🔍 Google searches for memecoins are picking up again, still far from the January peak

Welcome to the Daily for Thursday, September 04, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, September 04, 2025, and just like every day from Tuesday to Saturday, we're bringing you a summary of the top news from the past 24 hours you shouldn't miss!

But first…

✍️ Cartoon of the day:

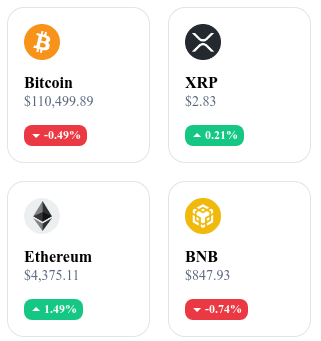

A quick look at the market…

🌡 Weather:

🌤️ Partly sunny

24h crypto recap! ⏱

💰 Ethereum Foundation prepares to sell 10,000 ETH to fund its projects

The foundation announces a gradual sale of 10,000 ETH (~$43M) to finance research, grants, and donations. It retains a reserve of 224,800 ETH (> $1B) and limits its spending to 15% of the annual budget to ensure stability.

👉 Read the full article

🔍 Google searches for memecoins are picking up again, but remain far from January’s peak

Interest in memecoins is gradually returning, without reaching the level of enthusiasm seen in January 2025. This trend reflects a more mature and less speculative market, with growing support for technical infrastructure.

👉 Read the full article

⛏️ Bitcoin: miners will rake in nearly $1.66B in August

Bitcoin mining revenues range from $1.633B to $1.66B, nearly identical to July, signaling resilience despite energy costs and constraints. Revenue structure is evolving, with transaction fees making up 2% of total rewards, while the mempool remains congested (~85,000–93,000 transactions).

👉 Read the full article

🔧 Pi Network rolls out V23 update, but price remains flat

Version V23 of the Pi protocol, based on Stellar Protocol 23, is being gradually deployed from testnet to mainnet. The Pi token price remains stable at $0.34, below its 20-day moving average ($0.36); a breakout above this level could trigger a bullish move, otherwise downside risks remain.

👉 Read the full article

Crypto of the Day: Oasis Network (ROSE)

🧠 What innovation and added value?

Oasis is a Layer 1 blockchain focused on privacy, adopting a modular architecture that separates the consensus layer from the execution layer (ParaTime).

This design enables sensitive tasks to be processed in parallel and confidentially via Trusted Execution Environments (TEE), while preserving the performance and security of the main network. Oasis is particularly suited for Web3 use cases focused on private data, digital identity, and responsible decentralized finance.

The ROSE Token: Utility and Benefits for Holders

The ROSE token is used to:

pay transaction fees (on the consensus layer and within ParaTimes),

stake or delegate to participate in network security,

engage in on-chain governance to shape protocol development.

The dual model (consensus/ParaTimes) provides a robust framework fostering security, privacy, and community participation.

📊 Real-time Performance (September 4, 2025)

Current price: $0.02391 USD

24h change: –0.26 %

Market capitalization: ≈ $177.14 million USD

CoinMarketCap rank: #245

Circulating supply: ≈ 7.408 billion ROSE

24h trading volume: ≈ $6.56 million USD

Fed: Christopher Waller pushes for an imminent rate cut

As the U.S. Federal Reserve prepares to meet in less than two weeks, Christopher Waller, an influential governor and potential successor to Jerome Powell, is calling for an immediate shift in monetary policy. In a highly anticipated speech, he advocates for a rate cut as early as this month, citing a sharp reversal in the labor market. A strategic stance that reveals internal tensions at the Fed and raises questions about the central bank’s future direction.

Waller calls for rapid easing in response to a weakening labor market

Christopher Waller, member of the Fed’s Board of Governors, publicly stated that the conditions are in place to initiate a rate cut at the September 16–17 meeting. His main argument rests on a rapid deterioration in the labor market, which he deems serious enough to justify immediate monetary action.

“I believe the data will support a first cut as early as this month,” he said, emphasizing the need not to wait for worsening economic tensions. Waller favors a gradual approach, where future decisions depend on incoming data rather than following a predefined rate-cutting path.

He also stands apart on the inflation issue, particularly regarding tariffs on Chinese imports. Unlike some of his colleagues, he does not foresee lasting inflationary pressure from these measures, arguing that we need to “take a step back” on that matter.

A strategic stance ahead of Powell’s succession

This public intervention comes at a politically significant moment: Christopher Waller is seen as one of the frontrunners to lead the Fed in early 2026, when Jerome Powell’s term ends.

In this context, his position marks a break from the caution displayed by other committee members. He presents himself as an advocate of a reactive, even proactive, monetary policy that refuses to ignore early signals from economic indicators.

By taking a stand against the more conservative voices within the institution, Waller outlines a vision of a more flexible Fed, capable of adapting to economic cycles without being locked into a rigid doctrine. An approach that may appeal to both markets and policymakers looking for agility in uncertain times.

If the Fed follows Waller’s line, a rate cut in September would mark a major shift in U.S. monetary policy. It could potentially pave the way for several additional adjustments by mid-2025, with direct effects on the dollar, financial markets, and inflation dynamics.