GameFi in tatters, Ripple negotiating with the SEC

Welcome to the DailyTribune of Friday, December 1, 2023 ☕️

Hello Cointribe! 🚀

Today is Friday, December 1, 2023, , and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

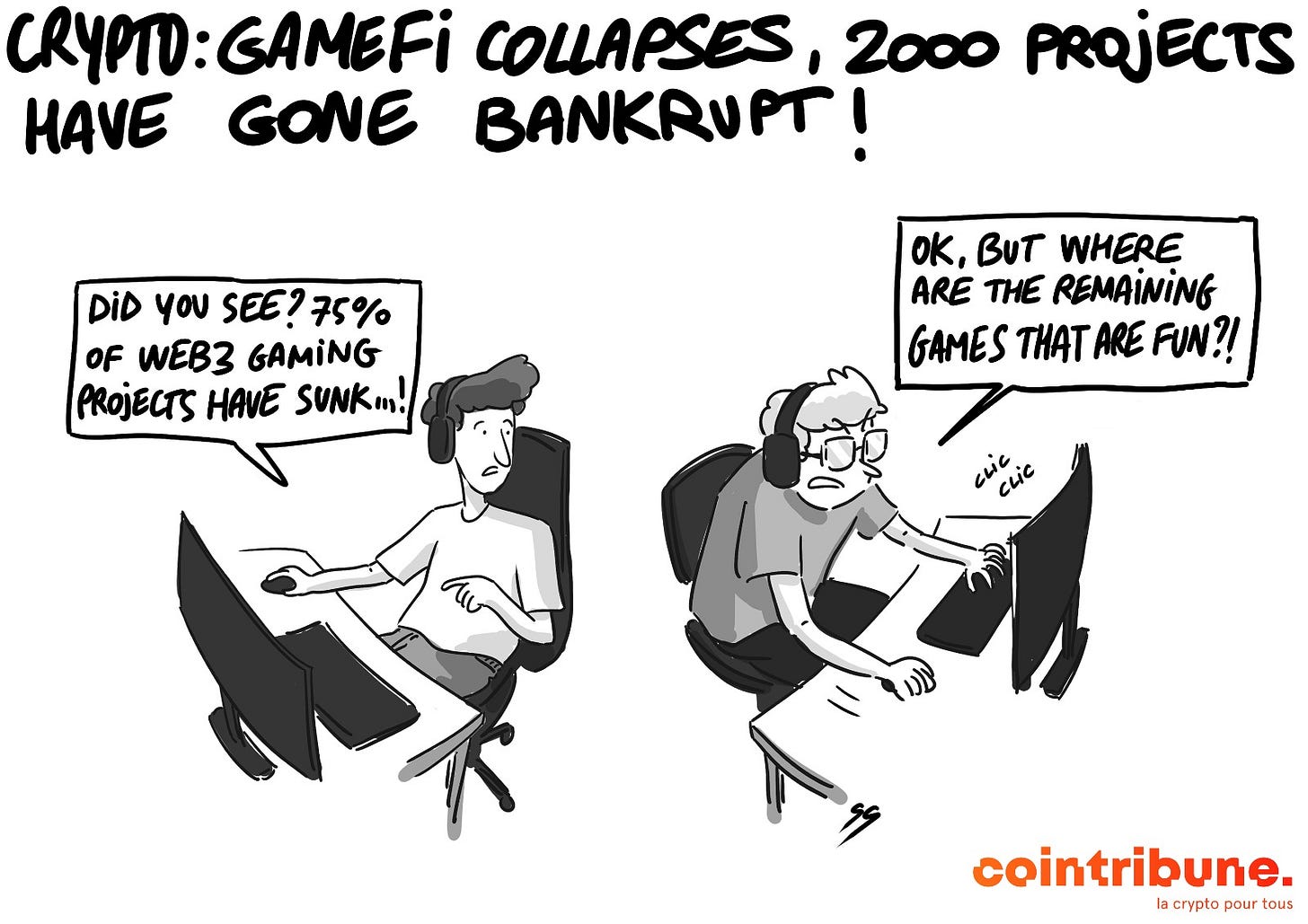

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24-hour crypto summary ! ⏱️

🌐 Bitcoin: The revolution of small wallets

A study by Grayscale Research reveals a surprising reality: 74% of Bitcoin addresses hold less than 0.01 BTC, or about $376. This distribution contrasts with other high-yield assets, typically reserved for accredited investors. It also testifies to a decentralized and open ownership structure for Bitcoin, with only 2.3% of addresses belonging to large holders, defined as owning more than 1 BTC.

Grayscale also highlights that nearly 40% of the total BTC supply could be linked to identifiable ownership groups, including exchanges, government entities, and public and private companies such as Tesla. A key concept highlighted is that of sticky supply, where 14% of the BTC supply has not been moved for over 10 years, potentially including original coins from the creator of Bitcoin, lost coins, or coins held by long-term investors. This high percentage of "immobile" Bitcoin could have a significant impact on price fluctuations related to demand.

The massive concentration of Bitcoin among small investors reveals a transition towards democratization of crypto ownership, but also raises questions about market volatility and liquidity. With a majority of holders owning small amounts, the market could be less prone to manipulation by large players. However, this could also mean reduced liquidity, as small wallets are less likely to actively participate in trading, thus influencing the dynamics of the Bitcoin market.

