoin is based. The public exposure of Bitcoin addresses through Google's search engine could indeed compromise users' anonymity. This situation highlights the challenge of reconciling wide and simplified access to Bitcoin information with the protection of privacy and anonymity principles that are at the heart of crypto ideology.

Ethereum Surpasses One Million Validators 🧩

Ethereum, the second-generation blockchain known for its ability to execute smart contracts, has reached a major milestone by reaching one million active validators. This development reflects the growing confidence and commitment within the Ethereum community and represents a significant milestone for network security and decentralization. With 32 million ETH at stake, valued at over $114 billion, the resilience of Ethereum is clearly strengthened.

However, the exponential increase in the number of validators raises questions about Ethereum's ability to effectively manage such a large number of participants without compromising transaction speed and efficiency. Influential figures in the crypto world, including Ethereum co-founder Vitalik Buterin, have expressed concerns and suggest that the network may need to adapt to maintain a balance between decentralization and performance.

Fed Stays the Course: Bitcoin Balancing Act 📊

During his recent conference in San Francisco, Jerome Powell, the President of the United States Federal Reserve (Fed), clearly indicated that interest rates will remain unchanged until concrete signs of inflation deceleration are observed. This statement had an immediate impact on the cryptocurrency market, leading to a 1.35% drop in Bitcoin in just one hour. The Fed, by being firm on its monetary policy, aims to combat inflation, which remains a major challenge for the US economy, despite a slight decline in the PCE inflation index from 2.9% to 2.8% over one year.

The Fed's position, focused on a restrictive monetary policy for an extended period, is designed to ensure a sustainable return of inflation to its 2% target. This strategy is not without debate, with voices calling for monetary easing to support the economy. However, Powell remains firm in his belief that decisive action against inflation today is essential to guarantee stable and sustainable economic growth in the future. In this context, the cryptocurrency market, and especially Bitcoin, finds itself navigating uncertain waters, with its prospects closely linked to the future evolution of the Fed's policies regarding inflation.

Crypto of the Day: Bittensor (TAO)

Bittensor offers cutting-edge innovation in the blockchain and artificial intelligence (AI) field. By integrating decentralized consensus mechanisms with neural networks, Bittensor aims to create an infrastructure for sharing and rewarding AI contributions. Its added value lies in the ability to provide a platform where data, storage, and computation are pooled, thereby facilitating access to quality and affordable AI resources for developers and businesses.

Bittensor's native cryptocurrency, TAO, plays a central role in this ecosystem by rewarding contributors and enabling a decentralized economy around AI. TAO is primarily used as a reward and transaction mechanism within the Bittensor ecosystem, thus encouraging participation and the sharing of AI resources. Its initial distribution was carried out through a staking and reward process for early contributors, aiming to ensure fair distribution and motivate active contribution. For holders, TAO offers several advantages, including participation in network governance, access to advanced AI services, and the opportunity to stake for rewards. TAO's use extends to the purchase of compute and storage capacities within the network, making interaction with AI services more accessible and affordable.

Recent Performances

Current Price: $496.06

Percentage Increase/Decrease: +8.32% (decrease in 1 day)

Market Cap: $3,219,330,582

CoinMarketCap Ranking: #44

What is Flat Coin?

A term that is gaining popularity is flat coin a phrase you may have come across but whose meaning remains unclear to many. Today, we will demystify this concept and provide you with a clear and precise understanding of what a flat coin is.

The term flat coin refers to a cryptocurrency whose value remains relatively stable and does not undergo major fluctuations in the market. Unlike stablecoins, which are anchored to a fiat currency or other assets to maintain their stability, flat coins are not necessarily backed by a specific asset. Their stability instead comes from community trust and adoption, internal regulation mechanisms, or a limited supply, making them less volatile than traditional cryptocurrencies like Bitcoin or Ethereum.