🔥 Gemini smashes expectations for its Nasdaq IPO

Welcome to the Daily for Saturday, September 13, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, September 13, 2025, and just like every day from Tuesday to Saturday, we're bringing you a summary of the top news from the past 24 hours you shouldn't miss!

But first…

✍️ Cartoon of the day:

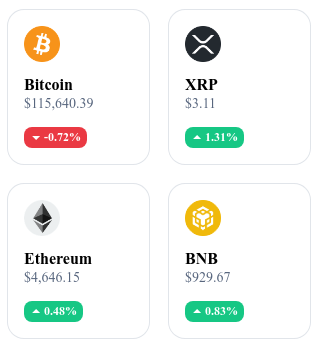

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

⚖️ Sam Bankman-Fried appeal hearing set for November 4

The U.S. Court of Appeals for the Second Circuit has scheduled Sam Bankman-Fried’s hearing for November 4, 2025, following his 25-year prison sentence for fraud and conspiracy linked to the collapse of FTX. This step represents one of the last major legal opportunities to challenge his sentence.

👉 Read the full article

🏦 BlackRock considers tokenizing its ETFs after the success of its Bitcoin fund

After the success of its Bitcoin ETF and its tokenized BUIDL fund (≈ $2.2 billion in assets), BlackRock is considering launching its traditional ETFs directly on blockchain. The project aims to provide greater accessibility (fractionalization, 24/7 trading) and contain outflows toward stablecoins.

👉 Read the full article

📲 BitChat becomes the digital weapon of protesters in Nepal

During the anti-corruption protests currently taking place in Nepal, following the suspension of social media, downloads of BitChat have surged.

👉 Read the full article

📜 Coinbase demands restoration of Gary Gensler’s deleted messages

Coinbase has filed a legal motion in federal court to recover a full year of Gary Gensler’s text messages, deleted by the SEC between October 2022 and September 2023, coinciding with the FTX collapse. The Inspector General’s report concludes that these deletions violated legal record-keeping obligations — Coinbase is demanding sanctions.

👉 Read the full article

📌 Crypto of the Day: Curve DAO (CRV)

🧠 What innovation and added value?

Curve Finance is a DeFi protocol specialized in stablecoin and similar-value tokenized asset exchanges. Thanks to its StableSwap algorithm, it drastically reduces slippage and fees, even on very large volumes.

Its model relies on the veCRV mechanism, which incentivizes holders to lock their CRV tokens to gain governance power and boost yields. Curve has thus become a central hub of stable liquidity, used by numerous DeFi protocols.

💰 The CRV Token: Utility and Benefits for Holders

The CRV token plays a dual role: as an incentive tool, it rewards liquidity providers, and as a governance instrument, it allows voting on protocol parameters (distribution of rewards, fees, pool choices). 🔒 CRV locked in veCRV strengthens ecosystem stability and gives an advantage to long-term participants, aligning economic interests with decentralized governance.

📊 Real-time Performance (September 13, 2025)

💵 Current price: $0.8271 USD

📉 24h change: –0.85%

💰 Market capitalization: ≈ $1.149 billion USD

🏅 CoinMarketCap rank: #75

🪙 Circulating supply: ≈ 1.389 billion CRV

📊 24h trading volume: ≈ $162.2 million US

Crypto exchange Gemini enters Nasdaq: A record IPO!

While the regulatory climate around crypto assets remains tense, Gemini — the platform founded by the Winklevoss twins — has just achieved a remarkable stock market debut. This operation marks a turning point for the company and highlights the sustained interest of investors in the most regulated crypto firms.

Kick-off on Nasdaq

Gemini made its first steps as a listed company on Nasdaq under the ticker GEMI, with an initial offering price of $28 per share. This amount exceeded the initial range of $24 to $26, reflecting clear market confidence.

The company raised $425 million through the sale of 15.1 million Class A shares, reaching a $3.3 billion valuation on the very first day. One of the most notable facts was the massive oversubscription: demand was more than twenty times higher than the available supply, an exceptional ratio that underscores investors’ appetite for companies firmly rooted in the crypto ecosystem.

It is also worth noting that Nasdaq itself invested $50 million in private capital in the operation, a gesture perceived as strong institutional support for Gemini’s business model.

Strategy and ambitions beyond trading

The IPO does not represent an end point, but a strategic lever for the company. Gemini has ambitions that go beyond simple cryptocurrency exchange. The company is focusing on three main areas: asset tokenization, payments via crypto cards, and the expansion of its own stablecoin.

This multi-channel positioning aims to diversify revenues and stand out from competing platforms, notably by highlighting regulatory compliance as a competitive advantage. The approach is clear: build a secure crypto ecosystem, attractive both to institutions and individuals, with a brand image centered on transparency and regulation.

Opportunities and challenges ahead

Despite this triumphant debut, Gemini faces several challenges. The first lies in the regulatory environment, particularly in the United States, where the SEC continues to multiply investigations and lawsuits against Web3 players. The management of Gemini’s in-house stablecoin could also raise compliance concerns.

Competition, increasingly dense, demands strong differentiation and constant innovation capacity. While the IPO validates market interest, the real test remains that of sustainable long-term growth in a sector exposed to high volatility.

By attracting the interest of traditional funds, Gemini shows that it is possible for a crypto company to combine innovation and compliance. The exchange’s short-term success is undeniable, but its ability to stay the course in a complex environment will now be closely watched.