🐋 Historic record: 18,000 Bitcoin addresses surpass the 100 BTC mark!

Welcome to the Daily Tribune for Friday, December 13, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, December 13, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

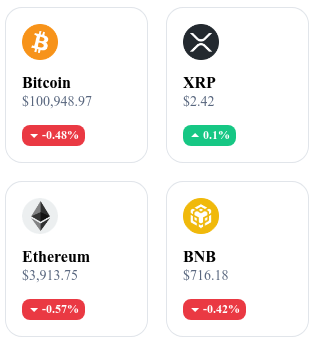

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

📊 Historic record: 18,000 Bitcoin addresses exceed 100 BTC

The number of Bitcoin addresses holding more than 100 BTC has reached a historic level in 2024, surpassing 18,000 addresses. This increase reflects a growing adoption of Bitcoin as a hedge against inflation, intensified by global expansionary monetary policies. The symbolic threshold of $100,000 recently surpassed by Bitcoin has reinforced investor confidence.

The involvement of financial institutions, such as Tesla and MicroStrategy, has also contributed to this trend by further legitimizing the asset. However, this concentration of wealth raises questions about future price volatility, although large addresses are often held by patient investors.

🏛️ Trump bets on a crypto expert to lead the CFTC

Donald Trump is considering appointing Brian Quintenz, former CFTC commissioner and current crypto lead at Andreessen Horowitz, to head the Commodity Futures Trading Commission (CFTC). Quintenz is known for his support of blockchain innovation and his advocacy for regulation suited to the specifics of the crypto industry.

This initiative is part of Trump's strategy to position the CFTC as the primary regulator of cryptos, in response to a SEC considered too strict. Quintenz, with his experience in launching the first futures contracts on Bitcoin and Ethereum, could redefine the rules of the game to favor institutional adoption and promote decentralized finance (DeFi).

💰 Spot Bitcoin ETFs register a massive influx

Spot Bitcoin ETFs have reached historic records, registering a total net inflow of $34.58 billion over ten consecutive days, reinforcing their key role in the crypto market. December 11 marked a peak with $223.03 million in inflows, led by the Fidelity Bitcoin Trust (FBTC), which captured $121.9 million in a single day. Other ETFs like ARKB from ARK and 21Shares also recorded significant inflows, benefiting from the spectacular rise of Bitcoin beyond $102,000.

However, not all funds are benefiting from this enthusiasm, some even experienced net outflows. With a total trading volume reaching $3.94 billion, these movements confirm the growing interest in Bitcoin-linked investment products, notably those from giants like BlackRock, positioned as a dominant player.

🔄 FTX recovers $14 million from political organizations

FTX debtors have recovered $14 million in political donations, a significant development in the attempt to recover the failed cryptocurrency platform. Among the major refunds, the House Majority PAC and the Senate Majority PAC returned $6 million and $3 million, respectively.

Although this amount seems modest compared to the billions lost in the debacle, it marks an important step in the restructuring overseen by the American judiciary, which aims to repay up to 119% of creditor claims.

Crypto of the day: Curve DAO (CRV)

Curve DAO is a key player in decentralized finance (DeFi), based on the Ethereum blockchain. The platform stands out for its innovative approach to low-slippage exchanges between assets of similar values, such as stablecoins and synthetic tokens.

The native crypto, CRV, is used for governance, staking, and farming rewards. It was initially distributed via a retroactive airdrop in 2020, targeting early users of the protocol. CRV holders can participate in governance, lock their tokens to obtain veCRV, and thus influence the weighting of liquidity pools while generating returns. CRV is a versatile tool at the heart of the Curve ecosystem.

Recent performance

Current price: €1.08

Change (24h): +6.9%

Market capitalization: €1,351,312,930

CoinMarketCap rank: #104

💡 Yield, adoption, and crypto payments: CoinShares reveals the future of Bitcoin

CoinShares anticipates a major transformation of Bitcoin, which could surpass its traditional role as a store of value to become a powerful yield generator. This evolution is catalyzed by the growing adoption of Bitcoin in corporate financial strategies, notably through innovative tools like yield farming or derivatives products.

Companies capitalizing on Bitcoin's yield potential

The CoinShares report highlights initiatives from companies like MicroStrategy, which introduced a key indicator, the "BTC Yield", to assess the profitability of its Bitcoin acquisitions.

In 2024, this indicator revealed an impressive yield of 26.4%, consolidating the idea that Bitcoin can not only preserve value but also generate tangible income. By adopting innovative financial strategies such as Bitcoin lending or staking, companies are fully harnessing the potential of Bitcoin, repositioning this asset at the core of their financial models.

The rise of crypto payments and the institutional integration of Bitcoin

The rise of crypto payments, adopted by players like PayPal and Ferrari, supports the growing institutional recognition of Bitcoin. CoinShares predicts that this trend will push more companies to include Bitcoin in their treasuries in 2025, due to its ability to generate additional revenues while securing their reserves.

With staking platforms and financial innovations, Bitcoin is on track to become a standardized resource, not only for speculation but also as a pillar of modern institutional financial strategies.