🚔 Fraud of 1.8 million euros: a crypto influencer arrested in France!

Welcome to the Daily Tribune of Wednesday, February 12, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Wednesday, February 12, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

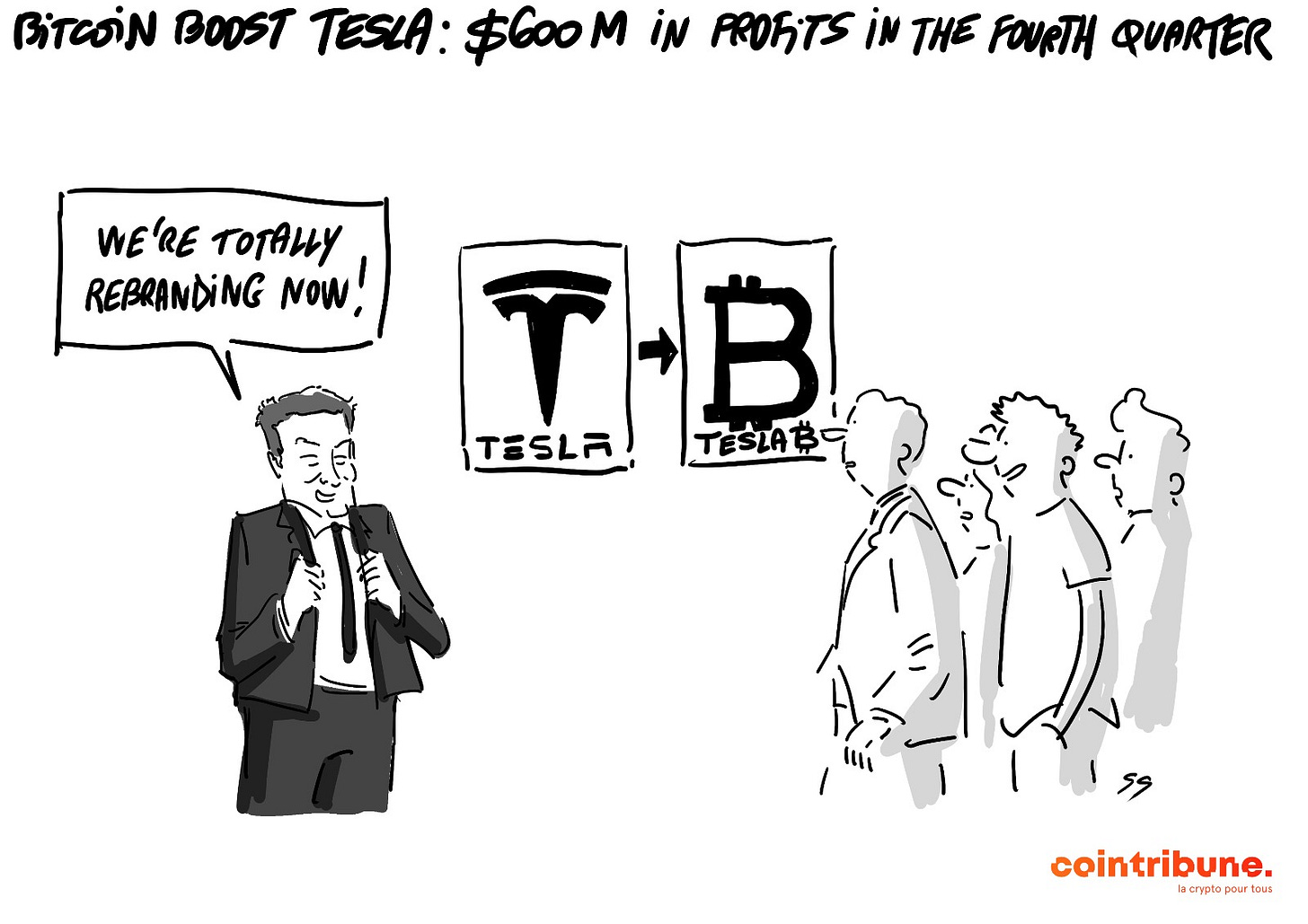

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partly cloudy ⛅

24h crypto recap! ⏱

🚗 Bitcoin drives Tesla: 600 million $ in gains!

