💸 Exchanges are empty of their Bitcoin: What do these massive withdrawals hide?

Welcome to the Daily Tribune Friday, August 2, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, August 2, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

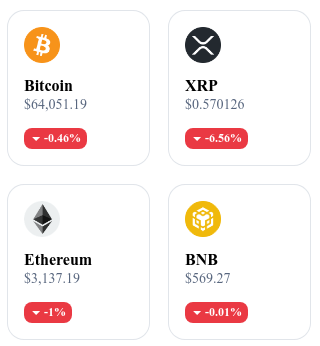

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🚀 Bitcoin ready to take off: Indicators predict an imminent rise

Technical indicators are signaling a possible price explosion for Bitcoin, with Bollinger Bands reaching their tightest point in twelve months. This compression, the tightest since April 2016 and August 2023, suggests high volatility to come. Similar previous occurrences have been followed by a 20% increase in a few months. Currently, Bitcoin is stabilizing in a range of 25%, oscillating between $55,849 and $73,679. Analysts, such as Matthew Hyland, anticipate a significant movement, potentially up to a new high of $76,614 by November, based on historical patterns of consolidation and expansion. 🔗Read the full article here.

💸 Bitcoin exchanges are emptying: A new era of conservation?

Bitcoin reserves on exchanges have reached historically low levels, with only 2.8 million BTC available, despite a rise in prices to around $66,700. This trend, which has been evident since 2022, has intensified recently, revealing investors' preference for long-term holding rather than selling. Massive withdrawals to cold wallets suggest anticipation of future appreciation of Bitcoin, influenced by events such as BTC releases by Mt. Gox or government sales. This decrease in reserves on trading platforms could indicate growing investor confidence in Bitcoin's long-term value potential, signaling a possible market "bottom" and increased maturity in conservation behaviors. 🔗Read the full article here.

📈 Memecoins boost DEX to $179.5 billion

Decentralized exchanges (DEX) are experiencing significant growth, reaching a transaction volume of $179.5 billion in July 2024, up 34% from January. This increase is partly due to the enthusiasm for memecoins and other emerging crypto assets, often listed first on DEX before centralized platforms. Technological improvements, such as Solana blockchains and Ethereum layer 2 solutions, are also contributing to this expansion by offering reduced fees and improved processing capacity. Although centralized exchanges still dominate the overall market, DEX market share has increased from 4.6% to over 7%, highlighting the growing popularity of decentralized platforms. 🔗Read the full article here.

💰 Tether smashes records with $5.2 billion in profit!

Tether has recorded a record net profit of $5.2 billion in the first half of 2024, revealing impressive financial performance. The company now holds $97.6 billion in US Treasury bonds, ranking 18th globally among holders of this debt. This quarter has also seen the issuance of over $8.3 billion in USDT, despite an unrealized loss of $653 million due to the decline in Bitcoin prices. In contrast, unrealized gains on gold, totaling $165 million, have partially offset this loss. With consolidated assets exceeding liabilities and a group equity increase of $11.9 billion, Tether continues to consolidate its dominant position in the stablecoin market and demonstrates remarkable financial strength. 🔗Read the full article here.

Crypto of the day: Aave (AAVE)

Aave, a pioneering DeFi platform on the Ethereum blockchain, stands out for its decentralized lending and borrowing system. It introduces innovations such as "flash loans," allowing for instant loans without collateral, and variable or stable interest rates to meet the different needs of users.

The native crypto of the network, AAVE, plays a crucial role as a governance token, allowing holders to vote on protocol modification proposals. In addition, AAVE can be used as collateral to borrow other assets or to reduce transaction fees on the platform. Initially distributed through a token swap, AAVE offers significant benefits to its holders, such as additional incentives for those who participate in securing the protocol by staking it.

Recent performances

Current price: €107.29

Percentage increase/decrease: +9.95% (decrease in 1 day)

Market capitalization: €1,599,018,916

Rank on CoinMarketCap: 49

Bitcoin tumbles below $63,000 despite speculation of Fed interest rate cuts!

Bitcoin has recently fallen below the $63,000 mark, reaching its lowest level since July 19, before bouncing back to $64,000 this morning. This decline comes despite speculation of possible interest rate cuts by the Federal Reserve (Fed). During its latest session, the Fed kept rates unchanged, but its chairman, Jerome Powell, mentioned the possibility of future cuts to achieve inflation targets. However, this announcement did not positively influence the crypto market, in contrast to traditional markets that reacted more favorably.

This indifference of Bitcoin to the Fed's announcements could indicate increased maturity or a disconnection from traditional economic policies. In the long term, discussions about the creation of a Bitcoin sovereign reserve by candidates for the U.S. presidency could redefine the cryptocurrency landscape. 🔗Read the full article here.