⚠️ Ethereum remains stuck despite strong ETF support

Welcome to the Daily for Saturday, December 13, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 13, 2025, and as every day from Tuesday to Saturday, we summarize the must-know news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

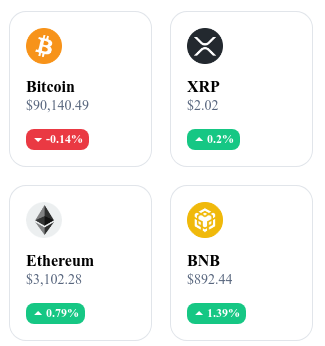

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

🇮🇹 Tether’s attempt to buy Italian club Juventus is rejected by majority shareholder Exor ⚽

The Tether group submitted an offer to acquire Juventus Football Club, including the purchase of a significant stake held by private investors. Exor, Juventus’ main shareholder, rejected the proposal during a general shareholders’ meeting vote. The decision prevents Tether from becoming a major shareholder of the club.

👉 Read the full article

🎬 Hollywood director Carl Rinsch found guilty of diverting $11 million into crypto 💰

A court ruled that Carl Rinsch diverted $11 million in Netflix funds into cryptocurrency investments and personal expenses. The verdict follows an investigation into unauthorized transfers carried out between 2023 and 2025. The trial concluded with a guilty plea, without specifying a sentence in the article.

👉 Read the full article

🏛️ DTCC receives regulatory approval for the tokenization of U.S. assets 📜

The Depository Trust & Clearing Corporation (DTCC) has obtained approval from a U.S. regulator to deploy an infrastructure for tokenizing financial assets. The authorization specifically covers the use of blockchain technologies to digitally represent certain securities. The decision marks a regulatory milestone for integrating tokenization into traditional financial markets.

👉 Read the full article

⚡ Bitcoin mining companies turn to green energy to preserve margins

Facing rising operating costs and environmental pressure, several Bitcoin mining firms are investing in renewable energy sources. Some players are signing contracts with solar and wind energy providers to reduce energy expenses.

👉 Read the full article

Crypto of the day: The Graph (GRT)

🧠 Innovation and value proposition

The Graph provides a blockchain data indexing and querying infrastructure. The protocol allows Web3 applications to quickly access reliable data through public and customizable subgraphs.

This data layer standardizes access to information for DeFi, NFTs, gaming, and infrastructure applications. The Graph reduces development costs, improves query performance, and strengthens the reliability of data used by smart contracts and user interfaces.

💰 The token

The GRT token powers the network’s economy. Indexers stake tokens to provide high-quality data. Curators signal useful subgraphs to guide network resources. Delegators help secure the network without managing infrastructure.

GRT is also used to pay for data queries, directly linking application activity to token demand.

📊 Real-time performance (CMC)

💵 Current price: €0.03570

📈 24h change: +3.35 %

💰 Market capitalization: €379.52 M

🏅 CoinMarketCap rank: #99

🪙 Circulating supply: 10.62 B GRT

📊 24h trading volume: €16.35 M

Ethereum stagnates… but are institutions preparing a bullish wave?

Despite a slight rebound, Ethereum’s price remains stuck below a major technical ceiling. This situation, which may seem harmless at first glance, actually reflects far more complex market dynamics. Between accumulation signals, technical uncertainty, and institutional involvement, Ethereum is moving in an uncertain environment. Breakdown.

A rebound that has yet to convince markets

Over the past few days, Ethereum has posted a moderate rebound around the $3,100 level. This renewed momentum, although welcome after a consolidation phase, remains confined within a critical range between $3,000 and $3,100. This zone currently acts as a buffer, preventing any significant price breakout.

From a technical perspective, a cup-and-handle pattern suggests potential upside. However, this chart formation—often interpreted as bullish—will only truly come into play if a breakout above $3,486 occurs. Without such confirmation, the market remains cautious, and the recent rebound is not enough to reverse the prevailing sentiment.

These technical levels clearly outline the thresholds to watch. Below $3,000, a return of selling pressure could challenge current stability. Conversely, a close above $3,486 could open the door to a move back toward Ethereum’s all-time highs around $4,779.

Contradictory signals between accumulation and caution

Alongside this technical tension, on-chain data paints a different picture. Several whales—large crypto holders—have taken advantage of the hesitation phase to quietly accumulate ETH, particularly in the $3,152 to $3,188 range.

On the institutional side, flows are also notable. Ethereum ETFs have recorded net inflows of $57.6 million over the recent period. Remarkably, BlackRock alone accounts for $56.5 million of this amount, signaling a clear positioning by the asset management giant on Ethereum’s blockchain.

Despite these encouraging signals, the broader market appears to be waiting for a stronger catalyst. The gap between fundamental signals and price action highlights a divergence between long-term investors and short-term traders. The former are accumulating, confident in the protocol’s future potential, while the latter prefer to wait for clearer technical confirmation before committing.

Ethereum currently stands at a crossroads. While fundamental indicators point to growing confidence from major players, the awaited technical validation has yet to materialize. A breakout above the $3,486 resistance could trigger a new impulse, but as long as this barrier holds, caution remains the dominant stance.