🌍 Greenpeace accuses Bitcoin of Pollution Again, 🔺Ethereum Breaks Records!

Welcome to the Daily Tribune on Thursday June 20, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, June 20, 2024 and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

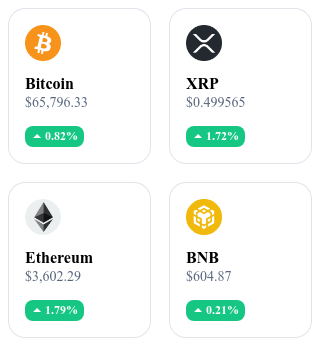

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🌐 Decrease in number of BTC holders, growth for ETH holders

The crypto market has recently observed opposite trends for Bitcoin and Ethereum. According to Santiment data, the number of Bitcoin holders has recorded a significant decrease, the largest since March, indicating a loss of investor confidence. This decrease in holders is mainly attributed to a recent 3% drop in the price of Bitcoin, prompting investors to liquidate their positions out of fear of further losses. On the other hand, Ethereum continues to attract new investors, thanks to the robustness of its technology and its reliability for decentralized applications. 🔗 Read the full article here.

🌍 Bitcoin accused of pollution again by Greenpeace

Greenpeace accuses Bitcoin of being a major source of environmental pollution, noting that BTC mining consumes as much energy as a country like Poland. The NGO also criticizes the role of Wall Street in financing this energy-intensive industry. Financial institutions such as BlackRock and Vanguard invest heavily in Bitcoin mining companies, contributing to substantial CO2 emissions. Greenpeace calls for more transparency and stricter regulations, while suggesting modifying Bitcoin's consensus mechanism to reduce its environmental impact. 🔗 Read the full article here.

📉 Trump Memecoin excluded from major platforms

Despite sustained efforts to gain a place on major exchanges such as Kraken, Bybit, and OKX, Trump Memecoin faces significant obstacles. This lack of listing on major exchanges significantly hampers its growth potential and limits its exposure to investors. As a direct consequence, the TRUMP token has dropped by 31% in just a few hours to reach $7.46, while other associated tokens such as TRUMPIE and $TRUMP have lost 76.1% and 65.4% respectively in two weeks. This situation jeopardizes the future of the memecoin and its ecosystem, as the project's ambitions are seriously compromised without a breakthrough on the major crypto marketplaces. 🔗 Read the full article here.

🚀 Ethereum soars after SEC investigation concludes

The conclusion of the SEC investigation into Ethereum 2.0 has caused a 3% increase in the price of ETH, marking a decisive turning point for the blockchain industry. ConsenSys confirmed that the SEC had closed the investigation without filing charges. This clarification comes at a crucial time for Ethereum as it prepares for its transition to Ethereum 2.0, a major update aimed at improving scalability and sustainability by moving from proof of work to proof of stake. The announcement immediately pushed the price of ETH above $3,100, boosting the confidence of investors and developers in the legitimacy of Ethereum. This legal victory could not only boost investor confidence but also set a precedent for future cryptocurrency regulation. 🔗 Read the full article here.

Crypto of the day: SingularityNET (AGIX)

SingularityNET (AGIX) is a decentralized platform that uses blockchain technology to create a global network of artificial intelligence. It allows developers to create, share, and monetize AI services through a marketplace. The main innovation lies in the decentralization of AI services, offering an alternative to traditional centralized solutions.

The native cryptocurrency, AGIX, is used for transactions within the network, rewarding developers and facilitating service exchanges. Initially distributed through an ICO, AGIX offers benefits such as reduced transaction fees and staking opportunities, strengthening holder engagement and enabling participation in network governance.

Recent Performance:

Current Price: €0.6824

Percentage Increase/Decrease: +27.57% (1-day increase)

Market Cap: €875,159,623

Rank on CoinMarketCap: #81

Crypto Analysis: Binance Coin (BNB)

Binance Coin (BNB) recently reached its latest all-time high before dropping below this key level. After surpassing $700, the price of BNB quickly dropped back to around $600. This $600 area could serve as short-term support as it coincides with the 50-day moving average, an indicator often used by traders to assess medium-term trends. Technical analysis shows that this rapid surge was not sustained, resulting in uncertain market dynamics and increased selling pressure.

Meanwhile, open interest in BNB/USDT perpetual contracts showed a resurgence phase before decreasing, indicating a temporary holding of buyer interest. Liquidation data shows capitulation of buyers, with a significant liquidation zone around $550. If BNB manages to stay above $600, a bullish recovery towards $725 or higher could be considered. On the other hand, a drop below this level could lead to a return to $500 or even $400, increasing the risk of increased volatility. Investors must remain vigilant in the face of potential market fluctuations.