Hello Cointribe! 🚀

Today is Tuesday, 25 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

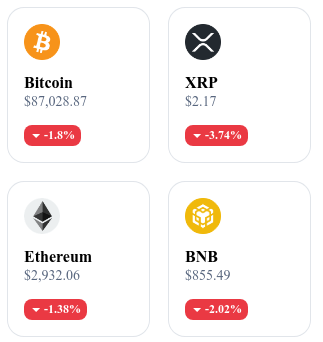

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🏛️France: Éric Larchevêque unveils “The Bitcoin Society”

Éric Larchevêque is transforming the micro-cap Tayninh (listed on Euronext) into The Bitcoin Society, a structure focused on Bitcoin and financial education. The project plans to build a BTC treasury, create clubs and launch fundraising initiatives to support this ambition.

👉 Read the full article

⏸️ Strategy suspends its Bitcoin purchases and worries the markets

Strategy, one of the major institutional Bitcoin accumulators, has not published any announcement regarding its weekly acquisitions for the first time in several weeks. This unexplained interruption comes as BTC attempts a recovery after having fallen below 81,000 dollars.

🧬 Cardano undergoes its first major split in 8 years after a developer error

The Cardano network experienced a double chain on 21 November 2025 following a malformed transaction exploiting a hidden bug in its software. The incident, although quickly resolved, highlights a rare vulnerability for a protocol of this calibre.

⚡ China: ultra-cheap electricity revives the Bitcoin mining industry

Despite the formal ban in 2021, China has re-emerged in the global top 3 for Bitcoin mining thanks to regions with very low electricity costs. According to sources, the country accounted for around 14% of the global hashrate at the end of October 2025.

👉 Read the full article

Crypto of the day: Nervos Network (CKB)

🧠 Innovation and added value

Nervos Network is a Layer-1 blockchain designed to solve the compatibility and scalability limitations faced by Ethereum and traditional smart contracts.

Its approach is based on a layered architecture:

a Layer 1 (CKB) dedicated to security, asset storage and the fundamental rules of the protocol;

a Layer 2 open to scalability and execution solutions, compatible with existing environments (EVM, rollups, sidechains).

The network uses a unique mechanism called the Cell Model, inspired by Bitcoin but optimised for smart contracts. This model enables flexible and highly programmable asset management while maintaining the security of proof-of-work (PoW).

Nervos aims to become a universal platform where developers can deploy interoperable applications across Web3 thanks to native cross-chain compatibility.

💰 The token

CKB (Common Knowledge Base) is the native token of Nervos Network. It is used to:

store states on Layer 1, a scarce resource that reflects the network’s capacity to maintain on-chain data;

pay transaction and execution fees;

incentivise miners to secure the network, since it relies on an optimised PoW protocol (Eaglesong);

participate in the multi-layer economy, where CKB remains the fundamental asset guaranteeing the security of applications deployed on upper layers.

The economic model of CKB relies on the direct relationship between on-chain storage usage and token demand: the more applications consume space, the stronger the pressure on supply.

📊 Real-time performance (CMC)

💵 Current price: $0.002564

📉 24h change: –0.56%

💰 Market cap: $122.35M

🏅 CoinMarketCap rank: #241

🪙 Circulating supply: 47.7B CKB

📊 Trading volume (24h): $4.97M

Ethereum stuck below $3,000!

Despite a stabilised market structure, Ethereum is struggling to reclaim the $3,000 level. While on-chain indicators show strengthened positioning among long-term investors, the overall momentum remains constrained by the absence of new inflows. This configuration highlights a clear fracture between internal confidence and external attractiveness, compromising the long-awaited bullish recovery. The $3,000 threshold, now loaded with symbolic tension, acts as a revealing marker of the market’s current fragilities.

Long-term investors hold firm but struggle to trigger a recovery

The on-chain HODLer Net Position Change indicator is back in the green, reflecting increased accumulation by long-term wallets. This signal of confidence, often a precursor of bullish phases, is still not enough to restart the market engine. Indeed, the absence of new entrants is limiting growth. The number of new Ethereum addresses is stagnating, illustrating persistent hesitation among recent buyers. Loyal holders provide relative stability, but they alone do not have the strength required to break the current resistances.

The technical structure remains healthy but rests on a limited foundation. As long as inflows fail to intensify, the potential to break through $3,000 remains theoretical.

A symbolic milestone out of reach without renewed confidence

At the moment, Ethereum is oscillating around $2,900. The lack of fuel — in other words, fresh capital — prevents the market from regaining genuine bullish momentum. This inertia extends the consolidation phase, marked by false signals and timid rebounds.

A return in demand could reverse the trend, turning $3,000 into support and then opening the way to $3,131. But as things stand, bearish pressure persists. The recent slip below this symbolic level heightens tension in an already weakened crypto market.

Ethereum’s trajectory highlights a fundamental reality of crypto markets: without a constant renewal of demand, even the strongest assets eventually lose steam. The absence of new capital inflows, coupled with stagnating adoption indicators, limits the impact of favourable technical signals. While the $3,000 level remains achievable, its recovery will depend less on the loyalty of long-term holders and more on the market’s ability to spark a new accumulation cycle. For now, Ethereum finds itself in a pivotal zone where every bullish attempt will undergo a test of confidence.