Ethereum Sees Red, Solana Breaks Records 📊

Welcome to the Daily Tribune of Tuesday, September 24, 2024 ☕️

Hello Cointribe! 🚀

Today is Tuesday, September 24, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

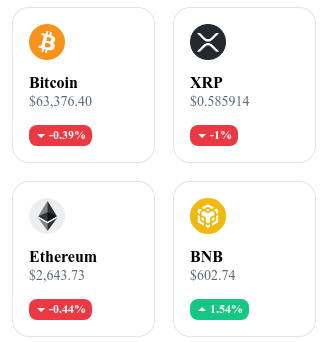

A quick look at the market…

🌡️ Temperature:

Partially sunny 🌤️

24h crypto recap! ⏱

Ethereum: Fees on the Rise, Number of Users in Free Fall 📉

Ethereum is going through a paradoxical phase in September 2024. Transaction fees have tripled in a matter of weeks, rising from $0.85 at the beginning of the month to $3.52 on September 21. This surge is primarily due to overconsumption of gas by popular smart contracts like Uniswap and trading bots on Telegram, such as Maestro and Banana Gun. At the same time, the Ethereum "burn" has exploded, reaching 1,360 ETH. However, this spike in fees comes as the number of active users on the network significantly decreases. Active accounts have dropped by 11% to their lowest level since December 2023, with around 385,000 users.

Critical Update from Binance and Return of CZ: An Imminent Turning Point for the Exchange 🔧

Binance has announced a major update scheduled for September 25, 2024, at 06:30 UTC. This operation will lead to temporary interruptions affecting key services such as spot trading, futures, and P2P. The goal is to improve system performance and stability, without impacting API transactions or asset security. This update comes at a critical time, shortly before the release of Changpeng Zhao (CZ), co-founder of Binance, who has been incarcerated for money laundering since April. CZ will be released on September 29. However, ongoing legal issues could still affect Binance in the coming months.

Kamala Harris: A Promising Framework for AI and Cryptos 🛡️

During a fundraising event on Wall Street, Kamala Harris expressed her support for digital technologies, especially cryptos and artificial intelligence, while committing to protect investors and consumers. She promised a clear and transparent regulatory framework aimed at supporting innovation while ensuring user safety. Harris also plans to present new economic proposals to encourage wealth creation in the United States, with a focus on tech companies. This position, aimed at attracting young voters and investors, comes at a key moment for the crypto industry. However, overly strict regulations could stifle innovation and drive talent to migrate to more flexible jurisdictions.

Solana: $67.8 Billion in Transactions, Explosive Expansion 🚀

The Solana network continues to demonstrate its dominance in the crypto ecosystem, with an impressive transaction volume of $67.8 billion, confirming its role as a leader among blockchains. The SOL crypto has recorded a 12% increase in one week, with a price reaching $146, as the network attracts giants from traditional finance. Tokens like Dogwifhat (WIF) and Bonk (BONK) add to the excitement, with transaction volumes of $1.7 billion and $1.2 billion respectively. Additionally, projects like Bonfida, Jupiter, and Stepn also contribute to Solana's rise, reinforcing its status as an essential platform. This success attracts not only developers but also institutional investors like Société Générale and Citibank, solidifying Solana's position in the market.

Blockchain Life 2024: An Event Not to Be Missed in Dubai 🚀

The 13th edition of Blockchain Life 2024 will be held in Dubai on October 22 and 23, 2024, gathering over 10,000 participants from 120 countries. This event is an essential platform for industry professionals, offering the opportunity to gain in just two days knowledge and connections that would normally take six months. The forum will explore major trends in cryptocurrencies and Web3, featuring leading speakers from companies like Tether, Tron, and Trust Wallet. Networking will allow participants to meet founders and industry leaders. Furthermore, an afterparty will close the event, and participants will benefit from a hundred parallel events as part of Blockchain Life Week. Ticket prices are rising quickly, so book now to take advantage of a 10% discount with the promo code Cointribune10.

Today's Crypto: NEAR Protocol (NEAR):

NEAR Protocol is a blockchain designed to be ultra-fast, secure, and able to handle a high volume of transactions thanks to its innovative sharding technology, called "Nightshade". This technology divides the network into smaller segments and allows for impressive scalability without sacrificing decentralization. In addition to these technical performances, NEAR is a blockchain designed for developers, with simplified tools to create dApps (decentralized applications), offering significant added value to accelerate the adoption of cryptos.

The native crypto of the blockchain is NEAR, primarily used to pay transaction fees and participate in staking to secure the network. It was distributed via a presale model and a public distribution. NEAR holders can participate in the governance of the network, vote on proposals, and earn rewards by staking their tokens, which strengthens the incentive to hold this cryptocurrency.

Current Price: €4.74

Variation (24h): Increase of 7.76%

Market Capitalization: €5.930 Billion

Rank on CoinMarketCap: 17

Bitcoin on the Dawn of a New Bull Run: The 4 Pillars That Will Change Everything 🚀

The next Bitcoin bull run could be propelled by four major factors.

First, BlackRock, the largest investment fund in the world, remains optimistic about the future of Bitcoin. Considered a safe haven against geopolitical crises, Bitcoin is seen as an alternative to the traditional monetary system. With an annualized return of over 100% in recent years, BlackRock emphasizes the growing appeal of Bitcoin as a store of value, especially during times of economic uncertainties.

Secondly, banks are beginning to adopt Bitcoin, as evidenced by a recent exemption granted to BNY Mellon, allowing the custody of Bitcoin assets. Michael Saylor, CEO of MicroStrategy, anticipates that multinationals like Apple or Google will turn to this cryptocurrency once major banks can manage its custody.

Thirdly, the 2024 U.S. presidential election could play a crucial role. A victory for Donald Trump would be particularly favorable for Bitcoin, given his statements about establishing a strategic reserve of Bitcoin by the U.S. government.

Finally, the expansionary monetary policy of the Federal Reserve, with an expected decrease in interest rates, should increase the money supply, thus boosting demand for decentralized assets like Bitcoin.

These four combined factors create a potentially explosive scenario for a new surge in Bitcoin prices in the coming months.

🔗 Read the full analysis here.