📊 Google Searches for Stablecoins Reach Record High

Welcome to your Daily Briefing for Thursday, July 31, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, July 31, 2025, and as we do every Tuesday through Saturday, we’re bringing you a concise roundup of the past 24 hours’ must-know crypto news.

But first…

✍️ Cartoon of the day:

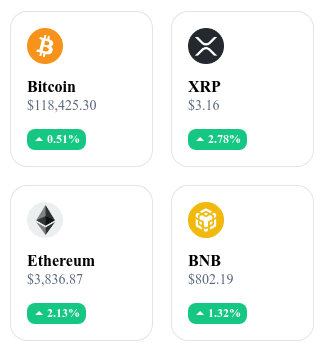

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

💼 Sequans Boosts Its Bitcoin Holdings with $88.5M Investment

Sequans has acquired 755 BTC for $88.5 million, bringing its total to 3,072 BTC and ranking it as the 22nd largest public holder. Funded through a public offering, the move highlights the company’s strategy to treat Bitcoin as a long-term store of value.

👉 Read the full article

📈 Google Searches for Stablecoins Hit Record Highs

Search interest in stablecoins peaked in early 2025, coinciding with the passing of the U.S. GENIUS Act and market capitalization topping $272 billion. This surge signals growing institutional adoption and the rise of new players beyond Tether and USDC.

👉 Read the full article

🏷 JD.com Prepares for Hong Kong Regulation with 'Jcoin' and 'Joycoin' Trademarks

Ahead of Hong Kong’s stablecoin regulatory framework taking effect on August 2, JD.com filed trademarks for “Jcoin” and “Joycoin” through its fintech arm JD Coinlink. Pegged 1:1 to the Hong Kong dollar, the tokens are expected to be among the first issued under the new regime, targeting both businesses and retail users.

👉 Read the full article

🏪 PayPal Enables In-Store Payments with Over 100 Cryptocurrencies

PayPal now allows U.S. merchants to accept over 100 cryptocurrencies, automatically converted to PYUSD or fiat, with a fixed 0.99% fee. Currently limited to the U.S. (excluding New York), the feature integrates with major wallets to streamline cross-border commerce and promote PYUSD adoption.

👉 Read the full article

🪙 Crypto of the Day: Sui (SUI)

🧠 What’s the innovation and added value?

Sui is a Layer 1 blockchain developed by Mysten Labs, a team of former Diem (Meta) engineers. It features an object-centric model that allows parallel transaction execution. This unique architecture makes the network extremely fast, with ultra-low latency and impressive horizontal scalability.

The protocol leverages the Narwhal & Bullshark consensus mechanism for near-instant finality. Sui also prioritizes accessibility through innovations like zkLogin (login via Google, Facebook, etc.) and sponsored transactions, lowering the barrier to entry for Web2 users.

Designed for use cases such as Web3 gaming, dynamic NFTs, high-speed DeFi, and even BTCFi, Sui aims to become a technical standard for large-scale Web3 adoption.

💰 The SUI Token: Utility and Benefits for Holders

The SUI token is used to pay for transaction and storage fees on the network. It also secures the protocol through staking, allowing holders to delegate their tokens to validators in exchange for rewards.

SUI is the native currency for dApps built on the network—spanning DeFi, gaming, NFT minting, payments, and more. It also enables on-chain governance, giving users a direct voice in the protocol’s evolution.

📊 Recent Performance (as of July 31, 2025)

Current Price: $3.89 USD

24h Change: +4.15%

Market Cap: ≈ $13.46 billion USD

CoinMarketCap Rank: #12

Circulating Supply: ≈ 3.46 billion SUI

24h Trading Volume: ≈ $1.69 billion USD

📊 Altseason on the Horizon: Sygnum Signals Capital Rotation Toward Altcoins

After a prolonged period of Bitcoin dominance in the crypto market, both technical indicators and institutional signals suggest a gradual capital shift toward altcoins. Swiss digital asset bank Sygnum highlights several key signs, starting with a sharp drop in Bitcoin dominance, increased activity on decentralized exchanges (DEXs), and rising capital inflows into Ethereum. This momentum could mark the beginning of a new cycle for alternative cryptocurrencies.

Falling Bitcoin Dominance Paves the Way for Altseason

According to Sygnum’s latest market analysis, the crypto space may be entering a new phase of capital rotation in favor of altcoins. One major technical indicator supports this thesis: Bitcoin’s dominance has fallen by more than six percentage points—a rare occurrence during prolonged bullish trends.

This decline in BTC dominance does not imply a price drop but rather a reallocation of capital into alternative projects with strong fundamentals or high speculative potential. Recent gains in tokens tied to DeFi and blockchain infrastructure suggest a renewed appetite for diversified risk profiles, reinforcing the case for an incoming altseason.

DeFi, Staking, and ETFs: Ethereum at the Center of Capital Rotation

Among the primary beneficiaries of this trend, Ethereum stands out as the key engine of this shift. Three converging signals strengthen its case: the surge in decentralized exchange activity, the rapid growth of staking, and the institutional momentum driven by newly approved Ethereum ETFs, following the "Pectra" upgrade.

DEXs now account for 30% of global spot trading volume—a historic high. At the same time, DeFi lending protocols report over $70 billion in total value locked (TVL), reflecting strong and sustained usage. Moreover, ETH staking has reached around 30% of its liquid supply, reducing sell pressure while enhancing network security.

On the regulatory front, recent clarity in the U.S. regarding staking has lifted a major source of uncertainty for institutional investors. This more transparent legal framework, combined with ample market liquidity, supports a strategic portfolio rotation toward alternative assets amid a maturing crypto market landscape.