🎮 GameFi: The collapse of a crypto dream

The GameFi sector, once flourishing, is facing a major crisis. A recent study reveals that between 2018 and 2023, 75.5% of GameFi initiatives have failed. Out of 2,817 games launched, 2,127 did not survive more than a year. This dramatic drop is attributed to the rush towards the play-to-earn model, inspired by successes like CryptoKitties. This rush has led to market oversaturation!

Thus, 2022 became the black year of GameFi, with 3 out of 4 projects failing. Despite a certain stabilization of the mortality rate around 70% since the beginning of 2023, the future remains uncertain for surviving projects, faced with an ultra-competitive environment.

The collapse of GameFi projects can be seen as a symptom of a broader trend in the crypto ecosystem: the pursuit of innovation without a deep understanding of market needs. This reflects a disconnect between technology and practical value, where many projects are launched based on technological concepts rather than real solutions to user problems. This could signal a need for the industry to refocus on creating real value for end users, beyond speculation and innovation for innovation's sake.

⚖️ Ripple vs SEC: Towards a historic settlement?

The long legal battle between Ripple and the SEC, focused on the status of the XRP token, could soon find a resolution. After three years of conflict and several partial victories, a court has ordered both parties to consider a settlement. Several meetings have been scheduled for this purpose, including a closed-door meeting to discuss the terms of the settlement. This meeting falls under the Sunshine Act meetings and will address topics such as institution and settlement of administrative proceedings, injunctive actions, and resolution of litigation demands.

The SEC initially requested Ripple to pay a fine of $770 million, a sum that Ripple has opposed. Legal experts, such as pro XRP attorney John Deaton, believe that Ripple could negotiate this amount downwards. Deaton suggests that a settlement below $20 million would be a total victory for Ripple, while attorney Jeremy Hogan predicts a settlement below $100 million. Analysts agree that Ripple and the SEC could reach a resolution by July 2024.

The ongoing negotiations between Ripple and the SEC are crucial for the future of cryptocurrency regulation. A settlement could signify an implicit recognition of cryptocurrencies as a legitimate asset class, requiring appropriate regulatory frameworks. It could also influence how other cryptocurrencies are treated by regulators, setting a precedent for how token offerings are classified and regulated.

🔥 Elon Musk challenges advertisers: "Go **** yourselves!"

Elon Musk, known for his outspokenness, recently reacted vehemently to the boycott of X platform by advertisers. At a conference organized by the New York Times on November 29, Musk expressed his dissatisfaction with what he considers to be blackmail by advertisers. They suspended their advertising campaigns on X in response to Musk's tweets deemed anti-Semitic and racist. Musk described these tweets as "stupid" but made it clear that he would not be influenced by threats related to advertising or money.

X platform, which cost Musk $44 billion, has seen its value halved and is at risk of bankruptcy due to the loss of advertising revenue, estimated at $75 million. Musk threatened to reveal to the world the names of the advertisers responsible for the "death" of the company, stating that he would prove it "in every detail".

Elon Musk's reaction to the advertising boycott of X highlights the challenges faced by social media platforms in balancing freedom of speech and social responsibility. This situation could prompt other platforms to reconsider their advertising and content policies, potentially influencing how businesses interact with social media.

Crypto of the day: Ankr (ANKR)

Ankr stands out as an innovative platform in the blockchain space, offering accessible and cost-effective blockchain node hosting solutions. Founded in 2017, Ankr has created a marketplace for container-based cloud services using shared resources. This approach allows developers and businesses to easily deploy blockchain nodes at a lower cost than public cloud providers.

Ankr's native cryptocurrency, ANKR, plays a crucial role in this ecosystem, serving as a means of payment for services on the platform. ANKR holders benefit from reduced rates for node hosting and other services, thus reinforcing the commitment to decentralization and network security. The use of ANKR on the platform highlights its practical utility, offering tangible benefits to users and contributing to the stability and growth of the Ankr ecosystem.

Recent Performance

Current price: €0.02342

Percentage change: - 0.27% (increase over 1 day)

Market capitalization: €234,228,104

CoinMarketCap rank: #149

Please note that this information is provided for informational purposes only and does not constitute investment advice. Always do your own research before making any financial decisions.

Crypto term of the day: Liquidity Pools

Liquidity pools are a crucial innovation in the decentralized finance (DeFi) ecosystem, acting as engines for decentralized exchanges (DEX). To understand how they work, imagine a liquidity pool as a shared financial reservoir, where participants deposit pairs of cryptocurrencies, for example, Bitcoin and Ethereum.

Let's take a concrete example: in a Bitcoin-Ethereum pool, you, as a liquidity provider, deposit an equal amount of Bitcoin and Ethereum. Your deposit facilitates exchanges between these two cryptocurrencies for other users on the platform. In exchange for your contribution to this pool, you receive transaction fees proportional to your share in the pool. These fees are generated from exchanges made by other users using your deposited funds.

This system not only ensures constant liquidity on DEX, but also offers liquidity providers an opportunity to generate passive income. Liquidity pools use specific algorithms, often based on the Automated Market Maker (AMM) model, to automatically adjust prices based on supply and demand in the pool.

In summary, liquidity pools like those of Uniswap and Curve are vital elements of DeFi, enabling smooth and efficient decentralized exchanges while offering income opportunities to participants who support the ecosystem.