Thanks to its investments in Bitcoin, Tesla records 600 million dollars in gains in the fourth quarter of 2024, confirming the relevance of its accumulation strategy. Although the company sold 70% of its initial portfolio, it still holds 11,509 BTC, currently valued at 1.1 billion dollars. The new accounting regulation from the FASB, which now allows the valuation of cryptos at market price, reinforces this approach. Tesla could use its BTC as collateral to borrow, a strategy that could inspire other companies. 🔗 Read the full article

🗑️ He wants to buy a landfill to recover his 8,000 BTC!

After 10 years of struggle, James Howells, a British computer scientist, is making one last approach to recover his hard drive containing 8,000 BTC (750 million $), accidentally thrown away in 2013. The municipality of Newport still refuses to give him access to the site, despite his offers to invest in drones and AI to sift through the waste. Faced with the imminent closure of the landfill, he is now considering buying the land entirely to conduct his research. 🔗 Read the full article

📈 Coinbase skyrockets by 40% with Trump, but a danger looms!

Since the election of Donald Trump, trading volumes on Coinbase have reached a two-year high, resulting in a 40% increase in its stock price. This enthusiasm is mainly due to the massive arrival of institutional investors, attracted by more favorable crypto regulation in the United States. However, retail traders, who represented 40% of volumes in 2021, now account for only 18% in 2024, threatening the platform's profitability. Coinbase will need to diversify its revenue sources to avoid becoming dependent on the activity of large investors alone. 🔗 Read the full article

🚔 Crypto scam: a French influencer arrested for 1.8 M€ of fraud!

The influencer Swagg Man, known for his extravagant lifestyle, has been arrested for a crypto scam of 1.8 million euros. He promised his followers ultra-profitable investments in crypto and real estate, but the funds disappeared via an opaque offshore scheme. Already sentenced to 20 years in prison in Tunisia, he is also being prosecuted in France and Canada. This case reignites the debate on the regulation of crypto influencers, often involved in large-scale frauds exploiting the allure of cryptos for promises of illusory gains. 🔗 Read the full article

Today's crypto: Ethena (ENA)

Ethena is a synthetic dollar protocol built on Ethereum, offering a crypto-native solution for currency without relying on the traditional infrastructure of the banking system. It provides a savings asset denominated in dollars, globally accessible, called "Internet Bond". The protocol aims to provide a decentralized and scalable alternative to traditional currencies, relying on delta hedging strategies to ensure the stability of its synthetic asset, USDe.

Ethena's native token, known by the symbol ENA, serves as a governance token within the Ethena ecosystem. ENA holders can participate in the governance decisions of the protocol, thereby influencing its development and updates. Additionally, ENA plays a crucial role in the operational aspects of the protocol, although the specific details of its utility are not clearly defined in available sources. The benefits for holders include participation in the governance of the protocol and potential access to exclusive features within the Ethena ecosystem.

Recent performances:

Current price: 0.4303 $ (approximately 0.40 €)

24-hour change: -13.8 %

Market capitalization: 1.35 billion dollars

Rank on CoinMarketCap: 64

Solana below 200 $: an alarm signal or simple market correction?

Solana is going through a turbulent phase, with its price dropping below 200 dollars, marking a significant decline of 28% in on-chain volumes in a week. This decline is mainly explained by the cooling down of speculation around memecoins, which had previously driven network activity. Several flagship tokens, such as Dogwifhat (-60%) or Goatseus Maximus (-67%), saw their value plummet, leading to a notable decrease in liquidity on Solana's DeFi platforms. Thus, Orca and Phoenix have lost 47% of their activity, while Raydium has dropped by 27%. However, this correction is not only affecting Solana: Ethereum and BNB Chain are also experiencing a slowdown, indicating a general market exhaustion.

Despite this correction, some signals suggest a potential recovery. From a technical standpoint, Solana is currently hovering around 195 dollars, with a support level identified between 190 and 195 dollars. To confirm a bullish reversal, SOL must break the resistance of 210-220 dollars, a key threshold. The state of the perpetual futures market, which shows a negative funding rate for Solana since February 2, indicates that sellers still hold the advantage, but a trend reversal remains feasible if a catalyst occurs.

One element that could rekindle Solana's bullish momentum relies on speculation surrounding a potential Solana spot ETF. Institutional interest in cryptos continues to grow, and a dedicated ETF could attract massive capital towards SOL, similar to the impact of Bitcoin ETFs on the market. Moreover, some analysts, including VanEck, remain optimistic and foresee a target of 520 dollars for Solana in 2025. It remains to be seen whether this anticipation will be enough to reverse the current trend or if the correction will continue before a genuine restart.