🌟 Gary Gensler predicts the launch of Ethereum ETFs very soon

Welcome to the Daily Tribune on Saturday, June 15, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, June 15, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

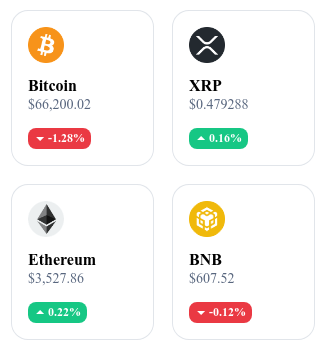

A quick look at the market…

🌡️ Temperature:

Partly cloudy ⛅

24h crypto recap! ⏱

🌟 Glimmer of hope for Ethereum ETFs before the end of summer

SEC Chairman Gary Gensler recently stated before a U.S. Senate subcommittee that Ethereum ETFs could receive definitive regulatory approval by the end of summer. This announcement has reignited investor enthusiasm as an Ethereum ETF would make access to the second-largest cryptocurrency by market capitalization easier. Several major financial players, such as VanEck and BlackRock, have already obtained initial approval from the SEC. Definitive approval could mark a significant turning point for the digital assets market, particularly due to recent signs of slowing U.S. inflation. Read the full article

📉 Bitcoin tumbles: Altcoins in turmoil

Bitcoin experienced a significant drop, leading to a decline in altcoins as well. In just one day, U.S. Bitcoin-focused ETFs recorded net outflows of $226.21 million, with funds like Fidelity's FBTC losing $106 million. This wave of massive withdrawals reflects a change in sentiment among institutional investors, also impacting funds like Grayscale's GBTC and Ark Invest's ARKB. Bitcoin's price dropped by 1.48% in 24 hours, negatively influencing the altcoin market, although Telegram's Ton resisted and reached a record of $7.87. However, investors remain optimistic about the prospects of spot Ether ETFs, which could redirect flows from Bitcoin ETFs. Read the full article

🌐 The rise of Ethereum staking attracts investors

Since Ethereum's transition to a proof-of-stake (PoS) system, staking has become a common practice, despite the minimum requirement of 32 ETH, approximately $112,000. Bundled solutions like those offered by MetaMask, which recently staked 101,000 ETH, now allow more investors to access staking. Lido dominates the market with over 27% of staked ETH, representing 9.5 million ETH. Despite this dominance, competition is intensifying with the arrival of new players. However, a worrying decrease in the number of new stakers has been observed recently, possibly due to uncertainties surrounding Ethereum 2.0. Nevertheless, the diversification of staking options offers greater flexibility to investors. Read the full article

🏦 94% of central banks ready to issue CBDCs

A recent survey by the Bank for International Settlements (BIS) reveals that 94% of surveyed central banks are considering issuing central bank digital currencies (CBDCs), compared to 90% in 2021. This development could radically transform the management of monetary policy globally. While wholesale CBDCs, intended for financial actors, take priority, more than half of the banks are also working on retail CBDCs for the general public. Countries like China, Nigeria, and the Bahamas are already pioneers in this field. The adoption of CBDCs could offer unprecedented tools to central banks for managing the economy with increased precision. Read the full article

Crypto of the Day: Lido DAO (LDO)

Lido DAO stands out in the blockchain ecosystem for its innovation in liquid staking on Ethereum. This solution allows users to stake their ETH without locking up their funds, solving a major problem of traditional proof-of-stake systems.

The native token, LDO, plays a crucial role in governance, allowing holders to vote on DAO proposals. Initially distributed through private sales and distributions to developers and the community, LDO offers benefits such as staking rewards and voting rights. Usable on different DeFi platforms, Lido DAO optimizes the engagement and flexibility of crypto investors.

Recent Performances

Current price: $2.05

Percentage Increase/Decrease: 5.08%

Market capitalization: $1,829,228,699

Rank on CoinMarketCap: 52

📉 Bleak predictions for Bitcoin: A drop to $48,000 in sight?

According to Jurrien Timmer of Fidelity Investments, the stagnant growth of the Bitcoin network could lead to a significant drop in its value. Timmer, who describes Bitcoin as "exponential gold," notes that Bitcoin's price increase typically follows the power curve of its network's growth. However, he has recently observed a worrying slowdown in this growth, which could hamper Bitcoin's ability to reach new highs. For Bitcoin to reconnect with a strong upward momentum, a significant acceleration in the growth of its network is essential.

In parallel, experienced analyst Peter Brandt presents an even more pessimistic perspective. Brandt believes that the current Bitcoin uptrend may already be over, relying on previous cycles to predict a trend of decreasing returns. If Bitcoin falls below $65,000, it could quickly drop to $60,000, and potentially as low as $48,000. This forecast contrasts sharply with the optimistic outlook of some experts who envision prices reaching $100,000 or higher.