💥Ethereum triggers a tsunami on the crypto market

Welcome to the Daily Tribune for Thursday, July 17, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, July 17, 2025 and like every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you couldn’t miss!

But first…

✍️ Cartoon of the day:

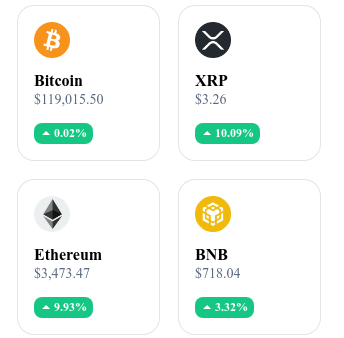

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🤝 Binance remains firm on Pi Network

Binance still refuses to list the Pi token from Pi Network despite its huge community support, notably due to the non-open source code, lack of security audit, and missing formal request. The exchange prioritizes strict compliance with standards before listing any new tokens.

🏦 Cantor Fitzgerald prepares to bet 4 billion on Bitcoin

Cantor Fitzgerald plans to buy 30,000 BTC from Blockstream via a SPAC, for an estimated value of 4 billion USD, including an additional 800 million dollars of external funds.

🧑⚖️ Trump appeases Republicans on crypto laws

Donald Trump managed to convince 11 of the 12 Republican members opposed to crypto bill projects, preserving support for Crypto Week through the Oval Office. The disagreement concerned the absence of an explicit ban on CBDCs in the GENIUS law.

🌐 Solana surpasses Ethereum in tokenized assets

Since January 2025, Solana has tripled its value in tokenized assets, reaching 553.8 million USD, representing a 218% growth compared to 81% for Ethereum (7.7 billion USD). This success marks a shift of institutional investors towards Solana in this strategic sector.

Crypto of the day: THORChain (RUNE)

🧠 Technology and innovation

THORChain is a decentralized cross-chain blockchain that enables native asset exchanges across different blockchains without using wrapped tokens or centralized gateways. Its protocol relies on the Tendermint Consensus (from Cosmos) and uses a native AMM (Automated Market Maker) mechanism.

Thanks to its network of anonymous nodes, RUNE ensures liquidity and system security by serving as an inter-chain reserve currency, thus facilitating swaps between Bitcoin, Ethereum, BNB Chain, and others.

💰 Main utility and token advantages

The native token RUNE is at the heart of the THORChain ecosystem:

It is used as the unique pair in each liquidity pool to enable cross-chain swaps.

It is used to secure the network via a bonding mechanism for validators.

It allows users to earn rewards through staking and liquidity provision.

It grants access to governance, although this remains limited compared to classic DAOs.

RUNE is essential for the protocol’s operation, ensuring fluidity, interoperability, and security.

📊 Market data (July 17, 2025)

Current price: $1.64 USD

24h change: +4.69 %

Market capitalization: ≈ 581.1 million USD

CoinMarketCap rank: #114

Circulating supply: 351.4 million RUNE

24h trading volume: ≈ 127.9 million USD

The awakening of Ethereum: technical breakthrough, DeFi rush and institutional FOMO

After stagnating for several weeks, Ether has just marked a spectacular trend reversal. By breaking a major technical resistance, it not only triggered a wave of massive liquidations in the derivatives markets but also revived institutional and speculative interest around its ecosystem.

Technical breakout and massive liquidation: signs of a lasting reversal

Ethereum has just broken an eight-week consolidation phase with a bullish impulse of rare intensity. The breakout was accompanied by significant volume, consolidating above its weekly resistance range — a technical signal perceived as the result of institutional interventions.

The market quickly reacted: more than 152 million dollars of short positions on ETH were liquidated within 24 hours, representing nearly 50% of all liquidations recorded in the crypto market. And this while Ether recorded an increase of nearly 9%, reaching about 3,330 dollars.

The structure of the derivatives markets indicates a "healthy" rise: open interest increased by 8.7%, while futures volume jumped by 27%, according to Glassnode data. The funding rate remains moderate at 0.0047%, suggesting absence of excessive leverage and measured optimism from traders.

DeFi, derivatives and sector rotation: underlying dynamics supporting the surge

Several contextual elements reinforce the credibility of this movement. First, a sector rotation of capital appears to be occurring. Solana, which had previously benefited from an influx of speculative investors, sees part of these funds migrate to Ethereum. This shift is visible through the rise of Ethereum-based memecoins, which are gaining popularity again.

The RSI indicator exceeds 80, and the moving average crossover — a golden cross between the 50-day and 200-day — confirms a decisively bullish technical setup. The ADX is near 29, illustrating the strength of the trend.

This renewed strength of Ethereum results from an alignment of technical, structural, and behavioral factors, signaling a strategic repositioning of investors. It remains to be seen whether the momentum will be sustained by ongoing inflows or if it will mark the peak of a cyclical rebound.